Marcus dePaula of Podcast Audio Lab shares how audio quality impacts your brand. Catch it early on our free Supercast feed along with narrated versions of our articles, or find it wherever you get your podcasts.

I’ve spent the last few weeks chewing over the latest announcement from Spotify, regarding the expansion of their Audience Network to include podcasts hosted on Anchor. And I’ve got to say, I keep coming to the same conclusion:

Spotify will be a major factor in podcast advertising exceeding the IAB’s projections of $2bn by 2023 and every single company in the podcast industry will absolutely benefit from it.

So let’s break down the announcement, this week with a focus on the publishing side and how Spotify’s actions will spill over to benefit the entire industry. Next week, I’ll focus on the advertiser side, keying in on why I’m so bullish on the moves that Spotify is making this time around.

Ambassador Ads

Ambassador Ads are the first offering that Spotify highlights, where any Anchor-hosted podcast with 50 or more listeners can “earn money by spreading the word about Anchor on their podcast.”

And I find this wildly clever on so many levels.

There is and always will be a stigma around non-host-read ads, especially for newer podcasters. So the idea of Spotify offering smaller podcasters paid host read ads at such a low entry point, encouraging them to treat it more like a candid conversation with their audience, will clearly resonate well. Spotify is said to pay out a net of $15 CPM for those ads, which is pretty good when you consider that AdvertiseCast lists a gross of $25 CPM as the industry average which would net to $17.50 after the standard 30% cut.

This entire funnel can be almost entirely automated. Both Anchor and Spotify apps require user login, which means attribution is entirely handled through first-party data. Spotify can also transcribe the ad with ease, confirming the ad hits any required talking points. And even if the host bombs the ad and isn’t converting new users to Anchor, it would take 20 episodes for a show with 50 listens per episode to get 1,000 plays, triggering a $15 payout.

I call Ambassador Ads a funnel for Spotify because it creates brand loyalty to Spotify and a well-defined path for monetization from such a low entry point. So what does that $15 CPM buy Spotify besides goodwill?

Eventually, more ad inventory for the Spotify Audience Network (SAN).

Automated Ads

Leading with host-read ads for Anchor with such a low barrier of entry is smart. It makes podcast advertising a reality for any podcaster. And when that podcaster starts to explore the next tier of options for revenue generation, they’ll find they’re eligible for Spotify Audience Network (SAN). Automated Ads enable an Anchor podcaster to set up additional ad markers for Spotify to fill for them if either the listener or show itself fit the targeting of the ad Spotify has sold.

I keep saying listens and listeners because Spotify keeps saying listens and listeners.

And that’s because all of these offerings clearly read like they’re aimed at the audience within the Spotify app. 70% of all podcasts on Spotify are hosted by Anchor, and since June 2020 new podcasts created on Anchor don’t offer an RSS feed by default nor are they submitted to any podcast directory other than Spotify. And when Spotify recently chose to bring another handful of their podcasts exclusively onto Spotify, they justified it by stating that the “[…]insights, only available thanks to streaming, allow us to create better shows and help you discover more shows.”

With an overwhelming majority of these new podcasts becoming Spotify exclusives by default and Spotify providing them access to Automated Ads, it becomes increasingly attractive for Spotify to grow this new batch of podcasters with their app and listener-based analytics. The more listens these shows get, the larger pool of Streaming Ad Insertion (SAI) inventory Spotify gains access to. While Spotify Audience Network does currently sell baked-in, dynamic ad insertion, and SAI inventory, it doesn’t seem like a stretch for this new offering to be solely SAI, further encouraging podcasters into this voluntary exclusivity.

This is exactly where Spotify’s efforts will start to benefit the entire industry, because not all podcasters will want.

Spotfiy will have onboarded, educated, and grown an entirely new class of podcasters. Many of those podcasters will see their success as a reason to expand their show into a full business, and explore other options for podcast hosting, ad serving, and monetization. Not just Spotify’s offerings.

Redcircle and Spreaker are two great examples of free hosting platforms that provide dynamically inserted programmatic ads for publishers of any size. So a podcaster prioritizing distribution and upgrading their podcast creation beyond what the Anchor app offers may find them more appealing.

Covering that wider distribution, Spotify’s Megaphone, a paid hosting solution, can absolutely work for those no-longer-Anchor podcasters, offering a robust DAI solution for direct-sold ads and programmatic ads served through VAST. All while still offering them the ability to be part of the Spotify Audience Network.

And now that we’ve entered into the paid self-service hosting solutions that can offer programmatic ads, there are even more options and more controls for the podcaster to take advantage of.

Premium Sponsorship

At the top end of the latest Anchor announcement is Premium Sponsorship, a host-read ad solution. Spotify, no stranger to selling host-read ads, now has the ability to look to the entirety of their opted-in Anchor podcasters (and presumably their Megaphone publishers) to offer their advertisers extended reach on their host-read campaign.

If the last Anchor offering was a gentle push into the wider podcasting industry, this tier is an outright shove for those podcasters to expand into a more serious business.

Host read ads are the bread and butter of podcast advertising. And while Spotify very clearly has the capability to sell and manage campaigns in this way for their Original & Exclusive podcasts, they’re not announcing this as they’re opening it up to every single podcast they’ll have access to. That leaves those eager podcasters even further motivated to explore other options, which the podcast industry is filled to the brim with.

