- Research shows sports podcast listeners are 2.3x more likely to trust adverts in podcasts compared to print and sports radio consumers

- Higher levels of trust influencing listener behaviour, with sport podcast listeners 1.3x more likely to respond to ad promotions as compared to digital ads

- Findings dispel stereotypes and assumptions about sport podcast listeners – an affluent group with strong purchasing power, with income 32% higher than the UK average

September 2024 – New research has shone a spotlight on the opportunity that sport podcast consumption represents for brands and marketing teams. Findings from Sport Social Podcast Network (Sport Social) and Kantar suggest that sport podcasts are more highly trusted as compared to other channels.

Sport Social’s 2024 Listener Survey report explores how sport podcasts stack up against digital channels, including X, Facebook, Instagram, TikTok and YouTube when it comes to advertising habits and preferences, with data gathered from Kantar’s TGI GB data and Sport Social Podcast Network’s own listeners in conjunction with Mindfield, the market research company.

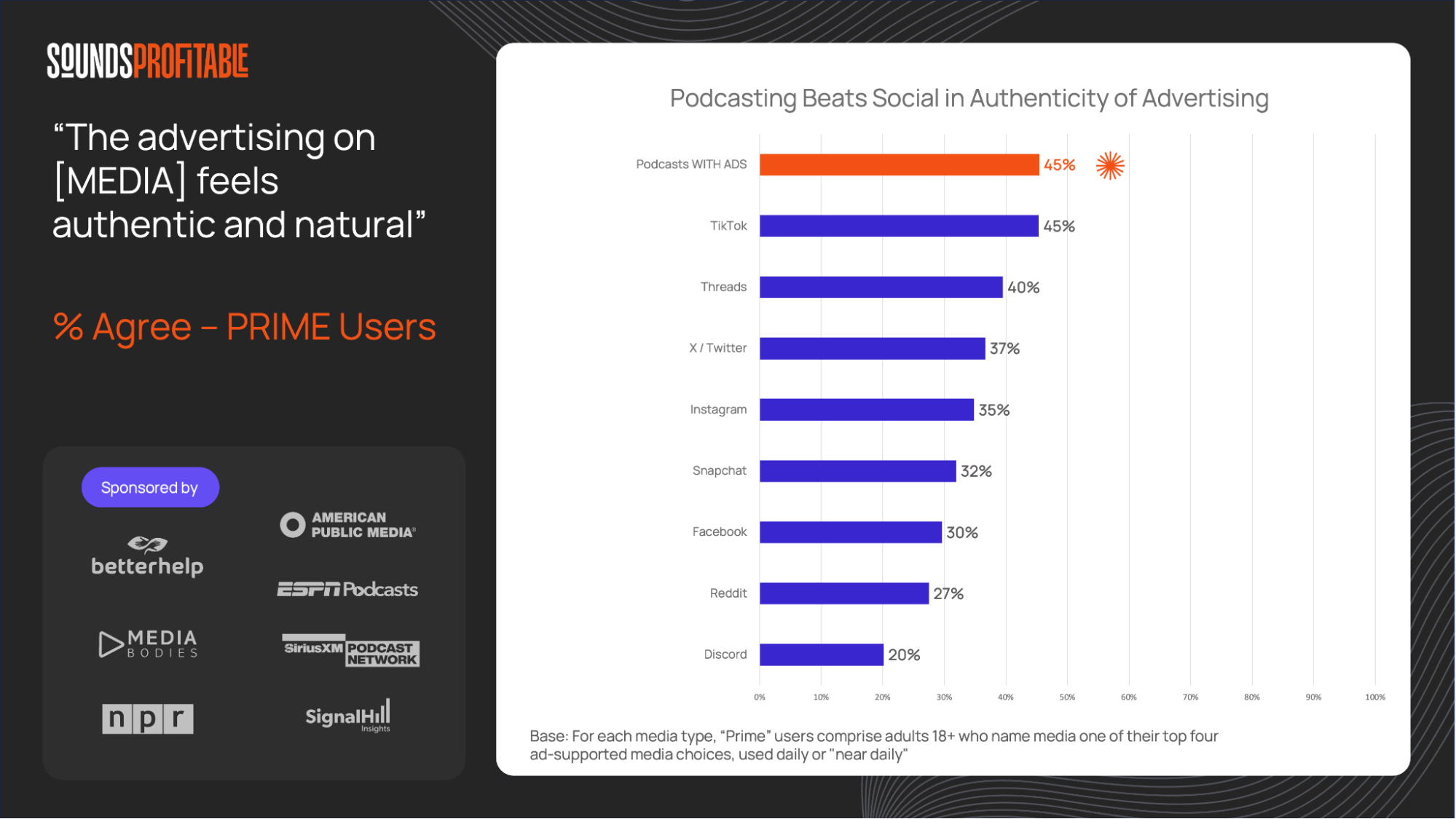

Sport podcast listeners were 2.3x more likely to trust podcast adverts, compared to print and sports radio consumers, with sport podcast advertising second only to TikTok when it came to ad impressionability. This trust and engagement in turn could be influencing consumer behaviour in response to adverts, with sport podcast listeners 1.3x more likely to respond to ad promotions, as compared to other digital channels. In line with recent studies*, Sport Social Podcast Network’s own audience shows high engagement with brands that advertisers in the podcasts they enjoy. 55% have visited a brand’s website and 40% have purchased products advertisers in podcasts.

The report also uncovered positive trends in relation to sport podcast listener purchasing power. Average income was found to be 32% higher than the UK average as a whole. This is significantly more than digital channels including X (formerly Twitter), where the average income is 8% higher than the UK average and TikTok, where average income is 4% lower.

These findings were echoed across Sport Social’s own listener base, where the survey revealed 78% to be homeowners, with almost a third (32%) having a yearly household income of over £100,000. The report also challenged perceptions of sports fans, highlighting a fandom that was very physically active (73% engage in exercise), 49% spent on personal care products while 54% enjoyed beer, wine and spirits. Such figures exemplify how, by turning to sports podcasting as part of marketing strategies, brands and advertisers can tap into an affluent audience with greater disposable income.

