This Week in the Business of Podcasting

Crisp fall winds have descended on the Midwest and annual discussions of “turkey or ham this year” have begun filling family group chats. Before it’s time for some of us to start deviling eggs and mashing potatoes, let’s tuck in to the podcasting news from this week.

Track behaviors, trends, and insights: Download Magellan AI’s podcast advertising benchmark report for Q2

Study Looks into Podcast Listener’s Consumer Verticals

This Monday from Brad Hill at Rain News: Signal Hill Insights and Triton Digital have teamed up on a new large-scale survey. This first release, built from a study of 12,000 respondents, is from a larger study in the Triton Digital Demos+ product.

This section of the study aims to connect consumer taste to listening habits. Four types of listener are identified: heavy listeners (people who listen at least five hours a week), sports podcast listeners, music podcast listeners, and new podcast listeners. When compared to the average podcast listener, heavy listeners are 63% more likely to visit a quick service restaurant on a daily basis, 24% more likely to have attended a gym in the past month, and 31% more likely to see a movie in theaters at least once a month. A quote from Signal Hill Insights Chief Inisghts Officer Paul Riismandel:

“These data points show how podcast audiences are particularly leaned in for specific consumer verticals. For instance, I was struck by just how much more heavy podcast listeners visit quick service restaurants, which is a real opportunity for these brands.”

Super Bowl 54 Ad Space is Hot, As Are Sports Podcasts

Last Thursday, from Alyssa Meyers on Marketing Brew: Paramount spokesperson Bridget Darcey says CBS has just about tapped out their Super Bowl inventory, far earlier than usual. Last time around NBC Universal said they sold out space just ten days before the match, with CBS reporting a similar timeframe for 2021.

The 2024 Super Bowl is also slated to be the first that will have an altcast (alternate broadcast) on a network other than the one that owns the rights, as Paramount’s Nickelodeon will be hosting a kid-oriented version of the game. Advertisers who bought into CBS Super Bowl ad space get access to both feeds.

While CBS might be running out of space , it’s worth noting sports-adjacent podcast content around the Super Bowl, both before and after, has consistently performed well.

ebiquity: 60% of Brands to Increase 2024 Ad Budgets

This Tuesday from Lara O’Reilly at Business Insider: New research from ebiquity, built from a survey of 92 respondents at multinational advertising companies, shows cautious optimism for 2024. As the headline notes, 60% of respondents plan to increase their budget next year, a marked increase from the 29% who said the same last year during fears of an economic downturn. Only 7% of the remaining respondents not increasing their budgets next year said they intend to decrease spending next year.

Video is expected to get the bulk of growth next year. On that subject, it’s worth noting studies, including Sounds Profitable’s own The Medium Moves the Message, show podcasting needs to be in that conversation. The leading advertisers in podcasting perform significantly better in lower-funnel metrics with podcast listeners than the leading advertisers in TV and Radio with their consumers. The addition of podcasts to a multichannel media mix also shows significant mid-funnel effects.

Q3 Podcast Earnings Roundup

Once again it’s earnings call time and podcasting’s got some highlights. First up: This Tuesday from PodPod’s Reem Markari: Acast has posted their Q3 interim report and things are looking good for the company. Acast’s report shows they have increased its net sales by 32% year over year, which CEO Ross Adams largely attributes to positive growth in North America. The region has undergone a 55% y-o-y net sales increase, double the growth in Europe and ‘other markets.’ In addition to new podcasts, acquisitions, and product launches, Acast also reports operating loss has decreased 57% year-over-year.

Meanwhile, at SXM Media podcasting remains “a tailwind,” according to CEO Jennifer Witz on their earnings call this past Halloween. SXM’s Q3 podcasting growth hit 28%, with their programmatic side seeing a 97% year-over-year increase. Pandora’s profits are up 4% year-over-year.

And finally: iHeartMedia’s earnings call shows broadcast radio earnings were down 6% year over year, but podcast revenue is up 12% (about $103 million for the quarter).

Industry Insights with Magellan AI

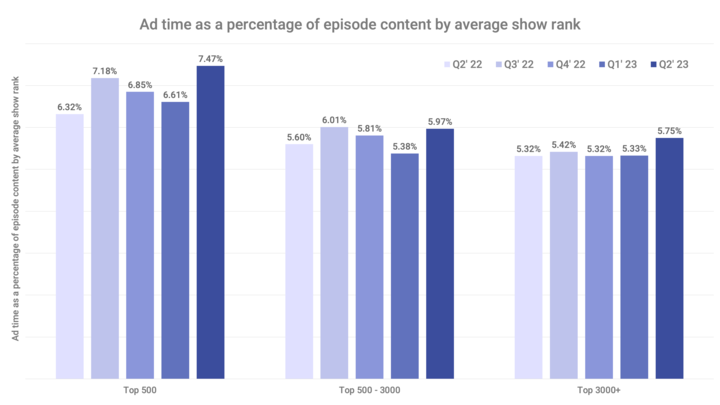

Between Q1 and Q2 2023, overall average ad loads increased from 5.55% to 5.97%. Quarter-over-quarter ad loads increased across all show groupings, but most (+0.86) in the Top 500.

Looking to get a handle on podcast advertising metrics? Book a demo with the Magellan AI team.

Quick Hits

While they may not be top story material, the articles below from this week are definitely worth your time:

- Making The Case for Podcasting by Tom Webster. Tom tackles the ever-present problem of making an appealing pitch for podcasts to non-listeners.

- Integration Powerhouse: Podbean and Descript Simplify Podcast Publishing. Next Thursday, November 16th, Podbean and Descript will host a free hour-long webinar.

- Podcasters Can Better Connect to Their Audiences With the Insights From Our Latest Fan Study. The study includes findings about the busiest time of day for podcast listening, and the efficacy of cross-podcast promotion.

- Adaptive Podcasting – open source release. The BBC’s Research and Development has published research and an open-source tool investigating the concept of dynamically-built podcast episodes based on listener data.