This week on the Sounds Profitable Deep Dive, Bryan Barletta is joined by SoundStack CEO Jon Stephenson to embark on a three-part journey through what the audio-as-a-service company has to offer. Tune in to learn how the SoundStack platform makes podcast hosting/distribution, broadcast-to-podcast, and monetization really simple.

The holiday season is always a blast for me, not just for spending more time with my family, eating amazing food, and all of the awesome traditions we have, but because this time of year I absolutely explore the consumer-side of things a bit more than I normally do. I download a bunch of new apps, sign up for trials of things that interest me, and of course, overcommit to a year’s subscription of a few too many services because the deal is too good to beat especially if it turns out I really like it (dear reader, I rarely do).

So in the spirit of keeping with traditions, Thanksgiving week (for us Americans) is a great time to talk about podcast subscriptions. While it may not be enough time for you to get your Black Friday or Cyber Monday deal out in time, there’s still an entire month of holidays to go, full of conversations with your Uncle Frank and gift cards burning a hole in your pocket. And while we have yet to see the same trends in podcasting quite yet that we do in the App Store, this is by far the most lucrative time of year to have an opportunity available.

In the past year, we’ve seen a ton of great content come out, showing the power in podcast subscriptions. But I think it’s important that we take stock of the players actively in the game, the way the landscape is evolving, and the improvements we need to see for podcast subscriptions to become an industry norm adoption and success-wise.

Apps At The Table

Today, there is no organization or protocol that gathers all the hosting platforms and podcast players together to decide standards for how the two sides will interact. There’s no certification for podcast players, and no obligation to share data, which has led to major stagnation in organizations like the IAB Audio Committee and TechLab when the IAB is unable to get both sides to come to the table together. Each podcast player of note has their own agenda, their own business. And while many of them work incredibly well with both hosting platforms and publishers directly, it can be a massive headache to navigate the different processes between each partner for a large publisher, and potentially inaccessible to anyone who falls shy of that mark.

When I think about major podcast players, I think about Apple, Spotify, Google, and Amazon. While there are other apps out there that may have a higher market share, these companies have committed substantial resources and acquisitions to grow their podcast positioning. Spotify, Google, and Amazon all benefit from selling inventory inside the podcasts they have access to directly (Google) or through acquisition (Spotify, Amazon). But there are two paths to generate revenue for these apps and the dozens of other podcast apps out there that go hand in hand: in-app advertising for podcasts, and today’s topic: subscriptions.

The value of podcast subscriptions is that they can provide an option for the apps to generate revenue through facilitating payments and further motivate those selling subscriptions to advertise in the apps that offer it. As more and more listeners engage on those apps, the publishers lean in further to that channel as a priority in their marketing.

Podcast subscriptions have the power to be the first standard across the industry that isn’t baked into the RSS feed. But what do we need to see to get there?

Direct Distribution

Publishers and hosting platforms need to insist that their hosting platform is the center of distribution and reporting. Starting a subscription on a platform does not in any way mean immediate revenue, and it could potentially be unprofitable for a publisher to upload uniquely to each platform until marketing takes off. Allowing a publisher to upload their content once and distribute it to the podcast players directly, for their subscription offering, and to any direct subscription partners, unlocks the ability for that same publisher-side individual to further explore the unique nature of each platform and make the most of it without profit-eating excess labor.

While we’re not quite there yet, this is becoming the norm. Apple’s Delegated Delivery, Spotify’s Open Access, and the subscription platforms prioritizing this flow makes partners like Google and Patreon stand out like a sore thumb. Google, who does compensate creators who subscribe to YouTube Premium (ad free), continues to require direct upload to their platform, ignoring all delivery capabilities of RSS or the benefit of publishers consolidating reporting in their hosting platform. Patreon also requires direct upload of content either to their internal offering, or through their sole partnership with Acast, which is incredibly limiting.

Unified Listening

A few years back, I heard a story of a podcaster whose subscriptions had started to really take off. At that time, their listeners were taking the private RSS feed and entering it into their app of choice, but for many of their listeners, that app was Apple Podcasts. The show itself had been charting well in the Apple Podcasts for their category, but as listeners switched from the podcast found directly in the app to the private RSS feed they paid for, the show dropped in the charts as those listening on the private RSS feed didn’t count toward the main podcast listed with Apple.

While Apple has done a great job of solving this for podcasters with their subscription offering, there currently is no way to associate their off-platform private feed to the feed they submit to Apple Podcasts. And this situation isn’t unique to Apple: any player that allows manual entry of RSS feeds lacks the ability to associate the public and private podcasts. The worst offender of this is Spotify, whose setup is built around two separate podcasts, basic and premium, unless you host both shows on Anchor, making even their core offering damaging to publishers looking to grow their reach.

Brands and Agencies are often concerned with brand safety and suitability across the advertising channels they use. The current brand exodus from Twitter is just one example of how public opinion – and risk tolerance – can shift overnight. Many of the decisions brands make about safety and suitability are based around assumptions derived from general consumer behavior, but do those assumptions apply to podcasting?

