Heather Osgood of True Native Media joined me earlier this year to talk all about the value of dynamic ad insertion and why everyone should have a grasp on it.

When we talk about adtech, we’re talking about it from the point of view of executing a campaign, most of the time. There’s such emphasis on the individual campaign that it can be real easy to lose track of the big picture. This is especially visible in the differences between podcast adtech, and the greater advertising technology ecosystem.

When I think about adtech overall, I think about programmatic solutions. Buyers utilizing technology they’ve chosen, to optimally purchase across multiple media channels from numerous publishers and aggregators at scale. Whether transacting with a single publisher with full transparency or trusting an intermediary, it all still operates through the same system and rules of engagement, and ultimately includes all the same preferred tracking methodologies to determine effectiveness.

In podcasting today, we think of programmatic tools mostly for filling our unsold inventory, not for the operational benefit they provide overall. But as major adtech partners like Google or Amazon continue to take podcasting seriously and encourage their ad-buying clients to use the same tech they do everywhere else, our corner of the adtech world will become more and more similar to advertising overall. This isn’t bad, it’s just different.

Today, the buyers responsible for purchasing podcast ads for brands are rarely buying anything but podcast ads, even streaming audio. This means that today, publishers continue to have an amazing opportunity to represent themselves uniquely and directly to buyers, as long as they do it in a digestible and actionable way.

And one way I expect to see take center stage in the coming months, is the increased use of audience insights tools.

Not Just for Targeting

IP-based demographic targeting can be a powerful, directional way to achieve success for a campaign. But the biggest flaw is how much inventory it cuts out to accomplish its goals.

Let’s say Ziprecruiter had a $500K budget for a podcast ad campaign. They don’t want to waste any money, so they’re going all in on demographic and behavioral targeting, as they want to target women, age 25-34, with a college degree and a household income over $150k. That wouldn’t be too difficult to pull off working with networks on hosting platforms or marketplaces that offer demographic targeting (Acast, AdsWizz, Audioboom, Megaphone, Triton Digital, Voxnest). But that level of targeting leaves a lot of highly relevant and desirable impressions on the table.

Wait, you say. How can that be? IP-based demographic excludes the downloads the advertiser doesn’t want to target, right? Correct. Sometimes that’s great. But other times… well, you’ll see.

Let’s start from the top and assume that half of all podcast downloads happen outside of the household, cutting the pool down to 50% because we can only use household IP addresses, as cell-based or business IPs aren’t reliable enough for this level of targeting. Then let’s generously assume that the device graph partners can match household IP address at a 50% match rate, dropping us down to 25% of the total. And of course, the actual demographic targeting, while not all that specific in this case, still likely cuts impressions in half again, down to 12.5% of the total impressions delivered.

To me, this has always been the hole with IP-based targeting: it leaves too much behind. IP-targeting examines each request in silo. Which, I’m arguing in this article, is too specific. Instead, we could be looking at all the download requests and learning more about the audience the show serves overall.

Audience insights tools open up the inventory—potentially all of the inventory—for a given show. And can even be used across multiple shows! Audience insight tools still rely on matching IP addresses to device graphs. But instead of looking at just one household in silo at the time of the ad request, they index downloads across all of those matched households identifying similarities of demographics that can increase the appeal of the show’s inventory overall.

Let me break that down, because I know it’s a little confusing. At its simplest, imagine what my entire household looks like on a digital level. The thousands of segments and the varied demographic information associated with it for the downloads initiated in my household by me and my wife. Now imagine comparing the segments of the 25% matched from a specific show. Either the listeners of that show will shine through in similar segments, shedding the other people in their house, or we’ll learn that the households overall are similar even when only one individual is listening to the show.

Should a woman who hits all the marks, except she’s 24 (range 25-34), be excluded from ZipRecrutier’s campaign? What if she doesn’t have a degree, but is far outpacing that salary range? Or what if it’s her spouse listening, who just happens to know she’s looking for a new job? By using these tools at the show level, instead of the impression level, publishers will be able to help buyers understand why cutting the pie that narrowly is not the right move for their audience.

Benchmarks & Indexes

Chartable (May 2021) and Podsights (July 2021) both recently launched their audience insights tool as an included feature for their publisher paid tiers. All you need to do is add in their prefix URL to your hosting platform to start collecting the data, or reach out to them if you already have the pixels live.

They each use different data management platforms to match IP to demographic and segmentation data. Chartable with Epsilon and Podsights with both Nielsen and Experian. Each shows similar demographics about the household including age, gender, income, education level, and ethnicity. Again, all things you can get from IP-based targeting. What’s new is that, with audience insights, you can now slice-and-dice your entire audience by any of those demographics, seeing not only the % of your show’s downloads that fit, but also how that percentage indexes with the general US population.

