by Andrew Goldsmith, CEO Adelicious

It is highly likely that usual podcasting advertising schedules, and therefore creator’s revenues, will be interrupted by the upcoming UK general election. Here, I explain why this is and offer some simple advice to help you reduce the impact.

First things first, none of us in the UK know when our general election, which is when we vote to choose the new Government, will be called, although it is becoming increasingly likely it will be November, alongside the US Presidential election. For those not familiar UK General Elections, elections have to be held no more than five years apart, but the timing of elections can otherwise be determined by the current prime minister. What we do know is that it will be called this year, meaning that both the UK and US public shall go to the polls in 2024, as well as all of India, another significant election globally. In fact, a total of 2.4bn[1] people from 50 different countries[2] will vote in elections this year.

I’m sure I’m not the only voter here in the UK who is frustrated by this lack of clarity when it comes to the potential date. And it’s even harder for brands planning their marketing activity when the key messages might be affected by a change of government. A change of government can lead to changes to both the CPI (the Consumer Price Index) and RPI (the Retail Price Index), which in turn can fluctuate wider business investment, impacting brand spend in the short term. Business categories such as network providers and streamers, to mortgage lenders and pension companies are all affected.

In the UK, when our parliament dissolves ahead of a general election, the pre-election period is triggered. Basically, a period in which restrictions are placed on government advertising spend. For reference, the UK Government is the single biggest UK media spender annually, responsible for all public messages and campaigns, worth somewhere between £15-25m per month to the media industry. Whilst the ruling only legally applies to government spend, it can and does have an impact on business. Pre-planned promotional or campaign activity which presumes the involvement of government, for example ads promoting careers in the public service, such as teaching or the military, might prove difficult to deliver, given the highly cautious approach taken by civil servants to any business engagement in a public setting.

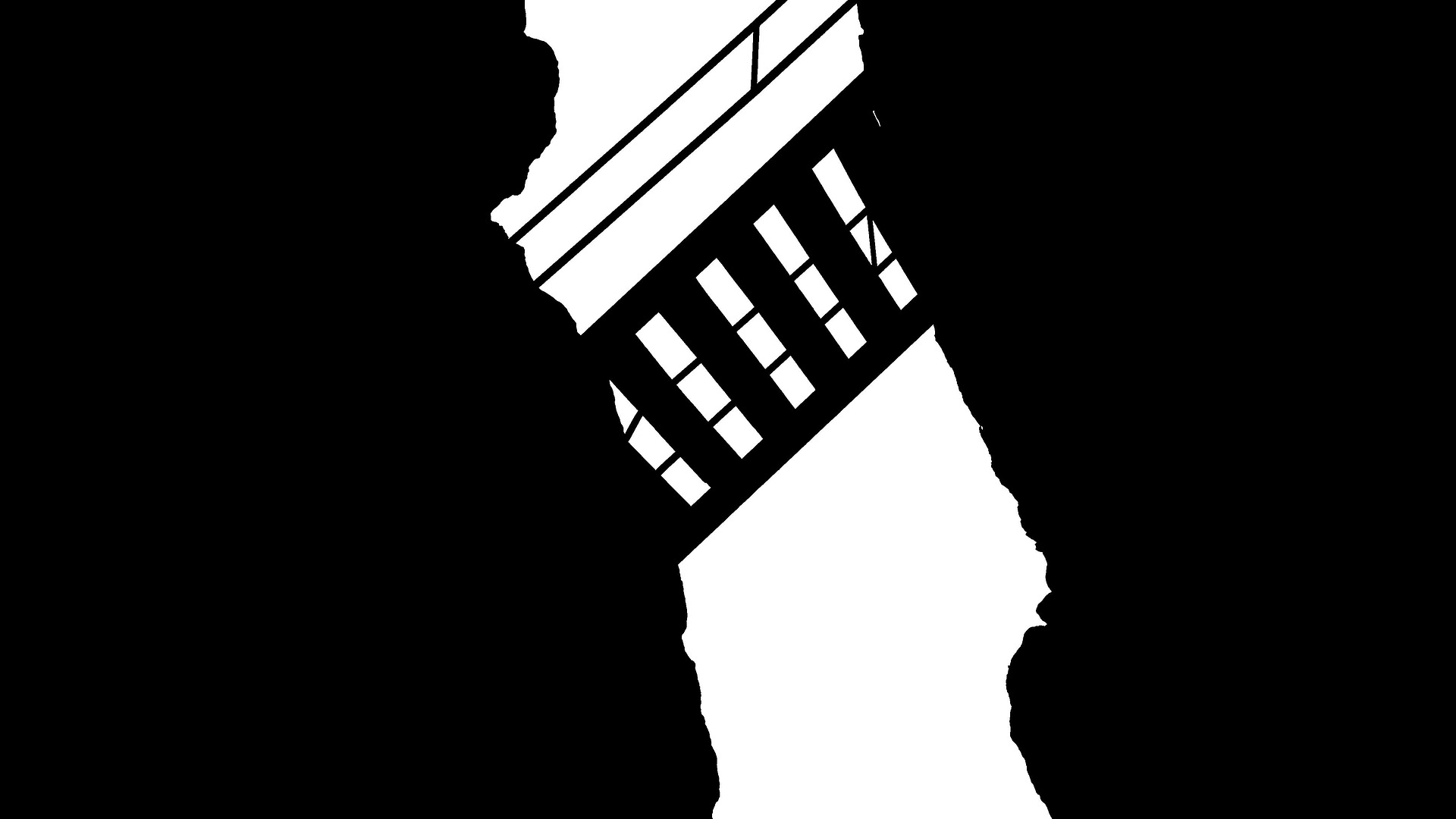

On top of this, if campaign messages are deemed to be closely aligned to the political agenda of the present government, meaning they may not be delivered as planned should the general election deliver a change of government, then these campaigns can also be subject to pre-election period restrictions. An example of this might be any services provided by local authorities, such as this public transport campaign for Transport for London (TFL).

