On track to reach $2.6 billion by 2026

New York – May 9, 2024 – After consecutive years of healthy double-digit growth, podcast ad revenues grew at a slower pace in 2023 posting a modest revenue increase of 5% to $1.9 billion, according to IAB’s “U.S. Podcast Advertising Revenue Study: 2023 Revenue & 2024-2026 Growth Projections.”

This was due in large part to a challenging advertising climate that particularly affected mid-tier companies, resulting in losses that tempered the sector’s overall growth trajectory.

The eighth annual IAB U.S. Podcast Advertising Revenue Study, prepared for IAB by PricewaterhouseCoopers LLP (“PwC”), quantifies annual podcast advertising revenues generated over the past year, analyzes revenue share by ad category and content genre, and forecasts future revenues through 2026.

“While a few of the largest podcast companies maintained double-digit growth, mid-tier companies hit a speed bump,” said Chris Bruderle, VP, Industry Insights & Content Strategy, IAB. “But revenue is already bouncing back.”

Podcasting is projected to return to double-digit growth (12%), with revenues of over $2B this year. It is on track to reach nearly $2.6B by 2026. Publishers will fuel growth through various initiatives, including measurement, programmatic, live events, more aggressive show promotion, and the continued development of video podcasts.

Comedy and Sports are Top Performers

Likely aided by shows from notable comedic personalities, comedy’s revenue share grew by four points in the past two years and is now among the most-listened-to podcast genres (overtaking news and sports) and gained nearly 300 new advertisers in Q4 2023 alone.

Sports is the second most popular content genre for the second straight year, down slightly from 2022 (15%) to 13%.

“Between comedy and sports, consumers are using podcasts to be entertained and delighted – which provides a sanctuary from other serious headlines playing out across the nation and the world”, said David Cohen, CEO, IAB. “It’s where the greatest engagement and subsequent ad dollars are.”

CPG and Retail Brands Boost Revenue

CPG and retail brands revenue was up 4% and 5% respectively since 2022. Advertisers are shifting to digital platforms like podcasting that enable more direct connections with consumers.

