Sounds Profitable’s latest study The Podcast Opportunity: Buyer Perceptions of Podcast Advertising is now available for download! Find the latest quantitative and qualitative information on how buyers see podcasting. No registration gate, no emails, just a download. Come check it out!

I have spent a good deal of the last month doing a series of presentations with our partners in front of hundreds of buyers from agencies and brands, one Zoom at a time. From (A)utomotive Aftermarket to (Z)ervice Industry (OK there are no Zs), I am pretty sure I’ve talked to them all in the month of July. Here is what I’ve learned: I’m never going to be done talking to buyers. Every week, new people join an agency, move to a new brand, get promoted, or otherwise find themselves in a position to learn more about podcasting, and we have to be there for them – all of us in this industry can never cease singing the song of podcasting, because it continues to punch below its weight in advertising spend and many buyers still don’t know exactly how to integrate podcasts into their other media buys.

This is the mindset that informed Sounds Profitable’s latest research project, The Podcast Opportunity, which interviewed over 300 buyers to learn their perceptions of buying podcasts and what we as an industry need to do to increase their spend. My partner, Bryan, referred to the results as akin to an employee “performance assessment,” which I think is a pretty good analogy. Though I am going to refrain from assigning letter grades, I think this study gives us a pretty good report card, but also highlights some areas where different aspects of the Industrial Podcasting Complex can improve.

For this study we worked with both Digiday and Signal Hill Insights to source and verify over 300 buyers, representing brands and agencies. In addition, we conducted interviews with selected veteran buyers of podcast advertising – industry experts who do not represent the average podcast buyer, certainly, but provided us with valuable perspectives about the strengths and weaknesses of podcast buying that only come to the surface with significant experience in the industry. So, here are the top five insights from this project – the things we need to keep doing, do more of, or do better. Also, since I am writing this on a Sunday and need to motivate myself, let’s do it with Elvis Costello lyrics.

Pump It Up

I’ve written and spoken at length about the need to introduce podcasting to the general public at scale (which I’ve often referred to as podcasting’s “Got Milk” campaign). Well, advertisers are people, too. The lowest-hanging fruit to increase ad spend in podcasting is simply to get out there and tell our story to as many buyers as we can, and to expose them to the many advances we have made in adtech, targeting, and measurement over the past five years.

There’s no better indicator of this need than the answer to this question – the reason why non-buyers have yet to spend in podcasting:

More than a third of non-buyers said the reason they’ve never bought podcasting was a lack of demand from their internal or external clients. That, my friends, is simple top-of-mind awareness. We certainly have some amazing stories to tell – our previous study, The Medium Moves the Message is one of the most compelling arguments to date for buying podcasts, and that’s been the centerpiece of all of the buyer webinars I have been doing for the past month. This chart is why I am going to keep doing them as long as my voice holds out, because this job will never be done. Simple awareness and acknowledgement of podcasting as an effective advertising vehicle has significant potential to get more, new brands and buyers involved in the space.

And by the way, we also asked this question of buyers who had previously bought podcasting, but were not doing so in 2023. Guess what the number one answer for that group was? That’s right – 42% said a lack of demand by their client, which reflects both a lack of client awareness and a lack of buyer advocacy.

My Aim Is True

In addition to a general lack of top-of-mind awareness with some buyers, there is something related at play that is also extremely addressable: an awareness of how adtech has evolved in podcasting, and the current slate of tools available to target consumers. For instance, in the graph I showed above, just under lack of demand in a virtual three-way tie for second was “insufficient targeting/demographic information.” This is a sentiment that was somewhat more common with brand-side buyers than with agency buyers. In fact, when we asked people with previous experience in buying podcasts how much they agreed that they were “satisfied with the targeting tools available to podcasting,” the percentage of brand advertisers who disagreed with that was nearly double the agency percentage.

To me, one of the likely contributors to this perception is previous experience with podcasting back in the ancient past, say. 2015 or so when dinosaurs roamed the earth. Podcasting’s ability to target by demographic, psychographic, interest area, and location has grown enormously in recent years, and today if you want to geotarget fashion-forward young women in the Northeast, you could probably do that with a phone call in a way that would be impossible with radio or TV.

