Tomorrow at 2:00 p.m EST I’ll be sharing a webinar stage with SiriusXM Podcast Sales Marketing Specialist Alexandria Caggia in Unlock the Power of Purpose-Driven Podcasting. We’ll be looking at new data from The Advertising Landscape regarding two of the fastest-growing audience segments in podcasting: Self-Improvement, and Health & Wellness consumers. We’ll break down how these audiences use podcasts to build daily routines, the surprising social role recommendations play in their content choices, and why these genres lead in openness to brand integrations and celebrity-hosted shows. Registration is open now and the link - as always - is in the show notes.

I’ve been staring at some brand recall data from The Advertising Landscape today, which reveals a massive opportunity that podcasting is uniquely positioned to solve. This data is from the entire 5,000+ person sample, covering consumers of 22 different ad-supported media channels.

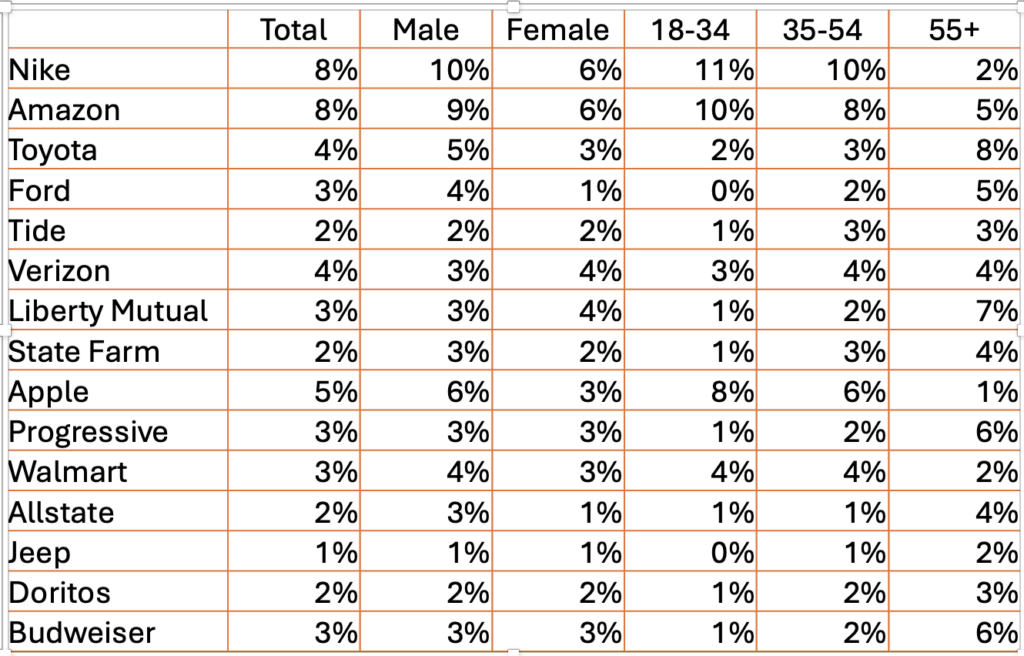

The question we asked was simple enough: “Without looking anything up, please list up to three brands or products you remember seeing or hearing advertised in the past week.” What came back was a fascinating mix of differences bounded by age and gender. And it highlights exactly why smart brands should be doubling down on podcast advertising right now.

The Digital Advertising Age Blind Spot

Let’s start with what our cross-media data revealed. Nike dominates brand recall across traditional and digital channels with 7.8% total awareness, but that number barely tells the story. Among 18-34 year-olds, Nike clocks in at 11.0% recall. Among 55+ consumers? A paltry 2.1%. Apple shows an even starker pattern: 7.9% recall among young adults versus just 1.3% among 55+.

Here’s what is happening: these brands have mastered digital and social advertising platforms that skew heavily toward younger demographics. But they’ve created a blind spot in their media mix that podcasting is perfectly positioned to fill. I’ve written plenty about the 55+ opportunity, but there are PLENTY of podcasts out there that already draw substantial segments of older listeners with little “waste.” And I really need to dig my running shoes out (checks scale).

The flip side of this story is even more compelling. Liberty Mutual shows 6.5% recall among 55+ consumers but only 1.2% among 18-34-year-olds. Progressive, State Farm, and Allstate all show similar patterns: strong performance with older demographics and virtual invisibility among younger ones.

