This Week in the Business of Podcasting

This week we’ve got a collection of both headline-grabbers and quiet inside baseball that nevertheless influences important aspects of the industry. Let’s get started!

Greater Trust. Greater Transparency. Better Performance.

How Much Podcasting Does a 30 Second Super Bowl Spot Buy?

This Tuesday from Kimeko McCoy at Digiday: Just in case anyone has $7 million burning a hole in their pocket but didn’t buy a 30 second spot at the Super Bowl, Digiday has done the math for what you could buy elsewhere. With that kind of cash you could get 10 million clicks in Candy Crush, 2.8 million clicks on in-feed TikTok ads, or 43.4 million clicks on Walmart Connect. For a podcasting perspective, we asked AdvertiseCast CRO Dave Hanley how far that might go in podcasting.

“Podcast advertising is a powerful trusted medium that combines influential host endorsements with a growing, highly-engaged audience. A $7 million investment in podcast ads at the current average CPM published by Libsyn’s AdvertiseCast Marketplace will deliver an advertiser over 300 million host-read, 60-second ad impressions on podcasts. Moreover, a Sounds Profitable study found that an impressive 68% of consumers are more willing to consider a product they heard about on a podcast ad.”

Hanley points to audiences shifting away from linear TV, with significant subsets of younger demographics becoming unreachable by traditional broadcast methods. Meanwhile, podcasts remain a largely untapped, high potential medium with excellent audience engagement.

“With the availability of sophisticated audience-based targeting and attribution measurement, advertisers can leverage the expanding opportunities in podcast advertising to achieve their brand goals, be it direct response or brand awareness — with minimal waste in ad spending.”

Accreditation for Black-Owned Publishers in Podcasting

From Digiday’s “WTF is” explainer series, Sara Guaglione has published WTF is accreditation for Black-owned publications?

One side effect of the 2020 flood of agencies pledging to commit a percentage of investments into minority-owned publishers has been the rise of accreditation processes that verify said publishers are actually minority-owned. One such organization that provides accreditation is the National Minority Supplier Development Council (NMSDC).While the Digiday piece looks into the broad strokes of accreditation for publishers, we went to DCP Entertainment CEO Chris Colbert to get a podcasting perspective on becoming NMSDC certified.

While not free, the process with the NMSDC specifically is charged on a sliding scale based on revenue. Companies making less than a million USD in annual revenue pay $400 for the certification process. The application and certification process is fairly intense, according to Colbert, but the accreditor provided support services like monthly group sessions walking new applicants through the process, as well as quick support responses via email. A quote from Colbert:

“We’re just scratching the surface of the benefits, but the NMSDC has relationships with a multitude of organizations, where one of the first events I attended featured Paramount, AMC, A+E and other media companies telling us how we can win their business. Also, as I’ve alerted other companies of our NMSDC status, it has opened up doors for contracting and sub-contracting work, as many major companies have initiatives to spend a certain amount of money with minority-owned businesses each year, and having the certification makes it easy for them to represent that they are following through on those initiatives.”

The Trade Desk to Lowball SSP Price Floors

This week from AdExchanger: To counteract supply-side platforms (SSPs) tacking on their own costs on top of a publisher’s minimum asking price, The Trade Desk has announced it will start undercutting SSP price floors in its bids.

The Trade Desk’s argument is that the existing SSP prices are not reflecting the “real” value of the ad impressions. To get a podcasting perspective, we spoke to Rockie Thomas, Chief Revenue Officer at SoundStack: “While this could work for the top three podcast networks, it will negatively impact the emerging podcast programmatic advertising space as it will limit monetization channels for the rest of the podcast space, particularly the independent creator whose programmatic revenue depends on working with large marketplaces. There are hundreds of quality podcast networks that are not large enough to pay or manage the needed technology stacks.”

Thomas goes on to say that undercutting audio SSPs and marketplaces trying to grow and better serve podcasters will likely experience the opposite effect than is intended by the Trade Desk pricing change.