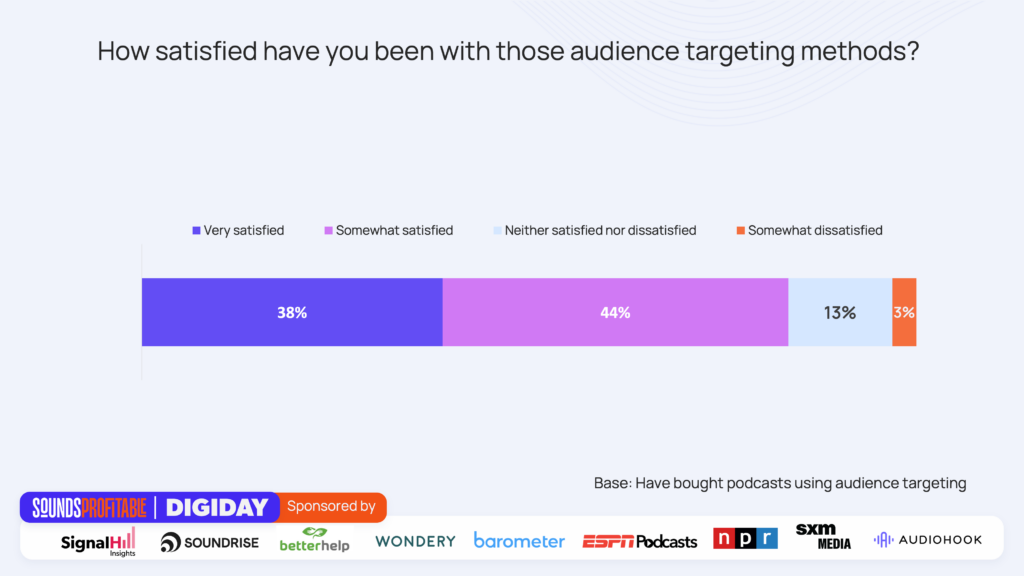

This is another example of an education issue. The evidence for that is pretty clear in the survey: among those who do make use of the various targeting methods available in podcast buying, over 80% are satisfied with those methods (and nearly four in ten are very satisfied).

What this means is that citing a lack of targeting as a barrier to buying podcasting is at least partially attributable to a dated awareness of these tools, or at least a lack of recent experience. The current advertising technology available to podcasting is extremely powerful, and the more targeting-specific case studies we can surface in public, the more chance we have to re-engage lapsed or reluctant buyers.

OK – that’s all the fun stuff. Now, for the work.

Accidents Will Happen

One of the benefits of having a robust sample and being able to do qualitative interviews with some really experienced buyers was that we were able to look at some of the numbers at the edges and make sense of whether or not these were “small problems” or big problems that most buyers just haven’t encountered yet. As someone who has been in media research for three decades now, the small numbers are always the things that I am drawn to the most. For instance, this group of four perceptions about buying podcasts were at least acceptable to most buyers, but when you see more than 10% and up to 20% disagreeing, it’s worth poking around, at least!

We are going to set aside ad skipping for the purposes of this article – I do talk about it more in the full presentation. The other three (clutter, ease of buying, and the quality of measurement tools) all point to one general conclusion: at the edges, with more experienced podcast buyers, there is friction in the buying process. One of our veteran buyers summed it up thusly:

“The biggest challenge for podcasting right now is how fast the [space] has grown and how slowly the technology has grown with it. Third party tracking and targeted podcast buying are helping solve some of those problems, but they’re not solutions yet.”

Some of these frictions are related to integrating podcasting with more complex marketing mix/attribution modeling used by multi-channel advertisers. For those buyers that are solely or mainly buying podcasts for their clients these issues may or may not be apparent, but finding ways to plot the relative efficacy and impact of the podcasting component of a larger buy remains something that is a little “black box” from case to case, and the outputs of podcast measurement don’t always comport with what those buyers are getting from display, or streaming video.

However, we also can’t forget, as I wrote about a couple of weeks ago, that some of those podcast-only buyers are massive contributors to where we are today, and where we hope to go into the future. So just as adtech providers need to continue to work to understand the needs of buyers for campaign integration, they can’t make it harder for people who spend on baked-in, host-read ads to continue doing so. This industry has come a long way to make podcasting a modern advertising platform, but there are still a few more improvements needed before “podcast” becomes a default box to check on an RFP.

