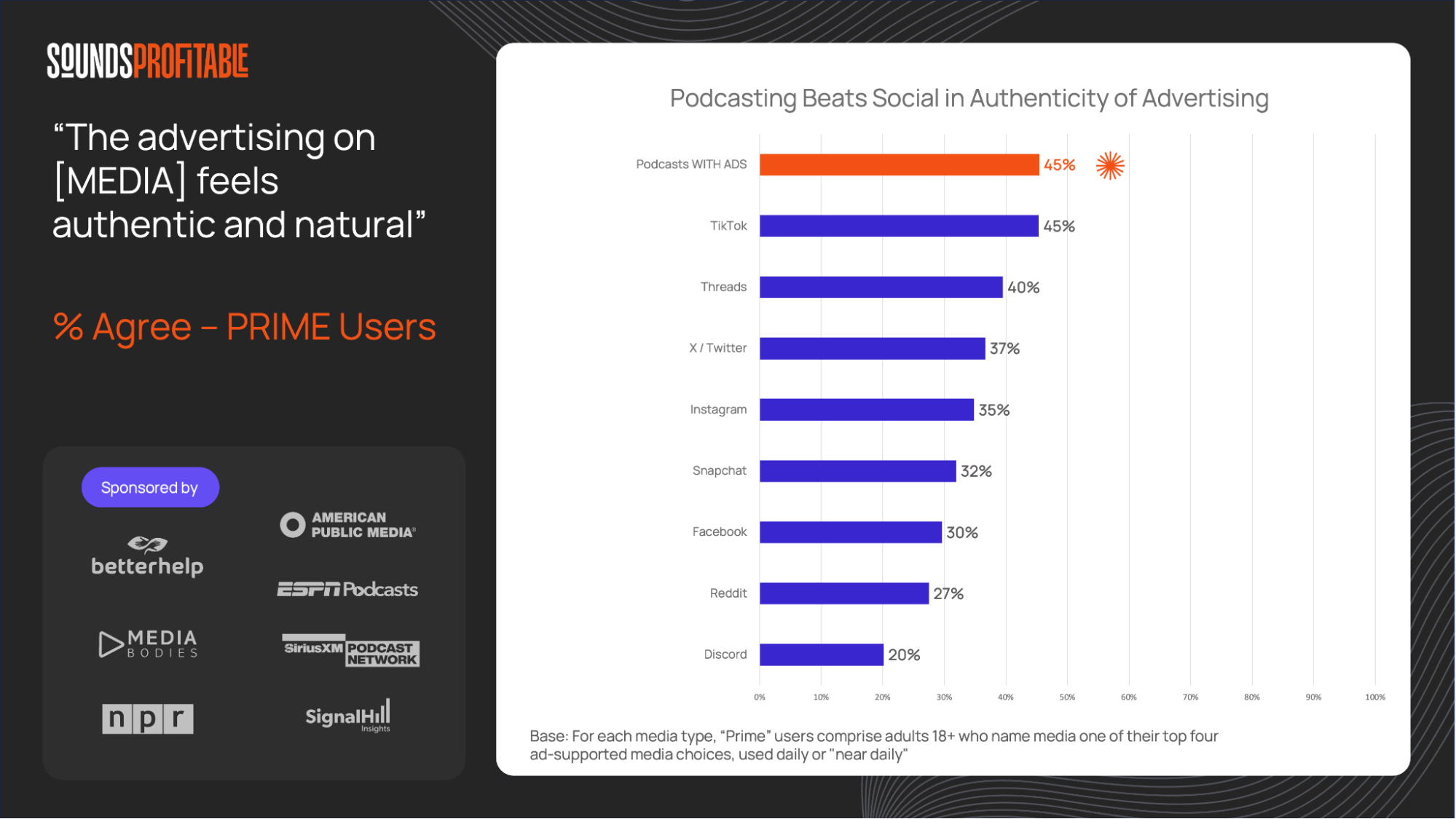

Join Sounds Profitable’s Tom Webster for the first look at The Advertising Landscape 2025, our newest flagship study of the ad-supported media landscape. This is the largest cross-media study of advertising in podcasting in America, and provides the most comprehensive picture to date of podcasting’s strengths and weaknesses as an advertising vehicle. The webinar is NEXT WEDNESDAY, April 16th, at 2:00 p.m. EST. Register now!

