This week on Sounds Profitable: Adtech Applied, Bryan and guest Sean Howard of Flight Path discuss building organizational solutions for audio networks. As an industry, can we collaborate to better these processes? Find out!

I’ve always found it incredibly uncomfortable that for a large chunk (if not most) of digital advertising, a buyer tracks campaign performance through one Google product, bids on ad inventory through another Google product all while publishers are managing their inventory via a third Google product.

That’s a lot of power ceded to Google from buyers and sellers alike. And because Google is first and foremost in the advertising business, not a single piece of that chain is truly objective. Nor can any of those tools be used as a check against the accuracy and effectiveness of the other tools. Grading your own homework isn’t third-party measurement.

The validation provided by third-party measurement exists to protect the ad buyer. It exists to be a check against the ad serving technology, the publisher selling the inventory, and even the marketplace transacting between the two. From everything as simple as accounting for each impression contractually sold to the ad buyer and all the way to impartially measuring performance of a campaign to determine success, third-party measurement is one of very few tools built to serve the ad buyer, providing the rest of the chain enough insight to continue winning their business.

Last week, Spotify turned two of the biggest names in third-party podcast measurement into first-party solutions. And while I’m about to tell you the immense value each of those companies bring to Spotify’s ad solution, I’m also here to make one thing incredibly clear:

Podsights and Chartable can no longer be considered third-party measurement or attribution providers.

Podsights for Advertising

Spotify, a walled garden, has always kept their data close to their chest. That makes perfect sense when you imagine what looking at three years of listening habits for an individual around Valentine’s Day would tell you about them. And that’s before we even get to all the valuable data Spotify already has from users by them creating an account and entering personal information, including their credit card details.

When Podsights adds Spotify data to their device graph, the entire dataset becomes skewed towards Spotify listeners. This is important because “[…]Podsights creates 10 control groups [for their lift reports] from a randomized sample of podcast listeners before averaging them. […] Podsights specifically builds their control groups from podcast listeners only.” Regardless of the skills of the Podsights data team (who I respect immensely), there will always be a bias in favor of Spotify in data so close to the source.

Taking Podsights public statement about data sharing and company separation at face value, having access to that aggregate data is still incredibly powerful. Just last week, Caila Litman gave fantastic insights using the Podsights Q1 ‘22 Benchmark Report on what the most sellable podcast programming is today.

Now picture Spotify having access to that data daily or weekly. Or imagine if Podsights stops publishing that quarterly report publicly. Spotify, using the aggregate data from Podsights, could quietly track increases and decreases in ad spend across advertiser and publisher categories. That type of knowledge can dictate the shows Spotify builds, acquires, and licenses. It can also guide their sales team on which advertiser categories are aggressively spending so they can pursue those budgets.

I want to emphasize that Podsights, even now as a first-party tool, is still immensely valuable for podcast advertising buyers even though Podsights is no longer objectively a third-party measurement and attribution vendor. If integrated correctly, Podsights could enable Spotify to auto-optimize campaigns, apply first-party Spotify data off-platform in a way they fully control, and offer the ability to retarget on and off Spotify.

Publishers and networks who host with Spotify’s hosting services—Anchor, Megaphone, or Whooshkaa—likely will benefit from this data as well. But for those on other hosting platforms, it’ll be a hard case to make to continue using Podsights when your actions in aggregate benefit a tool that is most beneficial to Spotify and their direct clients.

Chartable for Analytics

If the only thing Spotify uses Chartable for is to unify the data across Anchor, Megaphone, and Whooshkaa, the acquisition will have paid for itself.

My go-to answer for any network dealing with publishers operating across multiple hosting platforms had always been to use Chartable to unify their data. Applying that logic to Spotify’s three IAB-certified hosting platforms, who’ve shown no sign of consolidating their infrastructure would bring massive benefit to their clients. It would ease nearly all migration issues between platforms while offering a stronger core reporting backbone that all three could benefit from.

Chartable’s tools for marketers also provide immense value. Chartable was the primary tool Jordan Harbinger used to measure the effectiveness of spending $500k in 2020 on host-read ads for his show. So if Chartable gains access to the same Spotify “intelligence” that Podsights gains, and all of the download-level data from all three platforms, how much more powerful can their tools become?

If these tools end up exclusive to Spotify hosting platforms, what an incredible hook it will be to land publishers of all sizes. It’s easy to see how it could power a cross-promotion marketplace between all three platforms and even Spotify Ad Network, further improving their already high fill rate they offer publishers.

If they don’t go exclusive, I question the value Chartable can continue to bring to publishers and hosting providers when aggregate data will be so readily available to Spotify and further empowering Podsights.

Changing The Story

Narrative is everything, and Spotify is a master storyteller.

Spotify took full advantage of every salesperson who couldn’t defend the download as podcast advertising’s core metric by introducing Streaming Ad Insertion (SAI) to buyers hungry for more data. At the same time, Spotify continued to acquire magnitudes more Dynamic Ad Insertion inventory than their SAI offering, which they blended together in their favor when selling the Spotify Audience Network.

Now they’re preying on the same fear. One that Podsights and Chartable fought against for years. According to an incredibly aggressive paywalled report by Advertiser Perceptions that Spotify links to, “…measurement and attribution remain the two biggest unsolved challenges for podcast advertisers”. Perception is everything, and Spotify has masterfully figured out how to dismiss podcast advertising (DAI/Baked-In) as being inferior to In-App Audio Advertising (SAI) while being potentially the largest seller of podcast advertising.