Podcasters who choose to stay on Anchor and pursue host read ads can work with any number of publisher rep firms like Advertisecast, True Native Media, PAR, AdLarge, or Market Enginuity. They can accept direct deals from agencies like Ad Results Media, Adopter Media, OXFORd Road, Strategic Media, or Veritone One. They can directly represent their inventory and interact with the advertisers on marketplaces like Gumball and Podcorn. And for podcasters looking to work with partners that require third-party analytics or attribution which Anchor restricts but Spotify Audience Network supports, they might consider migrating to a hosting solution with a managed hostread ad sales component, like Acast, Audioboom, Art 19, RedCircle, or Podbean.

And of course, they can always migrate to Spotify-owned Megaphone, keeping them in the dynamic ad insertion side of the Spotify Audience Network relationship, while enabling the podcaster to work with just about any of the non-hosting solutions listed above.

Wrapping It Up

In one of the first podcast-focused Clubhouse rooms I ever joined, someone asked how much money they could expect from their two-month-old show. While I absolutely encouraged them to check out RedCircle and Spreaker, I also reminded them that for a Youtube channel to start monetizing it would need “[…]at least 1,000 subscribers and 4,000 valid public watch hours” and that they should treat this like starting a business if their goal was to pull a paycheck from it.

And while I don’t even remotely envy the team that will need to explain to numerous Anchor podcasters why they aren’t yet eligible to get paid for the sub 1,000 ad impressions they’ve run, providing more onramps into podcasting with revenue opportunities like the person asking the question above, is not a bad thing.

This Anchor announcement provides the entire podcast industry with something we need to keep our ecosystem strong and growing: access to more mature podcasters who suddenly find themselves interested in everything podcast advertising has to offer them.

Spotify has built a very powerful audio silo and an incredible funnel. As of right now, I’m not convinced there’s a company that can compete with their Ambassador Ads, and I expect to see the rest of their offerings stand out as their own channel in audio advertising. Their Streaming Ad Insertion solution is an incredible piece of audio adtech that continues to increase in value as more and more podcast inventory from a wider audience is available on it. This feedback loop will capture a large swath of podcasters of all sizes, because not every podcaster wants to build out and manage the technical or advertising side of their business, many just want to cash a check.

But for the incoming wave of podcasters forged by this new funnel from Anchor, this early support and momentum will lead them to further explore the greater podcast ecosystem. That ecosystem is full of fantastic companies that can help them pursue the next stage of their vision without having to be the partner to onboard them into podcasting overall, something this funnel can easily accomplish.

If podcasts like Last Podcast on the Left are willing to leave exclusive deals with Spotify, then the Spotify-grown mid-tier of podcasting will continue to find themselves with quite a lot of options for growth and ownership, all while turning their podcast into a business.

Next week, we’re going to explore why I keep calling SAI “in-app audio advertising”, what about all of this is appealing to advertisers, and how those advertising with Spotify will greatly benefit the podcast industry overall.

Product Deepdive – RedCircle

Our latest Product Deepdive features Mike Kadin, CEO of RedCircle, walking through the publisher side of their platform. Publishers of all sizes who host with Redcircle can easily monetize their inventory with host read and programmatic ads. Check it out and let us know your thoughts!

Rel’s Recs

This week, Arielle Nissenblatt of Earbuds Podcast Collective recommends Battle Tactics for Your Sexist Workplace, from Everything’s On Fire LLP, hosted with Captivate.

Battle Tactics for Your Sexist Workplace is your one-stop podcast for comedy, endearing banter between friends, actionable advice, and pop culture. Hosts Jeannie and Eula break down the dynamics of a sexist work environment in every episode. Sometimes the workplaces are familiar to us (Britney Spears’ situation, Michael Scott ala The Office), and sometimes they’re more general concepts such as essential workership, allyship in the office, and more. After a long hiatus, the show is back for season three and the first few episodes back are a real treat.

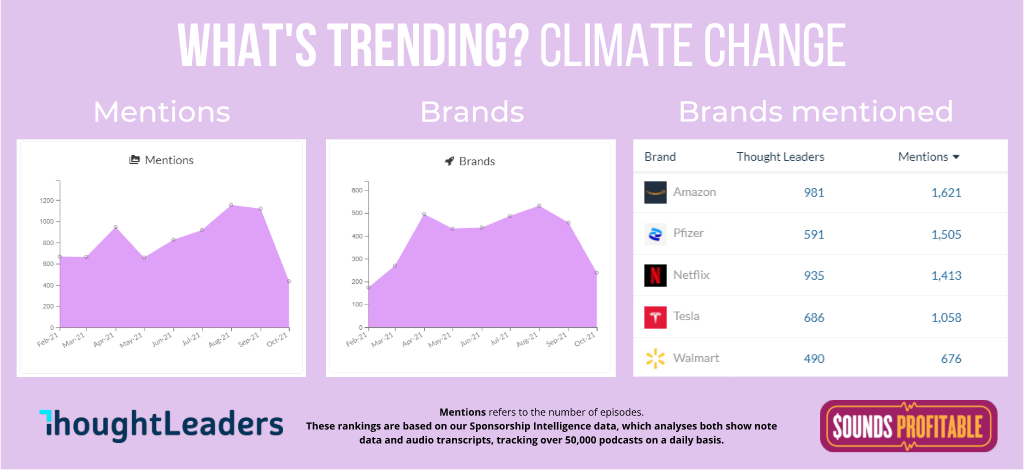

Market Insights – with ThoughtLeaders

Noam Yadin, Content and Social Media Manager at ThoughtLeaders joins me this week to share insight into current trends:

It looks like the climate trend is heating up (no pun intended). According to our data, in 2021 alone, there are over 7,300 podcasts mentioning ‘climate change’ by 2,700 podcasters. It’s also interesting to see that BBC Sounds currently stands at the number one spot for having the most podcasts relating to ‘climate change’ in 2021.