Intro

In October, I wrote about a post-apocalyptic future where Spotify dominated the podcasting adtech landscape. My intention was to provide a healthy reminder to the rest of the industry that Spotify is not playing by the same rules that podcast advertising is bound to.

Then last week Spotify bought Megaphone, before I had a chance to publish my follow up. My punishment has been reading the dozens of articles that make my doom and gloom scenario look like Candyland.

I’m here to tell you that the sun is shining bright on the podcast advertising space, even as Spotify gobbles up another company.

To avoid burying the lede, Spotify’s purchase of Megaphone is going to drive more money and legitimacy into dynamic ad insertion (DAI) for the entire podcast advertising industry, not just squirrel away fat stacks for Spotify’s proprietary streaming ad insertion (SAI).

Let me get one thing out of the way: I worked for Megaphone from December 2019 to August of this year, so I’m more familiar than most with how the company works. I’ll only write about publicly-available information here, though.

Selling Out

News of the acquisition wasn’t incredibly shocking.

Megaphone, not Anchor, has been hosting Spotify’s owned and operated podcasts and Megaphone built the hosting side of Spotify’s streaming ad insertion (SAI) product. So if you listened to Michelle Obama’s podcast on Spotify, you were listening to files hosted on Megaphone, not Anchor, because Anchor isn’t a platform currently used by the professional podcast industry.

But purchasing Megaphone wasn’t a tech acquisition. Megaphone’s big claim to fame tech-wise is an exclusive relationship with Nielsen that allows the matching of household IP addresses to Nielsen’s robust list of demographic segments, allowing Megaphone the ability to offer more granular targeting. But they have been late to the party on many several table stakes features, like IAB certification (spring 2020) and VAST support (quietly released in September?).

No, Spotify bought Megaphone for their sales and creative team. This is the same team that was so successful in their first quarter of existence that Panoply closed up shop as a production house, then re-branded to Megaphone and pivoted to becoming a hosting platform supported by the Megaphone Targeted Marketplace (MTM), one of the most successful second-seat ad sales solutions in podcasting.

Even without Megaphone, Spotify has been doing a bang-up job selling out their SAI inventory in their owned podcasts. According to Jay Richman, Head of Global Ads Business and Platform at Spotify, Spotify has “way more advertiser demand for [SAI] than inventory to satisfy it.”. That’s not really that surprising when you consider Spotify only has around 100 shows they can currently sell SAI ads on. While Spotify’s total US audience sits at 80 million listeners, only 22% of them engaged with podcasts. Selling out 100 shows to 17.6m listeners doesn’t exactly strike me as shocking.

So while some of the MTM inventory will find its way over into Spotify’s SAI offering, the lion’s share of what MTM offers is access to inventory outside of the Spotify ecosystem. For Spotify to truly take advantage of their purchase of Megaphone, they’ll have to start serving into dynamic ad insertion ad placements.

SAI Legitimizes DAI

Megaphone operates on a waterfall priority, meaning publisher direct ads are sold first, then unsold inventory opens up to MTM. Many of the publishers hosting with Megaphone are enterprise-level podcast companies or large networks that sell their inventory directly.

MTM gets the leftovers. Publisher direct ads take priority, and MTM will only fill an ad placement if there’s a hole.

Megaphone silently released VAST in fall 2020, allowing publishers to fill unsold inventory by connecting with Triton, AdsWizz, DAX, Magnite, and any other programmatic solutions. Reading the help docs, it looks like VAST would be set at the publisher-level of the waterfall, before MTM even got a shot, leaving MTM with even less priority inventory.

So the”which placement should be inserted” waterfall now looks something like this:

- Ads the publisher has directly negotiated to run

- Ads from programmatic sources, via VAST

- Finally, ads from MTM

Where will Spotify’s in-app ads – SAI – fit into the current equation? Shockingly, at the bottom of that waterfall. Yes, that’s right. Megaphone will tell the Spotify app about unfilled inventory, allowing Spotify to pause the audio and play the in-app audio ad at that unfilled ad spot. With the current setup, Spotify’s in-app ads will only run if the inventory wasn’t filled directly, wasn’t filled by programmatic partners, and wasn’t filled by MTM, and that specific download came from the Spotify app.

Even if the entire waterfall is shifted for SAI to get first pick, that just isn’t enough. For Spotify to hit their goal of 70% sell through rate, they’re going to have to serve ads directly into Megaphones full DAI inventory, not just rely on ads served with SAI in the Spotify app.

