This Week in the Business of Podcasting

We heard you liked data, so enjoy a big scoop of it right at the top. This week we’re covering where podcasting’s next 20 million audience members could come from, the evolution of video, and more. Let’s get down to business.

Transparency. Performance. Automation.

Connecting With Podcasting’s Next 20 Million Consumers

This Wednesday from Tom Webster at Sounds Profitable: Continuing a tradition started last year, Webster breaks down a slice of data from Sounds Profitable’s annual Podcast Landscape study to focus on a group he’s dubbed ‘the Persuadables.’

People who do not consume podcasts are not a monolithic group, and thus it’s worth focusing on why they say they’re not listening. 26% of Americans 18+ have never consumed a podcast, down 2% year over year. When asked why they haven’t consumed a podcast, the top reasons include “my existing options give me what I need” from 34% of respondents. 27% prefer watching video over listening. 22% don’t understand the benefits of podcasts.

13% of respondents can’t find a podcast that seems interesting, which bodes well as it’s down from 18% last year. The biggest decline of any reason from last year’s study. The reason with the most growth is existing options still providing what the person needs.

The 26% who have never listened to a podcast can be broken into three segments:

- The Unreachables (11%): These are difficult to reach due to economic reasons, such as not having a device to play podcasts or lacking reliable internet access.

- The Resistors (59%): They may have heard of podcasts but have perceptions that prevent them from listening. Reasons include preferring video, reading, or simply not understanding the benefits of podcasts. They aren’t unreachable, but their habits may be more firmly entrenched (though a big part of that is their strong preference for video over spoken word audio, which as we have seen in recent years, is less a barrier to podcasting than ever before).

- The Persuadables (30%): This group, about 8% of the US population 18+ or 20 million people, represents our next potential audience tier. Like the Resisters, they prefer video, but are more open to considering podcasting AND show signs that their existing media diet might have a few holes that podcasts could fill admirably.

For podcasting to meet The Persuadables and make a convincing case for the industry, Webster offers a few key suggestions. Video is growing, and we need the current stars of video podcasting to talk about podcasting loudly and proudly. Short-form content like TikTok and YouTube Shorts can be vital for establishing podcasting’s concepts and benefits. The decline of Twitter/X and commercial radio content may have created a gap in daily lives that short-form video content does not fill. Podcasting would benefit from discussing our ability to become a companion that enriches passive media consumption time. A quote from the article:

“The path to growing our audience lies in understanding and addressing the needs of The Persuadables and, in turn, even some of The Resisters! By emphasizing the convenience and companionship podcasts offer, we can make downtime more interesting and valuable. It’s up to us to show them how podcasts can enrich their lives and fill the gaps left by their changing media habits.”

Publishers Transform Podcasts Into Video Talk Shows

This Wednesday from Digiday’s Tim Peterson: Video podcasting has various forms, from the static image over longform audio, to full productions that emulate the classic television talk show. The latter is becoming more common as the visual side of the industry grows. As research from companies like Cumulus Media and Signal Hill Insights has found, YouTube is firmly the most-used platform for podcast consumption and discovery in the U.S. Even discounting YouTube, Spotify says over 170 million users have watched a video podcast on their own platform.

Video podcasting is here to stay, and with that comes a new workflow as formerly audio-only concepts adapt to incorporating visual language. For instance, A Touch More started as an Instagram Live series featuring hosts Sue Bird and Megan Rapinoe streaming from their own homes. When building a formal set for the video podcast version of the show, Vox took care to emulate the look of a living room, giving continuity to the show’s casual tone established early on.

For podcasts having to make due with Zoom-quality webcam recordings of hosts and/or guests, production crews normally tasked with digging up archival audio and sound effects are now digging deep for good b-roll footage to use for visual interest. As the video side of the industry grows, so will the need for production teams, editors, and all the other ephemera needed for consistent video production.

FTC Report Takes Issue with Social Platform Data Collection, Privacy Concerns.