Brand Marketing Grows, Performance Shrinks in WARC Data

According to new WARC data, the percentage of respondents who focus on growing brand over performance has increased 13% since 2022, with a projected 5% increase in 2024. To give some insight into this for the world of podcasting, we spoke with Cumulus Media Chief Insights Officer Pierre Bouvard:

“WARC’s report that marketers will increase brand spend is huge news for podcasting. Brand building is ‘being known before you’re needed.’ Brand campaigns create future demand. Dentsu’s recent attentiveness study with Lumen found audio ads outperform video for attention and brand recall. With over 50% of U.S. 18-49-year-olds listening to podcasts monthly, marketers looking to build their brands should look no further than podcasting and AM/FM Radio.”

A key best practice Bouvard recommends is to not make the mistake of measuring podcast brand campaigns with an attribution study that tracks website traffic. “Measure your podcast brand campaign with a brand effect study that quantifies awareness, consideration, brand favorability, and purchase intent.”

YouTube’s Place in Streaming

Last Thursday from Entertainment Strategy Guy, writing for The Ankler: Despite previous narratives proposing Netflix was most challenged by old-guard Hollywood studios, a certain free video platform is proving to be the real challenger.

According to Nielsen’s “The Gauge,” a monthly usage tracker of major streamers, YouTube has had at least a 1% market share lead on Netflix every month last year. It’s a free platform with over 100 million paid subscribers, taking a bite out of connected TV by acquiring live TV and sports programming while also making space for podcasting.

According to YouTube, the number of creators who get the majority of their watch time from CTV screens has increased 400% since 2020. Which puts podcasting in an advantageous position, given our biggest platform for discovery also happens to be one of the biggest video platforms overall.

Are longer ad reads really better?

Ever wondered if longer reads are worth the premium?

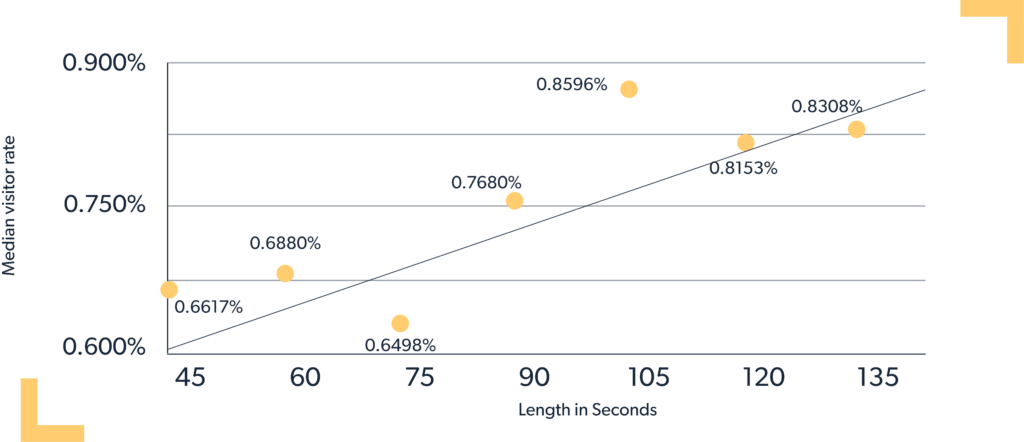

As you likely believed, new Podscribe benchmark data confirms that longer reads indeed perform better!

Through Podscribe’s analysis of 16,000 campaigns, the data indicates that generally the longer the read the better the performance (with a .8 positive correlation).

On average, it appears that 2 min+ reads roughly outperform 60s or shorter reads by about 20%.

Podscribe’s Q4 2023 PPB is set to launch this Monday! Here’s an exclusive sneak peek of the insightful data awaiting you.

Quick Hits

While they may not be top story material, the articles below from this week are definitely worth your time:

-

Reintroducing Podcasting by Tom Webster. The upcoming Sound Summit at SXSW, an official day for podcasting, will act as a way for podcasting to re-introduce itself to brands and agencies that might’ve only last encountered podcasting in its adtech infancy.

-

Spotify Reports Fourth Quarter 2023 Earnings. Paid subscribers are up, raising one million over guidance numbers. The company expects their podcasting arm to turn a profit by the end of the year.

-

Podcast benchmarking: How did your downloads compare in 2023? By Sharon Taylor. The benchmarks present what count as ‘good’ download numbers for ap podcast, divided into percentiles.

-

The Art of Podcasting with Joe Rogan and His New Multiyear Spotify Partnership. The Joe Rogan Experience has renewed its contract with Spotify for hosting and distribution, but the former exclusive has now returned to open RSS distribution.