As a part of the Sounds Profitable Research Series, we are about to find out! Join Tom Webster and Bryan Barletta live on Wednesday, December 7th, as they present the first-ever study of brand safety and suitability from the listeners’ perspective, Safe and Sound.

Listener Buying Experience

The most ideal path to purchase for a publisher is not always the best for the customer.

On one side of the great divide are the apps. For them, the listeners are their customers, not the customers of the publisher.

Apple’s in-app option is the most seamless, allowing a clear price to be displayed, free trial, and identification of what content is and isn’t gated from the main feed. Spotify’s entire flow is so hostile to listeners it truly feels like it was built solely to argue with Apple about anti-competitive behavior. Sometimes there’s a link hidden in the podcast description, other times there’s a lock icon that, if you’re signed in, will give you an external web link to purchase to.

Awkwardly in the middle is Patreon, as publishers are driving their listeners to an external service which the listener has to register with. Publishers only receive the listeners Patreon name, email address, and the tier of support they’ve subscribed to, while Patreon maintains access to all of the personal information. Once sold, the publisher then is responsible for getting the listener set up in their app of choice.

And on the other end are the subscription services, which allow the publisher to maintain full ownership of the listener to publisher relationship. Billing, personal information, and anything else they request. Some of these solutions, like Supporting Cast, can integrate smoothly with a publisher’s greater subscription offering for more than just podcasting.

At HotPod Summit, the team at Patreon highlighted that creators don’t seem to be choosing just one path of subscription offering, but multiple. Each service has a different appeal, from reduced friction, to added features, to reaching listeners on every operating system. And while the service providers are absolutely fighting for the same publisher customers and their revenue, they’ll need to concede that each other exists in a way that benefits publishers instead of alienating them.

And more importantly, to not alienate the listeners.

Hosting Platforms and Subscription Services

Today, if my podcast were on a hosting platform not participating in Delegated Delivery or Open Access, and not integrated with any of the core subscription services out there, and not offering even a light alternative themselves, I would have two options: quadruple my workload and directly submit to all of these platforms in their uniquely preferred way, or switch hosting platforms.

The first option leads to eventually abandoning avenues that might pay off in the future if the lift just isn’t worth it today. A publisher burnt out on exploring subscriptions because the hours spent far outweighed the revenue potentially damages the entire space. And while I’m not advocating that anyone with a subscription offering should get paid, I am saying that it’s easier to ignore not getting paid when there’s little to no additional work to accomplish something.

The second option, switching hosts, is becoming harder and harder to justify. Most hosting platforms have focused aggressively on ad-based monetization and have done incredibly well by their publishers. Different publishers thrive on different platforms, but many publishers are finding it difficult to leave a platform that pays them well, even if that platform has stopped building features to benefit them.

And I get it – hosting platforms need to make money, and taking 30% of the ad revenue they drive to publishers is more lucrative than building features that enable their publishers to monetize through subscriptions, which in many cases offer ad-free feeds. But providing those features is more attractive to publishers when ad revenue just isn’t cutting it, or when a competitor is trying to poach those publishers on higher ad revenue alone.

Initially, I believed that subscription services were a feature that podcast hosting platforms should build themselves, but today I know that’s wrong. It’s not simply a feature, it’s a full suite of tools that spans far past podcasting and into monetizing all sorts of content that publishers are now exploring. But hosting the content for a publisher is just a feature. The true benefit of a hosting platform is the workflow, ad serving, and reporting for everything podcasting. Hosting platforms can become that nexus by building strong relationships and integrations to distribute content and pull in reporting all in one place.

At a time when tensions are high, and publishers are looking to best monetize however they can, these types of integrations matter.

Wrapping it Up

I sat down to write about the whole process of subscriptions, from podcast players, to hosting platforms, to publishers. But ultimately, I realized that publishers need to own their piece fully. The roadblocks I’ve mentioned above are important for us to overcome to normalize subscriptions, and while there are a few more (like the truly awful in-app experience and promotion provided by Spotify for their offering), they’re not industry-wide.

Next week, we’ll dive into what publishers can do to make the most of their subscription offerings.