The findings come as spend on podcast advertising increased 23% year-on-year, according to the latest IAB/PwC Digital Adspend report, with the global podcast advertising market forecast to be worth USD $43bn by 2032. It shows the role that podcasting increasingly plays in the advertising channel mix as a way to engage audiences to take action. The format, noted for its more intimate nature than traditional print or radio, could be a factor behind this.

Sport Social counts Sky Bet, via agency EssenceMediacom, Visit Barbados and Travis Perkins are some of the household names that are increasingly exploring integrated podcasting campaigns as part of their marketing strategies.

Ruth Fitzsimons, Head of International at Sport Social Podcast Network, reflected on the findings: The more we learn about sport podcast audiences, the more they become an incredibly appealing market for advertisers driving increased interest from bands and agencies looking to bring podcasting into their advertising mix”

“This report illustrates how podcasting as a channel offers unique audiences, brand engagement and high effectiveness to invest alongside traditional linear channels. These findings speak to why that might be – this is a medium with loyal fans who have deep relationships and trust in their favourite sport podcasts and are not the one-dimensional consumers we might have once assumed them to be.

“This valuable and diverse audience is potentially easier to get in front of than trying to reach sport fans through traditional channels. Not only do they trust and engage with podcast ads more, but we’ve likely underestimated their purchasing power.”

To explore the 2024 Listener Survey, click here [https://content.sport-social.co.uk/download-sport-social-listener-survey].

Key Insights from Sport Social Podcast Network:

- 78% of listeners are homeowners

- 60% are employed in higher or intermediate managerial roles

- 60% are married/cohabiting with children

- 73% participate in regular exercise

- Sport Social listeners regularly shop for alcohol (54%), books (51%) and financial products (32%).

ENDS

*Recent studies include Veritonic’s Podcast Advertising Efficacy Guide and research conducted by SiriusXM Media.