The Inventory And The Scale by Tom Webster

If one does not proactively shape the creator landscape, its audience will never follow. Tom Webster’s final newsletter of 2025 hits on some concerning data from The Creators 2025 report: of current podcast consumers, 15% of men are creating podcasts. That number is just 8% for women. 17% of 18-34 year-olds are creating, while just 4% of Americans aged 55+ are creating podcasts. A quote from the article:

“I’ve seen this dynamic play out in another world I care about: magic. Magic remains overwhelmingly male. Go to a show at the Magic Castle in LA, and you’ll see a room full of dudes with decks of cards doing card tricks for other dudes. Why? It’s not because women can’t do sleight of hand. It’s structural. For two centuries, women were portrayed as assistants to male magicians rather than as magicians themselves. The traditional “uniform” of a magician (jacket and pants with plenty of pockets) is designed for concealment in ways that dresses are not. And perhaps most importantly, there’s been a lack of successful female role models that women can identify with. Not just successful people, but successful people like them.”

In addition to those entry barriers discouraging various communities from joining podcasting in the first place, we’re also churning them out. Both LGBTQ+ and 55+ creators have a 40% churn rate. They didn’t bounce off before becoming creators, they tried and left.

Webster reflects on a Garth Brooks story from a conference he once attended. Back in the day, songwriters looking to make a living in country music could “make it” in Nashville by securing the fourth single on a big star’s album. It might not be the single that gets a ton of radio play, but it’d be on an overall album that’d carry it far enough to pay the bills and keep them creating.

Now, in the streaming era of music, there’s no such thing as the “fourth single” on a Travis Tritt album. The format of the album itself is existentially hazy, as music lives and dies by individual singles. Podcasting has constructed itself in such a way it replicates this same problem. We celebrate our huge successes, but there aren’t many intentionally-built pathways to modest, sustainable success that keeps new creators afloat long enough to build their audience. Something that becomes doubly difficult when one is in a demographic that, by virtue of being a minority group, will have a harder time finding a ‘wide’ audience.

Webster’s challenge to the business of podcasting is simple: put your thumb on the scale. Fund creators in high-risk audience categories. Proactively fund and work with folks in those demographics to best reach the audiences not being served, and support the creators from those audiences to begin with.

How “OGs” Dominate Podcast Ad Performance, and Video Podcasting’s Achilles Heel

Oxford Road has had a busy week for research!

First up: a new ORBIT report focuses on the top 15 performing “OG” podcasts. A podcast defined by it being a show launched before March 2020 when Covid 19 lockdowns led to the podcasting equivalent of a baby boom. Top findings include execution outlasting hype, as 75% of the top performers in podcasting launched pre-pandemic. Their success stems not from flash-in-the-pan virality as far back as 2015, but consistent delivery on high production values. OG podcasts come with a 12% efficiency premium as well, with multi-year listener relationships effectively building armor around the podcast that brand new listeners can’t easily replicate. And with that protective shell of old-head listeners comes lower discovery costs and increased ‘stickiness’ to the show’s advertising.

Then the Wall Street Journal published a piece looking at a new white paper published by Oxford Road and Podscribe called Re-Thinking YouTube: Why Your Video Podcast Ads Are Converting 25% Worse Than Audio. As the title spoils, YouTube views prove 18-25% less effective at converting sales than audio download.

Which makes sense, given the challenges facing classic host-read baked-in ads. Even traditional YouTubers face sponsorship issues, as earlier this year the “skip commonly skipped segment” feature made it so any YouTube Premium viewer need only tap their remote twice to skip the exact length of a sponsored segment. The nuclear equivalent of podcasting’s (arguably over-feared) 30 second skip button. The Rethinking YouTube white paper comes with a ten-step guide on adjusting to the reality of baked-in YouTube ads and how to treat RSS audio download data in comparison to YouTube views (since, as the report shows, the two are not 1:1 exchangeable in terms of audience conversion).

Netflix’s Deals This week

Podcasting has been hearing Tudums multiple times this week as the big red N has been signing deals. First up, The Ankler scooped details on the reportedly nearly-finalized deal between Netflix and iHeartMedia. According to Natalie Jarvey’s sources, a deal is being struck to take around 20 of iHeart’s popular video podcasts (including The Breakfast Club and Stuff They Don’t Want You To Know) behind the Netflix paywall. There has been no official word from either Netflix or iHeartMedia on whether this proposed batch of shows is heading to (reportedly timed) exclusivity early next year.

Then came Barstool Sports. As The Hollywood Reporter covered, the streamer has signed a multi-year deal with Barstool Sports, which includes bringing three of the company’s most popular sports video podcasts (including Pardon My Take) to Netflix (both new episodes and “select library episodes”). Mondo Metrics founder Nick Cicero argues this isn’t a “podcast move,” it’s a “daily sports attention” move. Netflix wants to build daily viewership, something video podcasts (especially sports-focused podcasts) are good at: creating habits. Also, investing in sports fandom is a great way to build out the sports side of a catalog without the expense of paying for the rights to broadcast games live. By investing in shows fans listen to about their favorite teams, companies like Netflix can own the conversation between games. Instead of generating watercooler moments, you can invest in the watercooler itself.