Both SAI and DAI need to work together. In fact, they already do. Savvy buyers currently run a small portion of their campaigns on Spotify to glean directional data. They then apply those learnings across a larger swath of DAI inventory. Spotify – a company filled with data-savvy people – know this, and will offer buyers a blend of SAI and DIA inventory. This protects the high-value but low-availability of SAI while maintaining or even raising the value of the higher-availability DAI placements.

Hey, salespeople: If you sold out of 100% of your inventory, and you got access to additional inventory that was similar enough, would you lower the CPM?

Of course not.

Doing so would cheapen the value of both offerings, especially if the new inventory performed as well as the old. Because with SAI, Spotify is selling access to their listeners, not to the content.

If I’m wrong, even better. But keep this in mind:

Spotify does not allow any third party tracking in their platform for attribution, but DAI partners do. Why would anyone buy Spotify DAI if they don’t allow attribution tracking when you could still do the directional test on Spotify, then go buy more inventory from a programmatic partner or directly with a network or publisher?

All that indepth walled garden data level targeting Spotify offers, you can’t third party validate it, track attribution off of it, or use it in any way outside of Spotify’s walled garden. The buyers clamouring for data aren’t asking for just one side of the equation, they’re asking for both. If buyers can’t access and utilize that granular data, does Spotify really add more value than running broader DAI campaigns?

Savvy advertisers are going to keep running broader campaigns. There are 1.6m podcasts active today, and even if Megaphone retains 100% of their shows and convinces all of them to join MTM (less than half are currently opted in), that won’t even add up to 6,000 podcasts, or less than 0.4% of all podcasts out there.

And all of this assumes that Spotify offers the publishers a big enough cut of the ad sales to stop them from doubling down on their DAI programmatic partners, who are already plugged into major DSP’s, which Spotify’s podcast inventory doesn’t seem to be at this point.

We’ve Done This Dance Before

Remember iAd?

In 2010 Apple purchased mobile ad company Quattro Wireless. I vividly remember checking the terms of my lease shortly after hearing the announcement, because it was clearly going to be game over for those of us in the mobile advertising space.

Six years later, it died quietly in a corner.

While the overall mobile ad space was catering to the buyers by providing access to inventory through whatever ad network the buyer preferred working with, Apple built a wall. iAd was only available on iOS, which accounted for 57% US market share in 2015, but less than 12% in Asia (you know, the area Spotify lumped into “19% – Rest of the World” on their pie chart).

Initially, Apple required iAd to get first dibs on the publisher’s inventory, placing themselves at the top of the waterfall. But as ad networks gave way to ad exchanges, buyers became able to use their demand-side platform (DSP) of choice to buy into basically all of the available inventory.

And iAd became an expensive walled garden.

What really killed iAd was the lack of data sharing. Buyers got minimal data that they could use outside of the iAd ecosystem to learn more about their audience while publishers got absolutely zero data. And third party tracking? You can forget about that.

If this story sounds familiar to you, it’s because right now, if you squint, Spotify’s SAI has a lot of similarities to iAd. You might be able to target with high level data, but you can’t take it with you, which is what advertisers really want. Buying Megaphone and expanding into DAI tells me that they’re familiar with adtech history as well.

The rest of the space had some consolidation, and will continue to have more, but ultimately it’s still thriving.

Aggregators rise and fall in popularity. Spotify as a podcast player is one app. Spotify as a media company is adapting.

Hot Takes

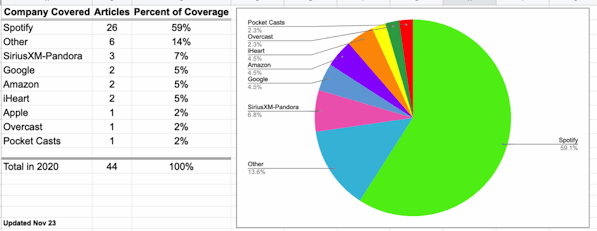

There were so many articles out on this topic last week, and I tried to read all of them, but a few stuck out with bits of information that I just couldn’t leave to be incorrectly represented through our space.

The Verge

I can’t believe I have to say this but: Spotify does not magically get access and rights to all of the hosting data Megaphone has collected.