Last Thursday from Allison Schiff at AdExchanger: Four years ago the FTC issued an order compelling nine of the largest social media and video streaming platforms to share detailed information on how they collect and use personal consumer data. The analysis of that data has been compiled into an 100 page report titled A Look Behind the Screens: Examining the Data Practices of Social Media and Video Streaming Services.

Issues flagged in the report include indefinite data retention policies, instances of not fully complying with user data deletion requests, and targeting based on protected sensitive data (such as where an individual goes to church, or their medical needs). A quote from the article:

“But they all boil down to the same underlying issue, according to the report, which is that these companies are incentivized to engage in the mass collection of user data for monetization, because that’s how they make most of their revenue. The problem of “vast surveillance,” as the report calls it, therefore has less to do with any specific product feature or aspect of a service, the FTC official said. It’s deeper than that.”

Solutions suggested include giving users more granular control over how their data is used in automated systems, and to close the loophole of companies passively ignoring the existence of underaged users so their platform doesn’t have to comply with COPPA. While podcast advertising exists on the periphery of this report, as the industry largely uses IP-level data, it’s worth taking notice and future-proofing against any potential FTC crackdowns. Especially with Kids & Family podcasting becoming a powerhouse in its own right.

Buyers Estimate Major Losses, Become Wary of Meta AI Ad Tools

Last Thursday from Ryan Barwick at Marketing Brew: Several ad buyers interviewed by Marketing Brew report issues with MEta’s advertising platform and tools. Harry Delmege, CMO of MHI Media, tells of a campaign running for a fashion brand that targeted younger audiences primarily on Instagram. At some point, Meta’s automated ad tools started targeting older, 65+ audiences on Facebook.

While unsure if the change was an intentional effect or a bug, Delmege says performance tanked as the campaign delivered ads for trendy teen-focused clothes to the opposite end of the demographics. He estimates the incident cost his client something in the “high five-figure” range.

Five other buyers interviewed for the story report personal experiences that lead them to feel Meta’s ad tools are broken. There’s also the issue of disruptions. Meta’s own website designed to track issues with Facebook Ads Manager has logged at least 12 disruptions to the ad tools since Memorial Day, with four of that dozen flagged as “major disruptions.”

Some buyers have distanced from any AI-powered tools, choosing to manually build out advertiser campaigns in hopes of avoiding further issues.

Freelance media buyer David Herrmann, who estimates a Meta Shops glitch back in June cost his client portfolio between $300k and $400k in potential loss, says glitches or not, there’s few other options besides Meta. “For the level of spend, there’s no other place to go but Meta, and that’s where MEta can kind of get away with these bugs – because we always come back.”