And every time we send uneducated salespeople and account managers out into the wild, we amplify that story. A story that will get even harder to unwind as Spotify continues to press on the measurement and attribution side, where they can replicate the same SAI vs DAI narrative with podcast advertising’s server-side, IP-based model vs their first-party data solution. Even if that solution accounts for a fraction of their total sold campaigns.

While Facebook laments the loss of third-party cookies and mobile device ID’s, Spotify completely skirts around those issues (and even Apple’s App Tracking Transparency framework) because Spotify owns the entire solution from start to finish, with very little of it having to run on the listeners device or requiring those data points.

If I sound mad, it’s because I am. Not at Spotify, but at the industry as a whole. We’ve put education last and simply ran headfirst into every dollar we came across. In the same way Podsights successfully marketed Chartable into a corner as simply an analytics company and not a true advertising attribution company, Spotify is defining what podcasting and podcast advertising is to the rest of the world.

And no amount of pedantic rambling is going to convince anyone otherwise. We need to take collaborative action.

In Defense of Third-Party Solutions

All media should be measured by a third party.

It is utterly absurd what walled gardens like Facebook and Google have been able to get away with in digital advertising. But when they’re the only shop in town and you want their audience, you have to make concessions.

Podcasting is not there yet.

First-party solutions will always be more actionable to a seller, thanks to their ability to integrate it directly into other internal tools or simply due to the amount of education the teams will have access to. But first-party represents the seller’s best interests, not the buyer’s. And every buyer needs a solution that represents their best interests, not the sellers.

To solve for this, we need accountability. We need transparency in collection methods, control group creation, data expiration, and more. We need frameworks that are just not possible for slow-moving organizations like the IAB to put together. We need the remaining third-party measurement and attribution companies to collaborate on all of this, with buy-in from major publishers, buyers, and hosting platforms.

Podsights and Chartable provide great value today and will continue to provide more value to their users with this acquisition. But no matter how hands-off Spotify is with them, their ability to collaborate will increase their overlap and the offerings they provide to the industry.

All of which will be in the best interest of Spotify.

Rel’s Recs

Arielle Nissenblatt of EarBuds Podcast Collective this week has chosen Spectacle from Neon Hum, hosted by Megaphone and measured by Chartable.

If you’ve ever wondered how the sprawling metropolis of Las Vegas came to be what it is today, this show is it. In this limited series, we learn about all aspects of Sin City — the quickie marriage (and divorce) industry, the gambling, the layout of the town, and everything else — it’s all here. I never knew why The Strip was named so, and now I do! This show is perfect for my geography and civic-minded interests; it’s the story of how a city came to bare its reputation.

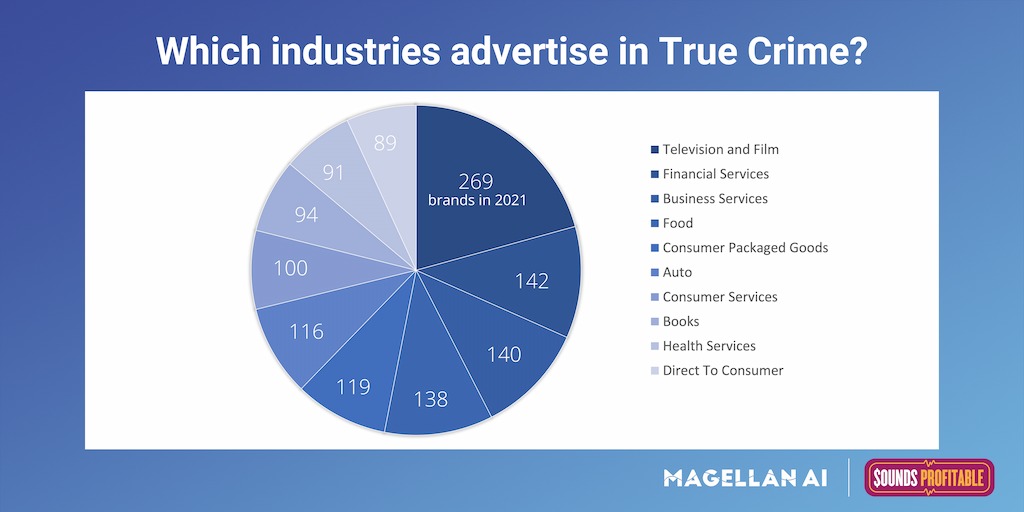

Market Insights with Magellan AI

True Crime had a spotlight moment in our 2021 analyses. Not only did the genre increase their ad load the most throughout the year – adding 3% – but they also have the highest ad load of any genre. We got curious, what kinds of brands are filling all that ad time? The chart displays the number of brands in the top 10 industries that we detected in True Crime throughout 2021.

How does the ad load in other genres match up? Download the Q4 Podcast Advertising Benchmark Report to find out.

Anatomy of an Ad with ThoughtLeaders

What makes a good podcast ad? You know it when you hear it, sure. But is there more to it? We’ve teamed up with ThoughtLeaders to break down what works, what doesn’t, and what it takes to make great ads.

This week’s Anatomy of an Ad breaks down a host-read ad for Trade presented by Dillon Cheverere, Dave Ruff, and Will deFries, hosts of the podcast Circling Back.

Find out what worked well and what could be improved upon as you work to make your own ad reads better.