Not The Only Flame In Town

The Medium Moves the Message, our last project, was the first real competitive assessment of the efficacy of podcast advertising versus two other spot advertising media channels, broadcast radio and network/cable TV. Now there is more work to do, and with the help of our partners we are doing that work. While TV and radio spends are not increasing, streaming video and music continue to be well-regarded as ad vehicles by buyers. About 70% of buyers in The Podcast Opportunity stated that they planned to spend more in 2023 on both streaming TV and streaming music, with podcasting right in that mix as well.

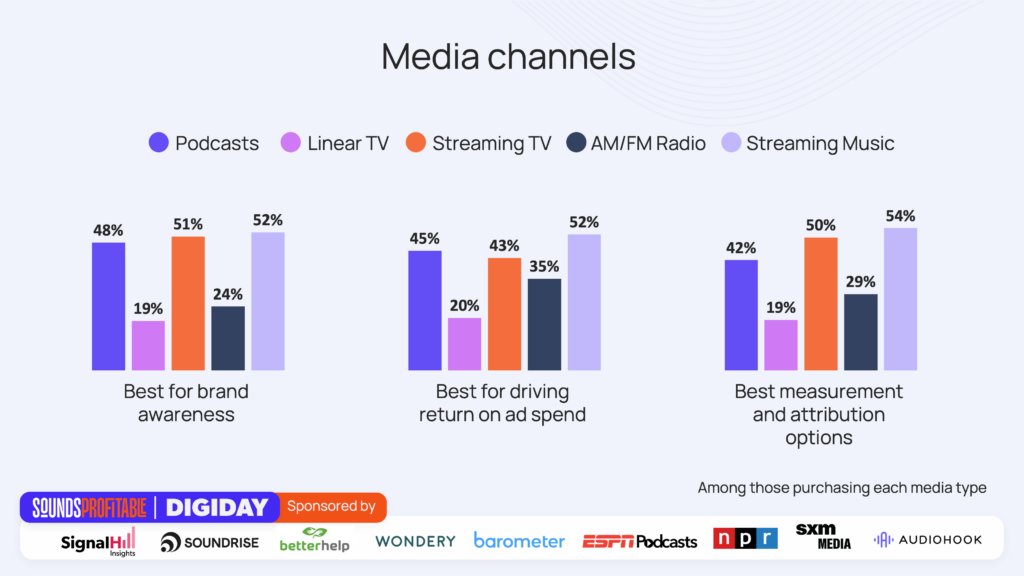

Some of the positive regard for these two streaming options is down to some of the things that I talked about in the last section – the robustness and standardization of the tools used to buy and measure ad delivery and effectiveness. When we asked buyers to compare various media platforms on effectiveness and measurement, podcasting did well – but lagged behind the streaming options particularly in measurement and attribution:

We have come a long way on measurement, and podcasting’s enormous success in direct response marketing surely contributes to the positive regard for return on ad spend. Still, we can do better, and we can also do different. We can do better by continuing to drive innovation in adtech and especially to coalesce around a true standard in measurement – not just a guideline. We can do different by looking at the differential impact of podcast advertising when compared to streamed video or music. It may or may not work better. But does it work differently? And, when integrated with a streaming campaign, does different equal something more than the sum of its parts? This is something we showed in The Medium Moves the Message, and that work also needs to be done for streaming media.

Every Day I Write The Book

Finally, it’s worth saying a word about one of the potential great advantages of podcasting – that magic moment when context, relevance, mood, and receptivity all come together in the perfect marriage of show and spot. I hope we can all agree that, while they certainly do have some degree of effectiveness, re-running the same screaming car commercials in podcasting that are employed for radio is not the best use of our listeners’ earballs. Buyers are receptive to what podcasting can do, and do differently, but we also have to lead.