Diversity Remains a Unique Strength

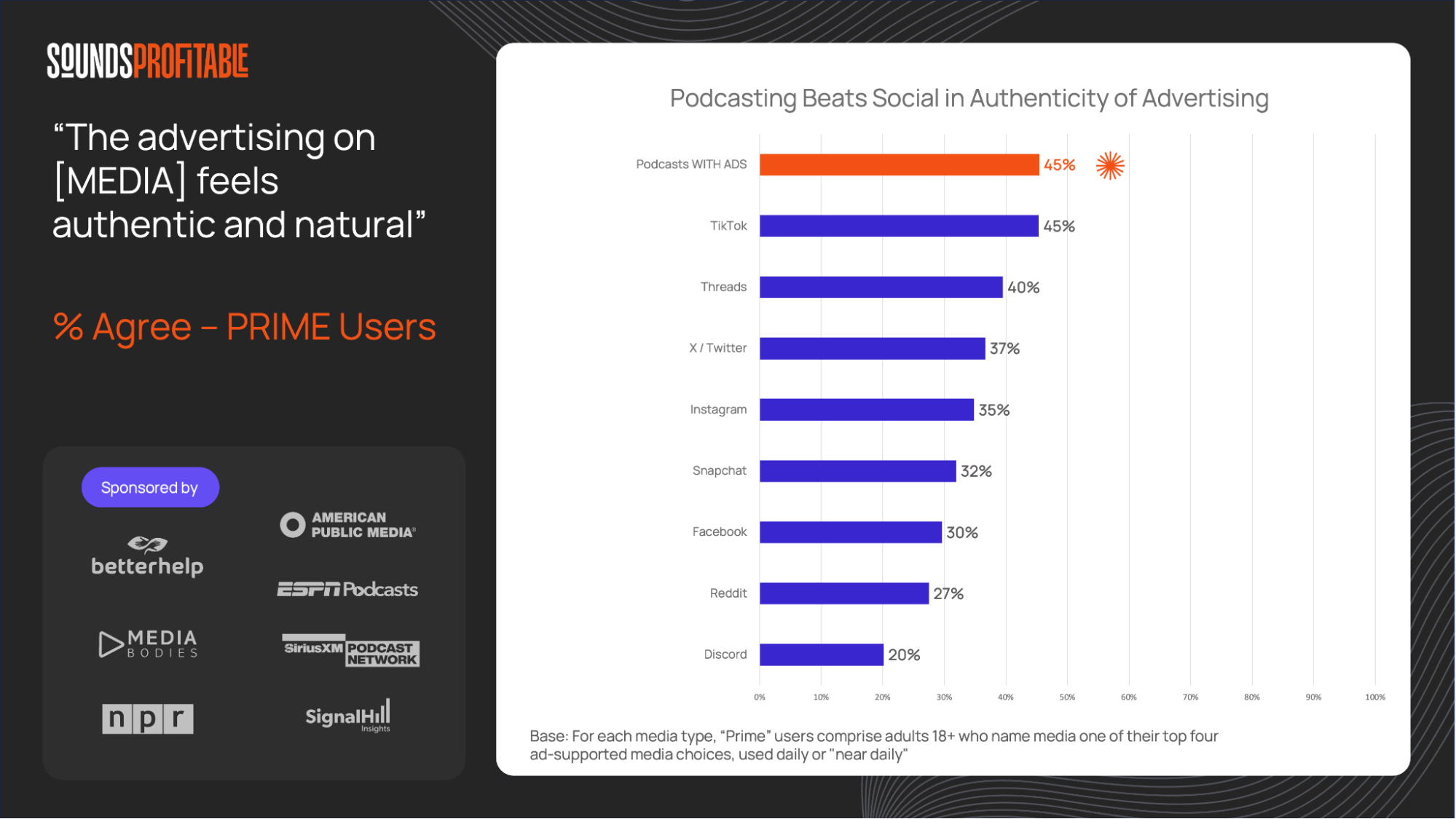

The wide variety of subjects podcasting addresses and the unique rapport between podcasters and their listeners continue to make the medium uniquely attractive for advertisers who need to reach niche audiences.

More than a quarter of podcasting revenues were in the “other” category, such as government, non-profit, pets, home, and more. These individual categories are often small but are so highly targeted that they are very appealing to advertisers who need to reach a niche audience affordably.

“Podcasts deliver at scale, can pinpoint niche audiences, and have the power to build authentic connections with consumers,” continued Cohen. “And as audience measurement in podcasting becomes more aligned with other digital channels, there’s more growth ahead.”

The full IAB U.S. Podcast Advertising Study can be downloaded here.

Methodology

A quantitative, online survey was sent to leading podcast industry professionals in February to understand 2022 podcast advertising revenues, revenues by industry category and content genre, as well as forecast revenue growth for the next 3 years. As in prior years, this coincided with a podcast advertising market-sizing to deliver an estimate of the market in the United States, inclusive of non-survey participating companies.

About PwC

As business, accounting, and tax advisors to many of the world’s industry leading technology, media, and telecommunications (TMT) companies, PwC (www.pwc.com/us/tmt) has an insider’s view of trends and developments driving the industry. With approximately 1,200 practitioners serving TMT clients in the United States, PwC is committed to providing clients with industry experience and resources. In recent years, our work in TMT has included helping our clients to develop strategies to leverage digital technology, identifying new sources of financing, and marketplace positioning in industries characterized by consolidation and transformation. Our experience reaches across many geographies and segments, including broadband, wireless, film, television, music, publishing, advertising, gaming, sports, theme parks, computers and networking, software and technology services. With thousands of practitioners around the world, we’re always close at hand to provide deep industry knowledge and resources

About IAB

The Interactive Advertising Bureau empowers the media and marketing industries to thrive in the digital economy. Its membership comprises more than 700 leading media companies, brands, agencies, and the technology firms responsible for selling, delivering, and optimizing digital ad marketing campaigns. The trade group fields critical research on interactive advertising, while also educating brands, agencies, and the wider business community on the importance of digital marketing. In affiliation with the IAB Tech Lab, IAB develops technical standards and solutions. IAB is committed to professional development and elevating the knowledge, skills, expertise, and diversity of the workforce across the industry. Through the work of its public policy office in Washington, D.C., the trade association advocates for its members and promotes the value of the interactive advertising industry to legislators and policymakers. Founded in 1996, IAB is headquartered in New York City.