This Week in the Business of Podcasting

We are officially all back from across the Atlantic safe and sound. Well, I caught a cold as soon as I got home but you gotta take the good with the bad. Before I check on my slowly-depleting box of tissues, let’s recap this week in the business of podcasting.

Transparency. Performance. Automation.

Addressing Spotify’s Place in Podcasting

This Wednesday from Bryan Barletta at Sounds Profitable: Bryan takes a look at several recent decisions made by Spotify, including their decision to leave the IAB.

All downloads reported by the Megaphone platform are now incompatible with IAB-compliant downloads. Also, “Ad delivery” as reported by Megaphone loses its meaning. A quote from Barletta:

“Ad Delivery pixels (often used for attribution) are simply fired when the hosting platform confirms they’re going to count Ad Delivery for the specific action and have no certification assigned to them either.”

In addition to the IAB chances, Spotify has also recently changed how Spotify Ad Network performs in relation to the rest of their advertising waterfall. As of July 1st of this year, publishers on Megaphone will no longer be able to set a price floor for SPAN. In its current configuration, Megaphone works with four tiers: direct-sold ad inventory, SPAN, VAST, and promo. When an ad is called for, it flows down the ‘waterfall’ of tiers, and each tier can only compete with itself before either filling the ad request or passing it down to the next tier.

Without a price floor on SPAN, it’s possible Spotify could take on a bunch of cheap inventory into SPAN and effectively guarantee that impressions will largely stop at the SPAN tier of the waterfall before Megaphone publishers’ programmatic options get a chance at bidding for the impression. A quote from Barletta on where things are likely to go next:

“But SPAN has its critics. At the IAB Podcast Upfronts several candid conversations were had about how blind buying into SPAN is and how it’s just not worth it for those invested in the space already. That’s not to say it’s not appealing for new-to-podcast advertisers or those buying audio and getting a taste of podcasting, but we’ve garnered enough attention now that many are exploring past single-entity buying.

The marketing machine that is Spotify is strong, but are they strong enough to convince advertisers to buy a blended SAI and DAI (uncertified) for Joe Rogan or Call Her Daddy? And even if they are, do we believe the publishers hosted on Megaphone can individually wield the same authority? I personally don’t, which is why I’ve written this incredibly long article.”

Barletta urges publishers on Megaphone to begin evaluating IAB-certified enterprise hosting platforms, such as Acast, Audioboom, ART19, Simplecast/AdWizz, Omny Studio/Triton Digital, Soundstack, Spreaker, Libsyn, and Dovetail from PRX. They should collect their SPAN revenue reports for the past few quarters and become comfortable shopping around, asking if different hosting platforms have the ability to meet net revenue along with capabilities to support publisher-led programmatic relationships.

The industry at large does not benefit from fragmentation. While it is Spotify’s own business and right to choose how to do things within their own app, dynamic ad insertion over RSS is a defined process with rules, expectations, and a decade of industry effort getting it to where it is today.

Editor’s note: In the initial publication of this newsletter PRX’s Dovetail was not included in the list of IAB-certified publishers. This has since been rectified.

Aging Out of Age Demographics

In the May 23rd installment of AdExchanger’s News Roundup, the subject of TV upfronts and aging demographics sparked conversation about formerly hip brands. Despite pop culture legacies of being popular with younger crowds, several major brands have experienced those younger groups aging in real-time. One notable example is the revelation that MTV, once a hub of youth counterculture, now has an average viewership age of people in their 50s.

The very concept of age demographics were originally created to segment and sell younger audiences under the premise of forming lifetime customer relationships early. Now they can have the effect of alienating valuable customers.

Take, for instance, Julie Alvin’s AdWeek article about how brands are effectively leaving trillions of dollars in revenue untouched by ignoring women over 40. Marketing campaigns have become so targeted on the extremes of age demographics they’ve accidentally left a hole. As Alvin puts it, the moment a woman ages out of the coveted 18-34 age range, she’s off the marketing radar until it’s time to sell her memory-retention supplements when she turns 50.

TV is working to rectify issues like this. At a recent upfront NBC Universal global ads and partnerships chairman Mark Marshall told advertisers age and gender demographics are falling out of favor and they should target “people who are in the market for your product.”

Podcasting is not immune to demographic oversight, as Tom Webster highlights with his Wilford Brimley analogy. Pop culture tends to remember character actor Wilford Brimley as always having been an old-looking man, with one of his breakout roles being him intentionally aged up 20 years with makeup to match his fellow elderly cast members in Cocoon. Pop culture thus presumes Brimley to be his character in Cocoon, not the tough-as-nails who dropped out of high school to become a literal cowboy and rode horses the rest of his life.