Editor’s Note: We’ve added additional details to this article, as of April 14th, 2025, to share further nuance to how the Spotify Video and Streaming Audio solution works.

The conversation surrounding video is nuanced and shows no signs of slowing down. It’s growing daily as new research, insights, and hot takes make headlines. This is why we’re hosting a Video Podcast Summit on May 5th at Headgum Studios in LA and prioritizing articles like this.

To make sense of the situation, we must understand all players and parts. In my previous article, I covered the consumer side of the Spotify Video experience, explaining how audio and video are presented to listeners and viewers in the Spotify app, including the new content invited over from YouTube that’s highlighted alongside podcasts that have been available on Spotify for years.

Today’s article is an examination of Spotify Video and Streaming Audio from the other side. Instead of burying the lede: In its current state, I urge the podcast industry not to take part in Spotify Video and Streaming Audio as it stands to have a massive and long-term negative revenue and reputational impact for those involved.

Here’s why:

Fraught with Fragmentation

If you don’t host on Megaphone, you now must upload your podcast to, potentially, three different places: your RSS Hosting Platform, YouTube, and Spotify for Creators. No single tool distributes to all three platforms and reconciles analytics data from them, meaning more manual work for podcast publishing teams without increasing audience size or revenue.

Uploading even one video episode, whether through Megaphone or Spotify for Creators, triggers a change in delivery for every episode of your podcast on Spotify. Instead of Spotify users accessing your RSS feed, Spotify caches all your content and streams it directly to their users, for all episodes, video and audio. For those of you who don’t host on either solution, you have the ability to manually log in to Spotify for Creators and replace a single audio episode with a video file, caching just the episode with no impact to your other episodes on or off of Spotify. [Added 04-14-2025]

Again, to be clear: adding a single video episode moves every existing episode, including audio-only, to a cached feed. This removes your ability to:

- Reconcile IAB Certified Downloads and Ad Delivery

- Utilize analytics and attribution prefix URLs

- Implement Dynamic Ad Insertion (DAI)

Spotify’s choice to not present IAB Podcast Measurement Technical Guidelines metrics alongside their new metrics is dangerous and could cost publishers substantial revenue.

Some advertisers still focus their podcast budgets on audio-only content, with separate teams handling video. Activating Spotify Video and Audio Streaming would remove their ability to buy your Spotify audience as the available analytics become Spotify’s first-party data.

Video and simulcast ad buyers understand the nuances of buying on YouTube. They have expectations about user behavior and link effectiveness in episode descriptions. We lack evidence that video podcasts have changed Spotify user behavior or enough information to model ad campaign success in this new solution.

Adding your show to YouTube does not cannibalize traffic to your RSS feed.

Adding your show to Spotify Video and Streaming Audio means discarding nearly 10 years of historically-certified data, and voluntarily degrading the service you provide to advertisers, with no clear audience gain, while opting into unvetted, untested, and unproven proprietary metrics.

And that’s before we even discuss ad serving.

BakedIn Backstep

The language Spotify uses to explain how Premium customers will receive a dynamically-inserted, ad-free experience on Spotify Video sounds good. I like it. They clearly communicate that the only ads users will experience are those embedded into the video by the creator. Something comparable to how subscribing to The Verge removes all ads that aren’t direct-sold, or matching the offering provided by YouTube Premium. It’s a trend I’d like to see more podcasters adopt when promoting the value of their direct subscriptions.

Both Spotify and YouTube bill this as a feature. In reality, it’s permission that – if you properly list ad inclusion and the host reads the ad – they won’t remove your content. There are no ad servers for BakedIn ads. No tools allow publishers to insert ads before publishing. Outside of Google Sheets, few widely adopted solutions track which ads are BakedIn to published episodes.

Where this “feature” becomes a service degradation is around Prefix Analytics URLs. These URLs are what elevate BakedIn advertising from content delivery to ad serving. Podcasting’s advantage over YouTube has been the ability to use third-party solutions to monitor delivery and attribution of entire episodes, weighing the success of embedded ads. Opting into Spotify Video and Streaming Audio removes this feature, even though they could maintain this functionality (at least on server-side).