Podscribe Index

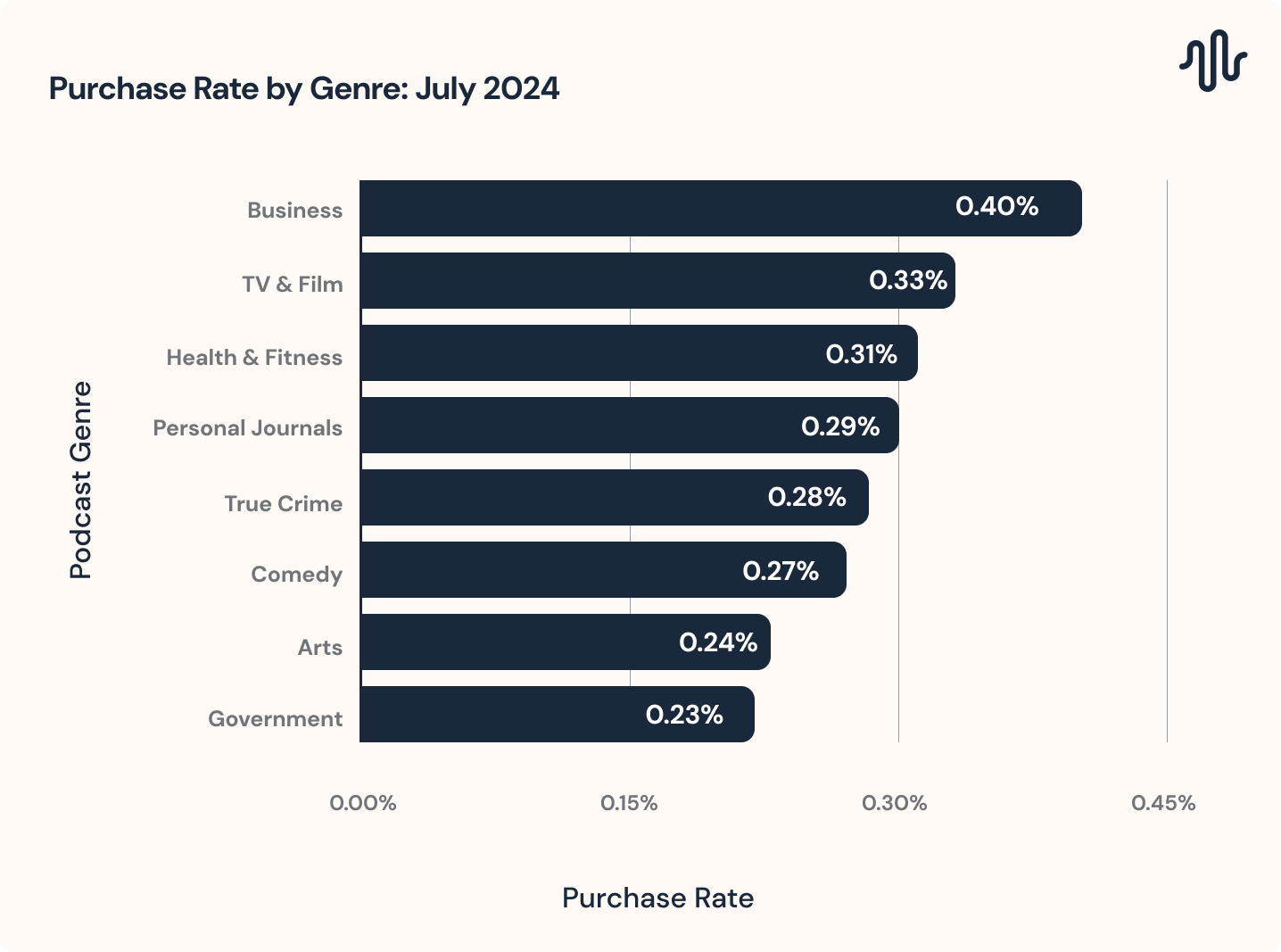

Purchase Rate by Genre, July 2024

In our latest Podscribe Index, notable changes in purchase rates came out from June to July. “Business” replaced “Fiction” for the highest purchase rate in July, coming in on top once again. “TV & Film” came in second followed by “Health & Wellness” which has seen rising purchase rates over the last few months. The biggest improvement was in “Comedy” which came in at #6 making the top 8 charts for the first time in 2024!

Quick Hits

While they may not be top story material, the articles below from this week are definitely worth your time:

- Top Podcast Advertisers for August 2024 – Magellan AI The top three spenders in podcast advertising for the month are T-Mobile, Amazon, and BetterHelp.

- Spotify Launches Synced Feeds The new synced feeds combine both free episodes and premium paid content onto the same Spotify show feed.

- New York Times to Launch Podcast Subscription Plan for Shows Like ‘The Daily’ by Ashley Carman The new subscription plan will give access to now-paywalled back catalogs.

- YouTube Unveils 9 New Features At Made On YouTube 2024 Greg Jarboe. New features include a wider release of auto-dubbing, and the ability to sort videos into television-style seasons and episodes for better viewing on a big screen.