Yes, technically, they get all this data. However, their publisher contracts say otherwise – and if Megaphone and Spotify are found to have used this data to poach podcasters or gain any competitive advantage, this could be reason for legal action. Megaphone doesn’t even have the rights to access granular publisher data without clear consent and definitely does not have rights to aggregate data between publisher accounts. I don’t know a podcast adtech partner that does.

So no, Ashley Carman, Spotify does not gain “[…]unprecedented access to data about other networks’ shows.”. The Verge literally hosts their podcasts on Megaphone. Go ask your legal team for the agreement – which will be really clear that Megaphone doesn’t have rights to your download numbers and stats.

Podcast adtech coverage from outlets like The Verge is what inspired me to start Sounds Profitable.

Pod Culture

The best part of Nick Hilton’s Pop Culture article on Spotify is the picture of The Lesser-Spotifyed Pig.

Nick wrote that:

“[Spotify] can now offer a nose-to-tail experience for podcasters, from creation with Anchor, hosting with Megaphone, dynamic advertising with their own Streaming Ad Insertion (SAI), and distribution with Spotify. And they’ll use creator acquisitions — like Gimlet, The Ringer, Parcast and Joe Rogan — to try and set this as the industrial default for emerging podcasters.”

For the new “Joe Podcaster” as he puts it, I super agree. Welcome to the TikTok-ification of podcasting. A funnel built to bring people in, help them create content, design algorithms to keep people engaged in the content, and let them earn bottom of the barrel CPMs for participating in a fully Spotify owned ecosystem, just like Youtube provides for their publishers.

But I could not disagree more about the impact on the larger podcast industry. If Spotify offers publishers a lower CPM than MTM offered, why would any publisher take that? Spotify can’t stop dynamically inserted ads from running on podcasts listened to via their app, because they don’t have the right to edit anyone’s audio files. No publisher is going to take less money than they’re currently making from a partner who will easily be looking to take the largest margin in the podcast advertising ecosystem.

Jay Richman – Spotify

On one hand, yeah, we do need to get more advertisers into the space. On the other, calling the space “not a sustainable or healthy ecosystem” is about as accurate as selling user level demographic targeting when best case you can target the household..

The IAB believes we’re about to hit our first billion dollar ad spend year in podcasting, with those already spending in the space expecting to nearly double their investment. In 2020 alone, Sirius XM purchased Simplecast for $28m, Stitcher for $325m, and invested $75m into SoundCloud. Both Podsights and Chartable raised funds as well.

Don’t knock a thriving space, Jay.

Hot Pod

I’m throwing in a quote from Nick Quah, Panoply alumn and guy-who-won’t-reply-to-my-emails, that helps highlight how gross Jay Richman’s comment above was:

“Increased targeting, measurement granularity, and ad inventory management ease could fundamentally ruin what made podcast advertising great — and make it as screwed up as the rest of digital advertising”

Real talk: the only thing that has stopped Big Ad from turning podcast advertising into another parking lot is the lack of data.

The big takeaway I’m aiming to get across today is that the acquisition of Megaphone by Spotify is very very good for all of us in the podcast advertising space. Spotify’s actions will legitimize DAI, removing the argument that future advertisers will only be interested in SAI. The data from traditional DAI, while limited, is still available and valuable for advertisers. Even more so than the Spotify walled garden data. And most important of all, while Spotify might be willing to take a loss and spend quite a bit to accomplish their goals, they’re not here to tank CPMs on a market they just bought into.

In fact, Spotify would like to raise them.

Homework

The goal of Sounds Profitable is to educate and empower each of you. If we’ve had a chance to talk directly, you know that I am truly passionate about both adtech and podcasting. We learn through asking tough questions and discussing the answers. Armed with today’s new knowledge, I want to help you ask more questions. Please consider supporting Sounds Profitable through our Patreon.

And share this article on your social channels while asking your followers a question. This week, there’s just one:

- Do you really believe that after convincing people to buy podcast inventory without MAIDs or cookies for years, Spotify, with their limited inventory but ability to provide that data, is going to put you out of business or drive CPMs lower?

New Sponsors!

It’s our goal to highlight the amazing people and companies that are helping Sounds Profitable keep the lights on. We’d like to personally thank our latest full sponsors: Voxnest’s suite of tools help content creators and advertisers to be heard in the vast ocean of the podcasting world.

We’d also like to thank our latest individual sponsors: John Rosso of Triton Digital and Mikel Ellcessor of Limina House. We appreciate your support! If you’d like to learn more about sponsorship or advertising with us directly, please reach out!