But we’re still not at ad serving…

Adserving Atrophy

Despite Spotify pushing Streaming Ad Insertion (SAI) for five years, it hasn’t caught on. It’s not a public standard and only works in their app. Only Megaphone enables publishers to serve their own ads with it. Most importantly, it never gained traction with podcast advertisers as presented.

Dynamic Ad Insertion (DAI) isn’t perfect, but nearly 10 years of use has allowed optimization for success. It uses Ad Delivery as its core metric, counting when the portion of the episode containing the ad has been downloaded. SAI is a live call from the app when the user passes an ad marker—which would make it an Ad Impression, albeit without third-party auditing or disclosed standards. This was a major selling point for Spotify Ad Network (SPAN), which often doubled prices for SAI inventory when compared to DAI. However, SPAN’s performance and lack of transparency didn’t justify the added cost, leading SPAN to announce last year they’d remove publishers’ ability to set price floors and a decline in SPAN revenue for most publishers.

Opting into Spotify Video and Audio Streaming currently:

- Changes your industry-recognized DAI into SAI for all Spotify users

- Removes your ability to serve ads to Spotify Premium users (68 million of 115 million North American monthly active users in Q4 2024)

When you lose your RSS metrics, you’ve stripped out Prefix Analytics. Between that and the degradation of service provided by SAI, there is a substantial amount of listenership that not only can you no longer serve ads to (without baking them in), but they’re also not appearing in your reporting.

It also eliminates your ability to serve VAST in any capacity to your Spotify audience. The only monetization options become direct ad serving (BakedIn or SAI) or opting into SPAN and potentially the yet-to-support-podcasting Spotify Ad Exchange (SAX). All your programmatic relationships, ability to explore Prebid Audio, the innovative OpenRAP solution for host reads, and Dynamic Creative Optimization campaigns won’t serve on that inventory.

What Do We Do?

Much of Spotify’s video offering benefit centers around the Spotify Partner Program, which pays eligible publishers for consumption by Premium users. But the calculations are a black box. We lack sufficient data to determine value. Even if revenue is great, everything above alienates podcasters from the advertisers that drive industry growth, making you entirely dependent on Spotify—a company not known for paying out more over time.

We need to speak openly and collectively. Our industry is small enough that we can do better than 101-level panels rehashing the same topics. We can list our needs for collectively buying into something new from a platform we all work with.

I want to emphasize: I’m not convinced we can collectively ask more of every big name in podcasting, such as Apple. But Apple didn’t try to change the game entirely and ask us to buy in. They didn’t advertise to premium users that there would be more video podcasts free of dynamically inserted ads. Spotify did. And to deliver on those goals, they need you to opt in.

In mid-May, after our Video Summit, we intend to gather those needs and post them publicly on behalf of nearly 200 Sounds Profitable partners and anyone else who identifies with them. We’ll pose questions to work towards answering over the next year, such as:

- Is overall usage of their app increasing with video inclusion, and does this benefit podcasting or spread across new video creators?

- How do video completion/consumption rates compare to audio?

- Does video add or detract from existing podcasters’ numbers?

- How exactly does the Spotify Partner Program work, and is the math the same for each podcaster?

One of our goals with this summit is to bring people together to connect, share ideas, and reach a collaborative position on what we can do. As for what can be done right now: if you’ve already opted in to Spotify Video, you can contact support for Spotify for Creators or Megaphone to request your show be rolled back to RSS support on Spotify.

Today, as things currently stand, it is not in your best interest to opt into Spotify Video and Audio Streaming, even with a substantial minimum guarantee. But it could be in the future.

New Partners

Sounds Profitable exists thanks to the continued support of our amazing partners. Monthly consulting, free tickets to our quarterly events, partner-only webinars, and access to our 1,800+ person slack channel are all benefits of partnering Sounds Profitable.

- At Audire, we reach an audience of over 150 million people, connect brands with consumers, and capitalize on the unique influence of digital audio.

- SMC is a full-service podcast production company for bold brands and big ideas, while Mosaic Monocle is the in-house creative lab bringing original stories to life.

- DeepCast Creator is an AI-powered companion for podcast creators, providing marketing tools, metadata enhancement, podcast searchability, and workflow automation without replacing creative control.

Want to learn more about partnership? Hit reply or send us an email!