This Week in the Business of Podcasting

Hello, podcasting! You’ve possibly been seeing a lot of me this week, as we’re now publishing daily teasers of Download top stories on YouTube and LinkedIn. While I decide if Monday’s news will be read off the back of a VHS copy of Con Air or Easy Money, let’s look at this week’s news.

Transparency. Performance. Automation.

New Report Examines Brand Perceptions of Podcast Advertising

This Tuesday from CoHost: in partnership with Sounds Profitable, podcast analytics and audience insight company CoHost – created by Quill – has published a new report titled The Impact of Branded Podcasts. The report surveyed 50 brands of varying sizes and industries, selected from multiple channels (including podcast agency client rosters, Brands in Audio, and industry networks).

Key findings include the fact that podcasts prove a good place for thought leadership. 76% of respondents prioritize thought leadership in their audio strategies, and find podcasts effective at establishing both brand authority and expertise.

The biggest barrier to branded podcasting is initial time and resource investment, as “requires a lot of resources” came first at 58% agreement with respondents ranking their top 10 biggest challenges. Second place is “growing my audience” and “cost” comes in third.

Despite the initial barriers, companies that do engage with podcasting are largely satisfied with their podcast performance. 90% of respondents reported satisfaction with the performance of their podcasts, with 52% identifying as “very satisfied.” Only two brands (4%) marked ‘somewhat dissatisfied’ and no respondents marked “very dissatisfied.”

Australian Podcasting Continues Growth (Multiple Sources)

New reports from multiple sources show the podcasting scene in Australia is showing no signs of slowing. In the overall audio space, the Australian Internet Advertising Revenue Report compiled by PwC and IAB Australia finds podcast and streaming audio advertising expenditure increased 23.6% year-over-year as of June 2024, reaching $290 million AUD. A quote from Commercial Radio & Audio CEO Lizzie Young:

“Advertisers are increasingly investing in online audio because it delivers both audience trust and accessibility.”

AdNews highlights that the total AU online audio advertising market for the 2024 fiscal year was $290 million AUD, with $105 million attributable to podcasting, which all told accounts for 4.7% of total general display ad spend for the year.

Speaking of CRA: CRA and Triton Digital have published their Australian Podcast Bi-Annual Report, which covers the first half of 2024. According to that study, AU average monthly listeners tracked on Triton Digital Podcast Metrics grew 8.7% year over year. The top five genres in the country are Sports, Comedy, News, True Crime, and Society & Culture in the top spot.

August 2024 Average CPM for Libsyn Ads Podcasts

This Wednesday from Libsyn Ads: The monthly Libsyn Ads recap of podcast advertising CPM (cost per thousand impressions) on podcasts in their platform is now available. The average CPM for a 60 second podcast ad spot in August was $21.25, down $0.68 from July, and down $0.85 year over year. A quote from Libsyn CRO Rick Selah:

“Podcast advertising in August 2024 presents a pivotal opportunity for brands and agencies to drive meaningful engagement. With 88% of podcast audiences describing their listening experience as deeply meaningful, the CPM rates underscore the tremendous value of reaching attentive consumers.”

Breaking out of the average, the three highest-earning categories of the month were Health & Fitness with $24 CPM, and both Technology and Government tie for first with $29 CPMs. The average CPM of 60 second podcast ads for podcasts with larger audiences fared best in August, with 100,000+ listens per episode holding steady at $20.15, and the 10,000 to 99,999 listen range increasing 17 cents, up to $23.37.

Political Ad Spend Spikes Post-Labor Day

Last Wednesday from Inside Audio Marketing: It’s election season in the U.S., and political ad spend is now in overdrive. According to AdImpact, a total of nearly $1.8 billion in ad spend has been kept in reserve by political campaigns in anticipation of the period between Labor Day and Election Day in November. Senate race spending alone sat aside $603 million in reservations, while the Presidential race parked $401 million.

Issue-specific spending makes up a good portion of the overall total with $231 million set aside for ads regarding hot-button topics in states putting up public votes, such as the three states with ballots to decide on legalizing recreational marijuana use for adults.

Democrats are reportedly spending more than Republicans with a difference of 41%, possibly influenced by the sudden shift in tactics after Biden stepped aside from re-election efforts. As political channels go all-out for this election season, U.S.-focused political podcasts stand to benefit, especially as their niche nature makes it easy for advertisers to reach voters on a variety of issues.