Market Insights with Magellan AI

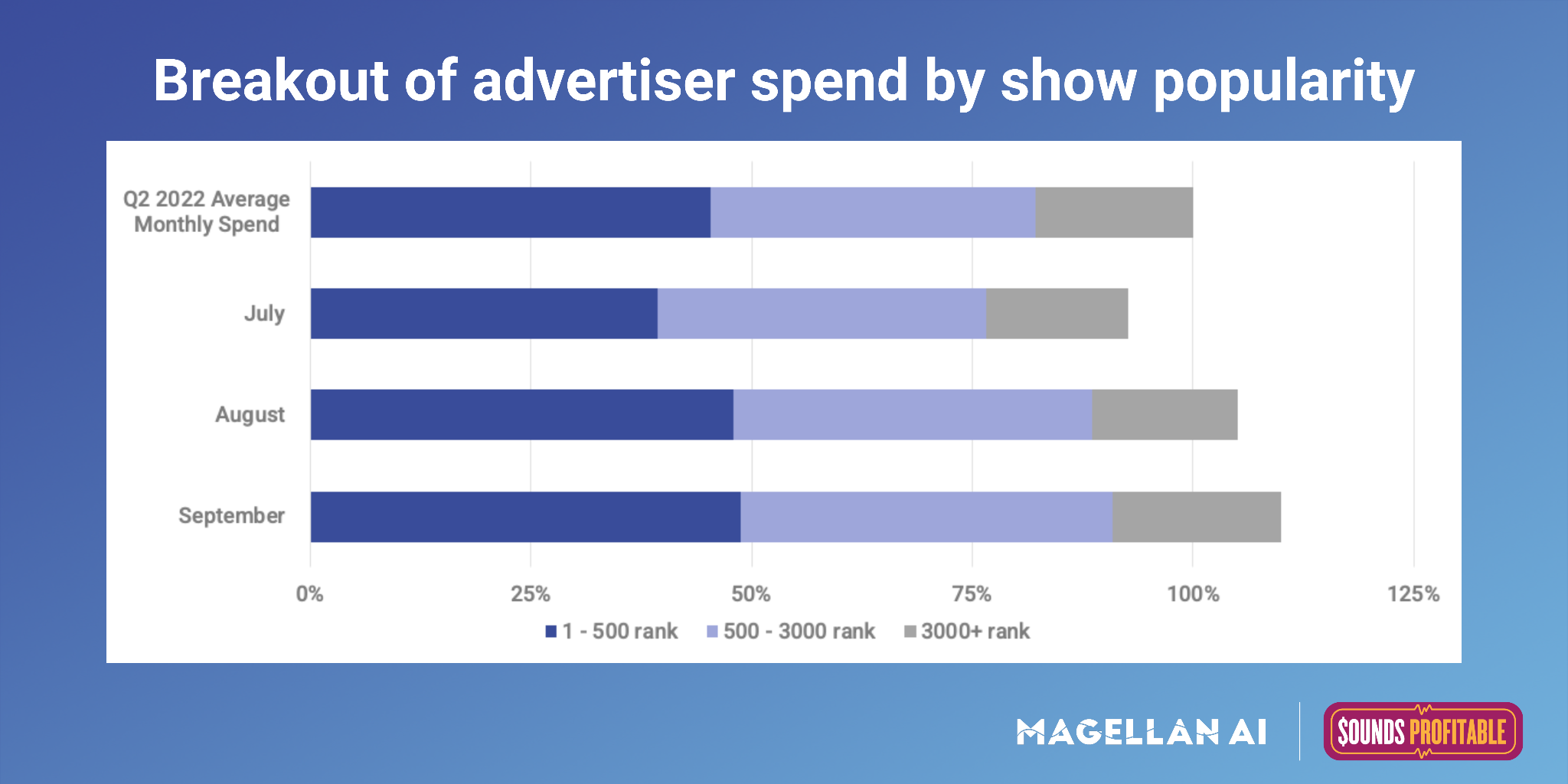

This week we are continuing to highlight the podcast industry by comparing the allocation of advertiser spending by popularity of shows measured by their rank. Between Q2 and Q3 podcast spending increased by 2.6% overall, with shows ranking in the top 500 accounting for around 45% of advertiser spend in Q3. Though spending levels varied from month to month, the distribution of advertiser spend remained relatively consistent.

Interested in more insights like this? Download the Q3’22 Podcast Advertising Benchmark Report for a full analysis

Anatomy of an Ad with ThoughtLeaders

Sponsoring brand: Magic Spoon

Where we caught the ad: Mind Pump: Raw Fitness Truth

Who else has sponsored this podcast? Organifi, Joovv, Caldera + Lab, Nutrisense

Where else has this brand appeared? The David Pakman Show, High & Mighty, Fightful I Pro Wrestling & MMA Podcast, Still Buffering, Pod Save America

Why it works: Right at the start of the podcast, the hosts introduce the sponsor of the episode – Magic Spoon – and highlight the aspects that would definitely interest their audience such as, ‘high protein cereal’, ‘almost no sugar’, and ‘the macros on this are incredible’. Its obvious that the hosts of this podcast know exactly what their listeners are interested in and what they need to know to persuade them to try out a product. Interestingly, although the ad-read is done and dusted, the hosts bring up Magic Spoon later on in the episode, “I did think of a downside to one of our sponsors, Magic Spoon…we had that guy call in and he’s like ‘I want you guys to know I tried Magic Spoon for the first time and I ate the whole box already’.” This tidbit definitely added to the ad-read!

New Partners

Sounds Profitable exists thanks to the continued support of our amazing partners. Monthly consulting, free tickets to our quarterly events, partner-only webinars, and access to our 500+ person slack channel are all benefits of partnering Sounds Profitable.

- Criminal Minded Media is a podcast production company specializing in journalistic, documentary-style storytelling.

- Since 1978, Coleman Insights has provided strategic research and guidance to audio brands around the world. Using methods including perceptual research, content testing, and focus groups, Coleman Insights provides deep actionable insights beyond the data to help build strong brands and develop great content.

Want to learn more about partnership? Hit reply or send us an email!