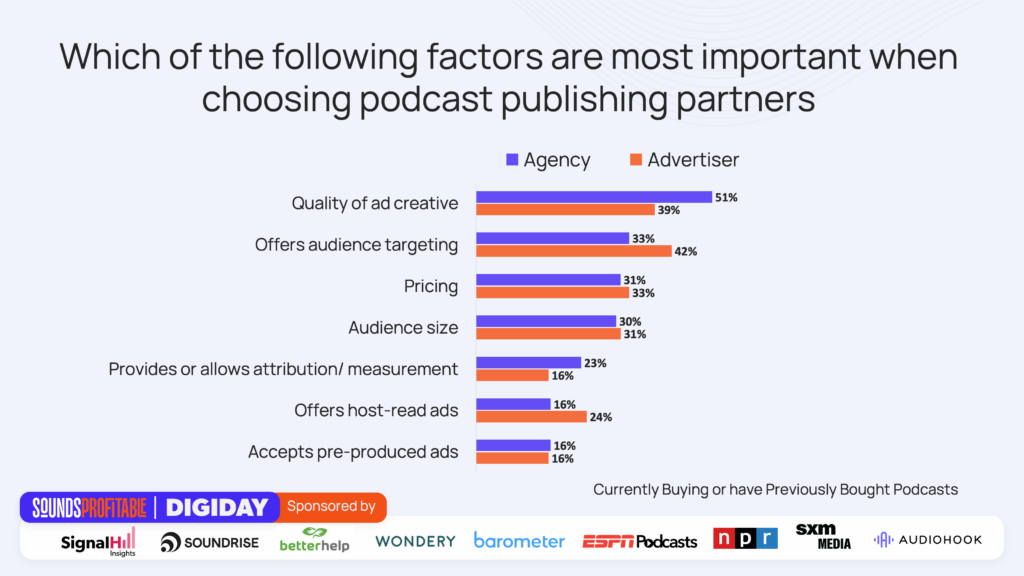

I think creative services as an integrated function is going to continue to be a way publishers and networks will differentiate themselves in the marketplace. We know how to make great ads for podcasts, and we know what will kill it with the various constituencies the content represents. The more we can demonstrate that, the more effective the outcomes will be. Buyers agree – when asked what factors were most important to consider when choosing a publishing partner, the number one answer with both agency and brand buyers alike was ad creative:

The full report also touches on some other aspects of creativity and content that impact our business, like the tension between buyers wanting new and novel content and shows to advertise on and the “flight to safety” that occurs when the ad market is soft that limits spending on exactly that kind of content. But the implications of the graph above are clear – the more we can put the same creativity into campaigns that we do into our content, the better the results will be for everyone. For publishers, this also means refreshing that creative more often, too. A host-read ad loses its magic when we hear the same one dynamically inserted for months. Creators work too hard on their 26 minutes to be let down by the other four, and to the listener, it’s all content.

Welcome To The Working Week

A lot of what you have just read forms part of the road map that Bryan and I are using to navigate our priorities as we continue to work to amplify this entire space and do our part to help develop the market – it’s work I’ve been doing since I first added podcasting to a survey in 2006. In fact, everything we are doing at Sounds Profitable is engineered to support and empower those of you who talk to buyers every day to sing the song of podcasting. But if we don’t ask the tough questions, we will never know the answers. With The Podcast Opportunity, we have some of the answers, and we all need to get to work…now.

I point this out because the IAB/PWC pegged 2022 US podcast ad revenues at 1.8 billion, with projected revenues of 4 billion in 2025. That means ad revenues are forecast to more than double in three years. One thing I have never gotten into over my 18-year career in podcasting is forecasting. It’s hard enough to reliably discern the present. But one thing that I can tell you – nothing doubles by itself in three years except, I dunno, COVID. Podcast revenues will not double by 2025 unless we make it so. Only acting with urgency can prevent missing this projection, and avoid the consequences of another raft of articles about the “death of podcasting.” I, for one, am tired of reading them.

Go and do likewise.

New Partners

Sounds Profitable exists thanks to the continued support of our amazing partners. Monthly consulting, free tickets to our quarterly events, partner-only webinars, and access to our 500+ person slack channel are all benefits of partnering Sounds Profitable.

- SCA's LiSTNR is one of the fastest-growing Australian audio app and podcast sales network with curated and personalized premium content spread across radio, podcasts, music, and news.

Want to learn more about partnership? Hit reply or send us an email!