Podcasting’s biggest opportunity for growth is audiences aged 55 and up. And it doesn’t require massive retooling of campaigns or new products to fully embrace. People over the age of 50 still buy meal kits. 36 year-old women still buy mattresses. And they tend to have more disposable income with which to do so than the hip, young crowd.

Lessons From the Podcasting Scene in the Middle East / North Africa

This Tuesday from What I Did Next host Malak Fouad on Entrepreneur: Podcasting has undergone a healthy expansion in the Middle East / North Africa region (MENA) in recent years, though the region’s podcasting potential has some hurdles to being fully unlocked. A quote from Fouad:

“The reasons are multifaceted, including a need for more understanding and awareness regarding podcasting’s value, a scarcity of content tailored to regional audiences, and a hesitancy among brands to invest. Furthermore, the creator communities in the region remain disjointed. Yet, despite the diverse cross-sections across multiple countries, there’s a significant opportunity to build larger, MENA-level communities.”

One prime example of a reason brands are hesitant to invest in MENA-based podcasting is a lack of consistent, reliable data on the region’s podcasting industry. While the U.S. podcast scene can rely on quarterly reports on details like popular categories or listener behavior, podcast companies in MENA are largely relying on surveys and estimations. Investment in research, creating relevant content networks, and broadening monetization could help foster an already fast-growing region.

Podscribe Ad Read Index: April 2024

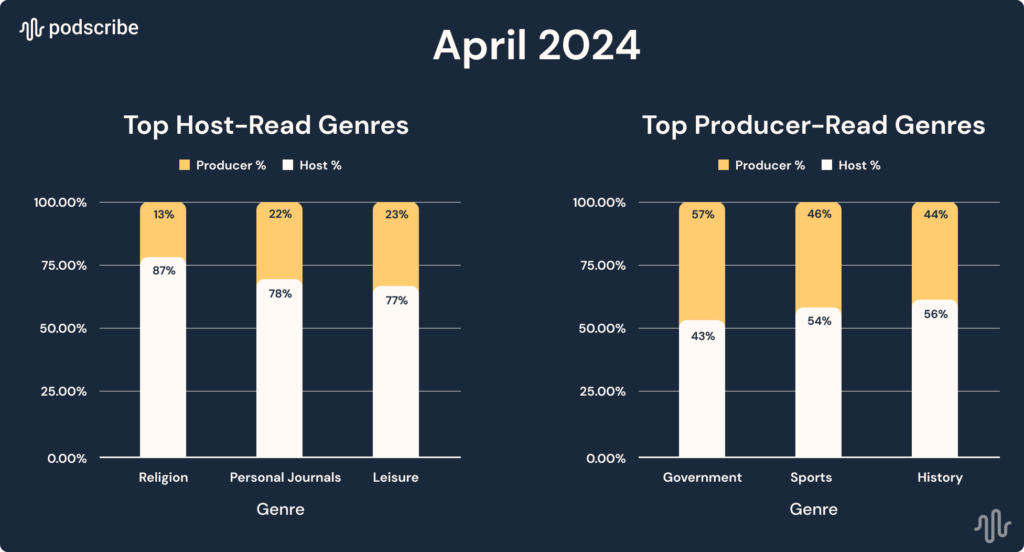

Top Genres by Read Type: Host vs Producer

What genres had mostly host-read or producer-read ads? In April, “Religion” (87%) moved up to the top spot in genres with the largest % of host-read ads, led by “Personal Journals” and “Leisure”. On the flip side “Government” (57%) followed by “Sports”, and “History” had mostly producer-read ads.

Quick Hits

While they may not be top story material, the articles below from this week are definitely worth your time:

-

Rogers Sports & Media to shutter Pacific Content by Connie Thompson. The parent company is shuttering Pacific Content in a move to re-focus their efforts on Canadian audio spaces.

-

Sequencing Retail Messaging With Podcasts by Tom Webster. A look at podcasting’s place in the business funnel and where it’s most effective in a customer’s retail journey.

-

Podcasts continue to grow in popularity in UK as BBC reveals data insights by Bron Maher. While the industry overall continues to grow, Gen Z interest appears to stall out in the UK as the difficulty of capturing younger demographics becomes more apparent.

-

Quality Over Quantity Is A Growth Strategy by Steven Goldstein. After the wave of quickly-abandoned podcasts in 2020, it’s more beneficial for producers to focus on more marketing for a smaller number of high-quality podcast offerings, rather than producing as many podcasts as possible.

-

What Netflix’s Latest Data Dump Means for Advertisers by Bill Bradley. Netflix’s latest data report, while impressive, is entirely self-reported and advertisers would benefit from third-party verification of the data before making any purchase decisions based on it.