A publisher armed with this information knows their show index in the direction that Ziprecruiter is looking to target.They’ll likely find it far easier to land a full show-buy with a host read ad across all downloads instead of settling for a small sliver of the downloads they can sell with targeting too-specific demographics.

For the publisher, selling based on audience insights helps them reduce operational costs of setting up and running a campaign when the slice gets too small. If your show gets 1 million downloads a month, how happy are you going to be recording an ad and setting it up to target just 125k impressions? Assuming you incur an average $5 CPM cost to set up that targeting, that’s a $2,500 invoice to the brand for that level of work for their campaign.

For an advertiser, buying based on audience insights allows them to explore the effectiveness of a broader audience who either are their intended targeting (those that would have matched at the impression level) or strongly aligns with the targeting (the rest of the audience in a show that indexes highly in that targeting), potentially opening up a new demographics to explore for future campaigns.

What’s Old is New Again

If taking a sampling of data about your audience and using it to speak to the complete value of your audience sounds familiar, it’s because this is simply a data management platform spin on the tried and true listeners survey format. Companies like Edison Research and Signal Hill Insights have been offering these solutions for publishers for decades, and not just in podcasting. It’s also incredibly common for publishers to do them directly too (which Edison has provided a completely free template for any publisher to give it a go).

Both the pixel-based and survey solutions offer immense value, and truthfully, publishers should be doing both. Having multiple points of data to shore up how you represent your audience, along with the logos of reputable third parties like Chartable, Podsights, Edison Research, and Signal Hill Insights, only serves to make your data that much more reliable.

And even more so, some of the data we see from individual download targeting doesn’t make a lot of sense. A great example of that is that in general, men tend to appear as head of household in IP-based demographic data at a higher rate than women. But that doesn’t mean that your podcast about female entrepreneurs with two female hosts actually indexes higher on male listeners. It just means that not all of the data provided by IP-based solutions will tell the full story.

Publishers with a strong, active understanding of their audience are better positioned to help brands enter this space directly. And that’s the kicker about podcast advertising today, it’s still direct, which means that we have to provide as much knowledge as possible for those looking to spend with us.

Rel’s Recs

Arielle’s pick for this week is: A Bintel Brief

Here’s an advice podcast from two very smart, very thorough Jewish mothers. Each episode focuses on a different question or problem from an advice seeker who has written in or sent a voice note. Hosts Ginna and Lynn take the time to tackle each question from every possible angle. One of the things that makes this advice show unique is that it’s a reboot of the more-than-a-century-old advice column from the originally all Yiddish newspaper, The Forward. A Bintel Brief means “a bundle of letters,” because at one point, bundles of letters were physically sent to The Forward’s offices. This is the 2021 iteration of the long-standing tradition of asking our mothers for help…now in podcast form!

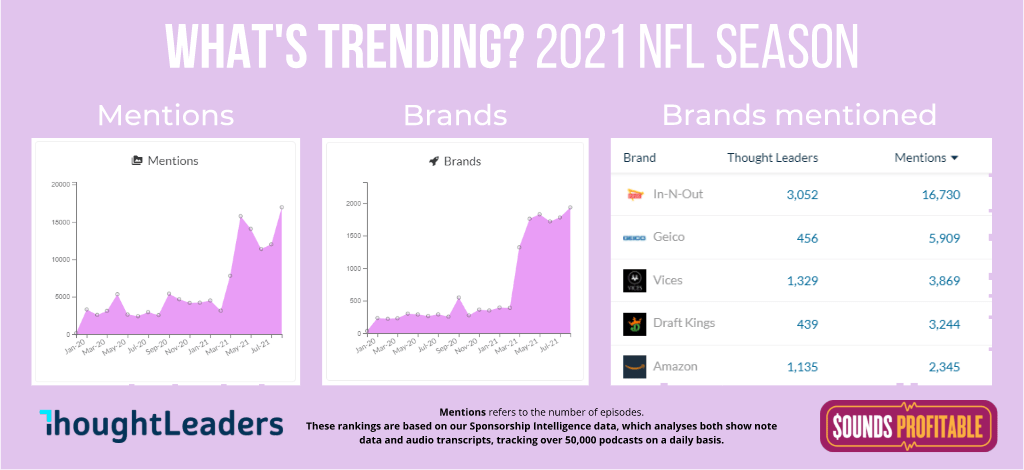

Market Insights – with ThoughtLeaders

Noam Yadin, Content and Social Media Manager at ThoughtLeaders joins me this week to share insight into current trends:

The NFL is underway! The 2021 NFL season started on September 9th, 2021 and will end on January 9th, 2022 in the NFL Kickoff Game. As the trend graph clearly shows, the hype around the 2021 NFL season is much much greater than in 2020. Unsurprisingly, brands are not missing out on the hottest sport season of the year – over 3,000 brands have been mentioned in 2021 alone by 8,400 podcasters. Some of the brands being mentioned the most include: In-N-Out, Built Bar, Vices, Draft Kings, and ESPN+.