Podscribe Index

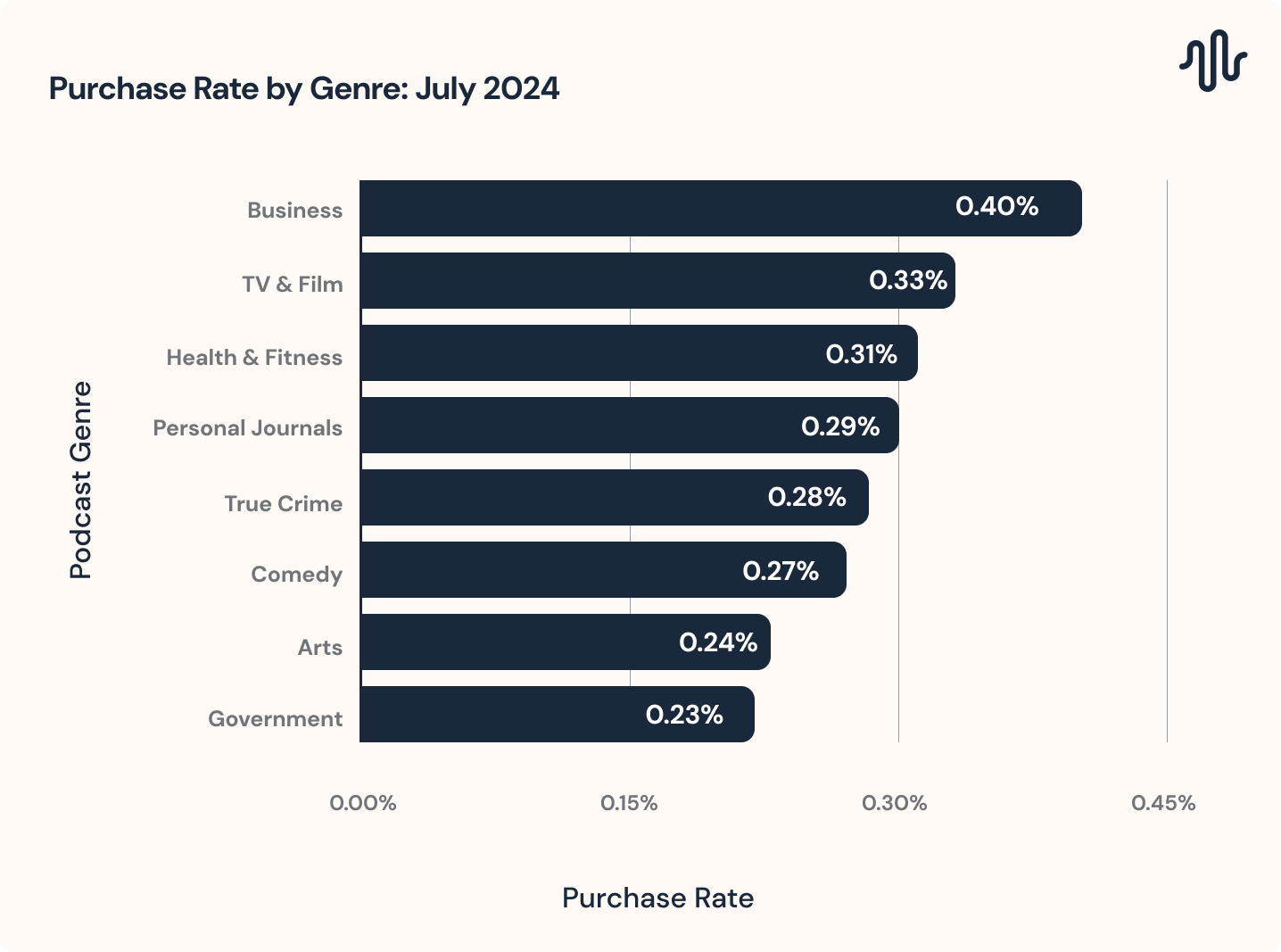

Purchase Rate by Genre, July 2024

In our latest Podscribe Index, notable changes in purchase rates came out from June to July. “Business” replaced “Fiction” for the highest purchase rate in July, coming in on top once again. “TV & Film” came in second followed by “Health & Wellness” which has seen rising purchase rates over the last few months. The biggest improvement was in “Comedy” which came in at #6 making the top 8 charts for the first time in 2024!

Quick Hits

While they may not be top story material, the articles below from this week are definitely worth your time:

- Saudi Arabia’s Podcast Boom: Breaking Records and Boosting Brands by Suzi Kuban. A look at Middle East/North Africa’s podcasting scene and data from Next Broadcast Media

- Magellan AI Introduces Reach Lift Measurement Product The new Reach Lift tool is launched in collaboration with Wondery.

- Spreaker Create Beta Testing Now Open The iOS closed beta features the new Create tools that enable full podcast production and distribution within the Spreaker app.

- Chartable analytics are back As reported by Podnews, Megaphone publishers have received an email confirming Chartable Analytics dashboards are back online after initially encountering issues in mid-August.