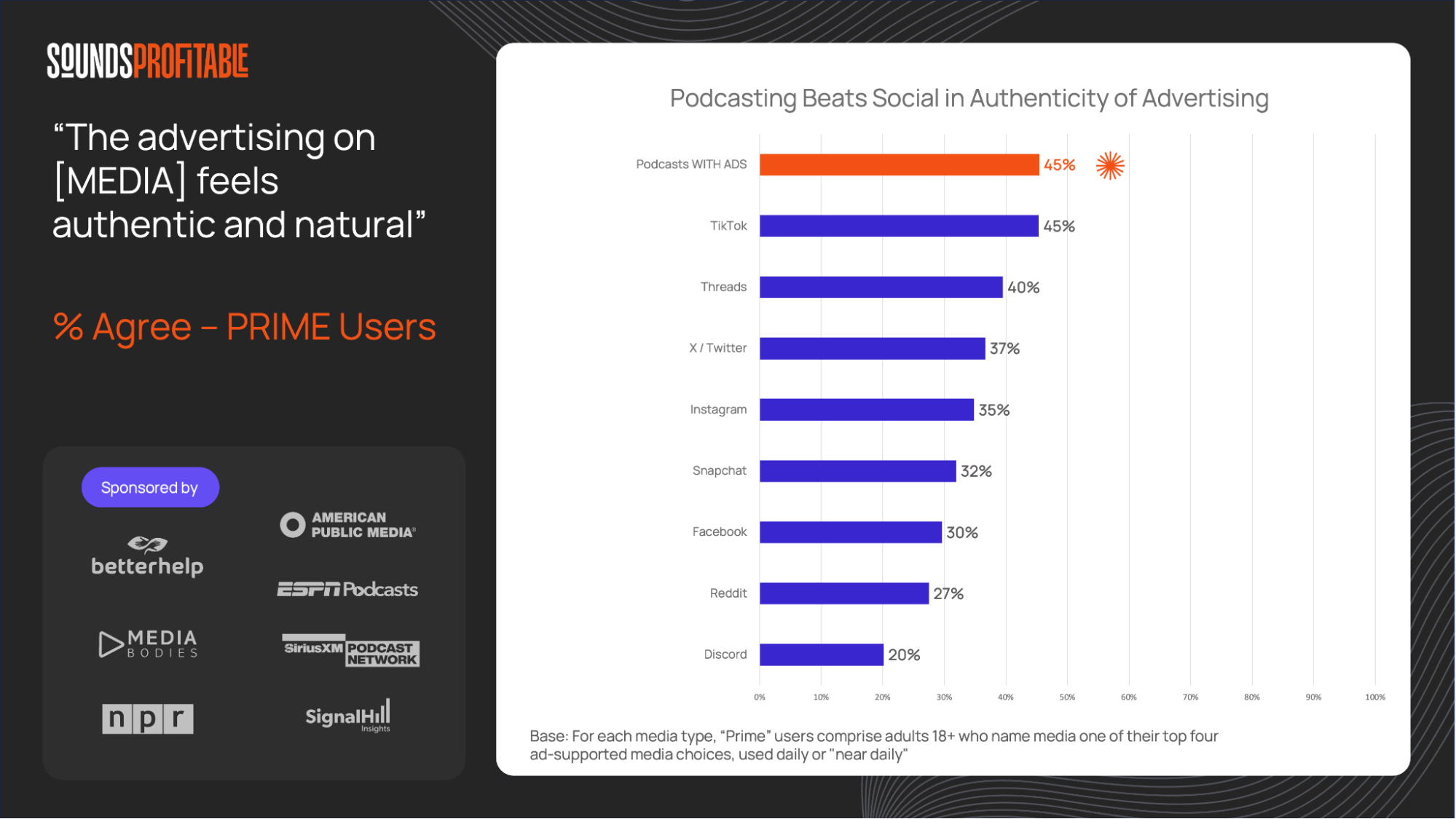

Three Podcasting Trends We See from Surveying 66,000 Podcast Consumers in 2025 by Paul Riismandel

Over 2025, Signal Hill Insights has surveyed 29% more media consumers than last year, reaching 86,000 total. Looking back over the years’ research, Riismandel collects three big ones worth remembering. I’ll only spoil the last one, as it’s a big lesson worth remembering: expect surprises. Smart TVs became the second most-used device for podcast consumption with weekly podcast consumers. French-Canadian podcast consumption bounced back from a one-year decline with a new all-time high. The political identity of the average U.S. podcast consumer flipped from 2024, likely due to politically-charged influencers with podcasts doing a good job at evangelizing the concept of podcasting to their audience.

With all of these developments that might not have been expected in 2024, Riismandel ends with the following message:

“The biggest lesson of all: don’t get too comfortable. But, having the research and insights will make you prepared.”

As for the rest of the news…

- On Air Fest has announced a slew of new guests and speakers for their February festival in Williamsburg, Brooklyn. Early Bird ticket prices run through January 5th.

- Friend of the pod Crime Writers On have published their list of the best true crime podcasts for 2025, topped by Bone Valley season 3, Spotlight: Snitch City from the Boston Globe, and Tenderfoot TV’s Wisecrack.

- Right Side Up director Lindsay Piper Shaw debuts a case study run with Fabric by Gerber Life, tracking the brand’s journey with podcast advertising since 2021.

- Amplifi Media founder Steven Goldstein writes about the “liquid content” era podcasting finds itself in, where podcasts are more a form of storytelling than a specific format.