All this already needs to be considered in 2024 brand planning, even though we don’t know when pre-election will start.

This is significantly different to the US, where there are no such restrictions on government spending. In the US, Group M forecasts that political advertising spend could reach a staggering $16bn this year. Of course, this shouldn’t be conflated with government spending, but US government campaigns are not paused during this time. In the UK, for instance, political parties are not allowed to spend on TV campaigns. Instead, the main political parties are given a set amount of time on TV to put their policies to voters. You’re likely to see these on the main TV channels – called party election broadcasts. You will also see the leaders of the main political parties in debates on TV. Supporters of political parties and their members might also put small posters in their windows or placards in their front gardens to show their support. It’s not unusual to see entire streets with posters on each house.

So, what does this mean for the world of podcasting here in the UK?

We can safely predict an increasing demand for political-based content as the election draws nearer. In terms of where people now look for this content, there has been a clear shift away from printed news in recent years, but interest in and the popularity of politics, news and current affairs remains strong.

The way news and politics is accessed has never been more fragmented. The traditional media landscape continues to change, with social playing a key part alongside aggregated platforms such as Apple News.

However, discontent with social algorithms is on the rise, coupled with a rapid decline in trust of the key broadcasters over the past decade (down from 51% in 2013 to 33% in 2023, source: Reuters 2023), leaving audiences searching for new and better ways to access this content.

News and politics podcasts have seen a huge rise in listenership, with the para-social relationship created between the podcast host and listener driving significant levels of trust. Listeners of news, politics and current affairs are a highly desirable audience, driving young and affluent audiences no longer found in traditional news media.

One of the biggest shifts in how news political media is consumed has been among Gen Z (those born between 1997 and 2012), who are tuning into podcasts in big numbers. Gen Z’s monthly podcast listening consumption has risen by 57% over the past five years, with 47% of Gen Z’ers engaging with podcasts in the past month. 66% of Gen Z listeners use podcasts to stay updated on the latest topics, while 61% tune in to keep abreast of social issues. And we know that many young people feel overwhelmed by the negative nature of news in their social media feeds, which is drawing them to podcasts. (Sources: Reuters 2023, Ofcom Podcast Survey March 2023 and SXM Media and Edison Research). We know from all previous general elections that voter turnout from younger voters is the lowest of all age-groups. The British Election Study shows slight growth in the percentage turnout from 18-24 and 25-34 year olds (at around 52% in 2019) but still significantly lower than any other age group, so where they are getting their political news from is important.

For podcasts here in the UK, the breadth and frequency of the news, politics and current affairs genre delivers the second strongest frequency of listeners, only just behind comedy. According to an Ofcom podcast survey from March 2023, 46% of news and current affairs podcast listeners listen every week, while 59% listen monthly. For politics podcast listeners, 37% listen every week and 50% listen monthly. This could mean that the pre-election restrictions could reduce ad revenue from a substantial amount of popular podcasts. But you can plan for this.

So, what are the five key things that podcasters need to think about now?

As a podcaster in this space, it’s important to plan your content, cadence and expectations as early as possible, ensuring that the wider advertising market truly understands the role you can play in them reaching and talking to your audience at a very important time. Doing this will mitigate any potential ad spend downturn due to pre-election. Here are some tips to help you prepare ahead of the general election:

1: If your show is non-political (or non-topical), then great! But it’s important to remain on the cautious side as programmatic revenue/ third-party revenue may still see a revenue dip during this period. It’s worth noting here that this wouldn’t just impact UK podcasts or even UK political podcasts, but impacts programmatic and direct advertising for global podcasts with a UK audience, regardless of the content being political/news related.

2: If you are already seeing significant revenue from Government-based activity (including branded content, host reads, spot ads), ensure that you are prepared to see this stop during the pre-election period and plan fiscally ahead. Proactively seek alternative brands and advertisers during this period. Evaluate pitching projects that could be commissioned before the election and worked on during, but wouldn’t be released until after, including branded episodes/segments/entire podcasts, etc.

3: If you are a topical show (but not political), it’s good to remain non-partisan, avoiding any extreme or bias messaging that could be deemed political, which will help your financial performance. Remember that most brands will remain highly cautious about the content they are seen around.

4: Remember, normality will resume. Advertising is (generally) cyclical and will kick start almost immediately. Spend that has been impacted by the pre-election period would likely return within a few weeks, so ensure you remain in contact with the brands during this period, so that you are best placed to reactivate campaigns the moment they come back.

5: And finally, it’s always worth remembering that advertising revenues are not the only way to make money as a podcaster, so think about other revenues streams: subscriptions, merchandise sales, live events and more as this could be a good opportunity to lean into these sources or explore new avenues that you haven’t already.

[1] Kelly Beaver, IPSOS UK, as quoted at The Media Leader Year Ahead Summit, 2024

[2] The Centre for America Progress, a US Policy Institute