This is where podcasting’s unique demographic profile becomes absolutely crucial. Unlike traditional radio or digital display, podcasting reaches engaged audiences across all age groups. While younger consumers might scroll past display ads or skip pre-roll videos, they’re actively choosing to listen to podcasts—and podcast advertising—for 30+ minutes at a time.

Every insurance executive understands lifetime customer value, yet their advertising apparently reaches consumers only after they’ve already formed relationships with competitors. By the time a 25-year-old starts thinking seriously about life insurance, they’re hearing ads from brands they’ve never encountered before.

For insurance companies, financial services, and other “future purchase” categories, podcasting offers what they desperately need: early relationship building with tomorrow’s customers. The 25-year-old listening to true crime podcasts today will be 35 with a mortgage and kids in a decade. Do you want to be the brand they’ve been hearing about for years or the stranger trying to win their business for the first time?

Innovative brands are already recognizing this opportunity. They’re using podcasting to reach their current customers and cultivate relationships with consumers years before they’re ready to buy. They understand that brand recall isn’t just about remembering an ad you heard last week—it’s about building the mental architecture that will influence purchase decisions for years to come. We already know that there is a tremendous “lag” effect in the efficacy of podcast advertising – why not lean into it?

The Gender Story

However, age isn’t the only demographic divide our data revealed. The gender gaps are equally striking and equally instructive for podcast advertisers. Nike shows a nearly 4% gender gap favoring men (9.7% male recall vs. 5.8% female). Amazon follows a similar pattern, with 9.3% male recall versus 5.6% female recall. Ford takes this to an extreme, with 4.0% male recall and only 1.1% female recall.

What’s fascinating here is that these aren’t necessarily gendered product categories. Women buy athletic wear and shop on Amazon. Yet, traditional and digital advertising channels are clearly failing to reach them with equal effectiveness. This is where podcasting’s diverse content ecosystem becomes a strategic advantage, of course. Still, the real advantage is found in our most recent report on trust and attention: Women pay the most attention to podcast advertising across the 22 ad-supported media channels we tested. Our research consistently shows that podcast listeners actively choose their content and pay attention in ways that don’t happen with banner ads or social media. This means that solving for reach might actually be solving for effective reach – where is the most attention paid?

More importantly, podcasting allows for the kind of customer cultivation that other digital channels have largely abandoned. The intimate, conversational nature of podcast advertising means brands can build familiarity and trust with consumers years before they’re ready to buy—exactly what insurance companies and other “future purchase” categories need.

This is the customer cultivation problem hiding in plain sight. Brands are optimizing for quarterly performance at the expense of the customer pipeline that drives long-term growth. Podcasting offers something increasingly rare: the ability to reach tomorrow’s customers with today’s advertising.

How Podcasting Erases Blind Spots

Here’s what I think might be the most critical insight from this data: some of these demographic gaps aren’t just about who brands are reaching—they’re about how much attention those consumers are actually paying. When Nike shows massive recall among young men but struggles with women and older consumers, part of that might be targeting, but part of it might also be that their ads appear in environments where those other demographics simply aren’t paying attention.

This is where podcasting’s unique consumption model becomes transformative. Unlike the scroll-and-skip behavior that defines most digital media, podcast listeners actively choose to spend 30, 45, or even 60 minutes with content they care about. They’re not multitasking through a feed or waiting for a video to load—they’re leaning in. And when a host they trust takes 60 seconds to tell them about a product or service, that’s 60 seconds of genuine, undivided attention.

Brands that understand this aren’t just buying podcast ads—they’re buying something that’s become increasingly scarce across all other media: actual human attention. Attention, it turns out, might be the great equalizer that helps brands bridge these demographic divides without having to chase consumers across an ever-fragmenting media landscape.

New Partners

Sounds Profitable exists thanks to the continued support of our amazing partners. Monthly consulting, free tickets to our quarterly events, partner-only webinars, and access to our 1,800+ person slack channel are all benefits of partnering Sounds Profitable.

- Studio Kairos produces podcasts in audio, video, and live formats, working with creators and brands to develop content across platforms.

- Disctopia is a creator-first streaming and hosting platform offering tools for podcasters, musicians, and filmmakers to publish, monetize, and grow their audience across audio and video content.

- Colture Podcast Network is a content-first podcast network focused on building strong partnerships between creator and advertisers.

Want to learn more about partnership? Hit reply or send us an email!