Podcast Revenue Growth Slowed in 2023, Will Return to Double-Digit Growth in 2024, According to IAB’s U.S. Podcast Advertising Study

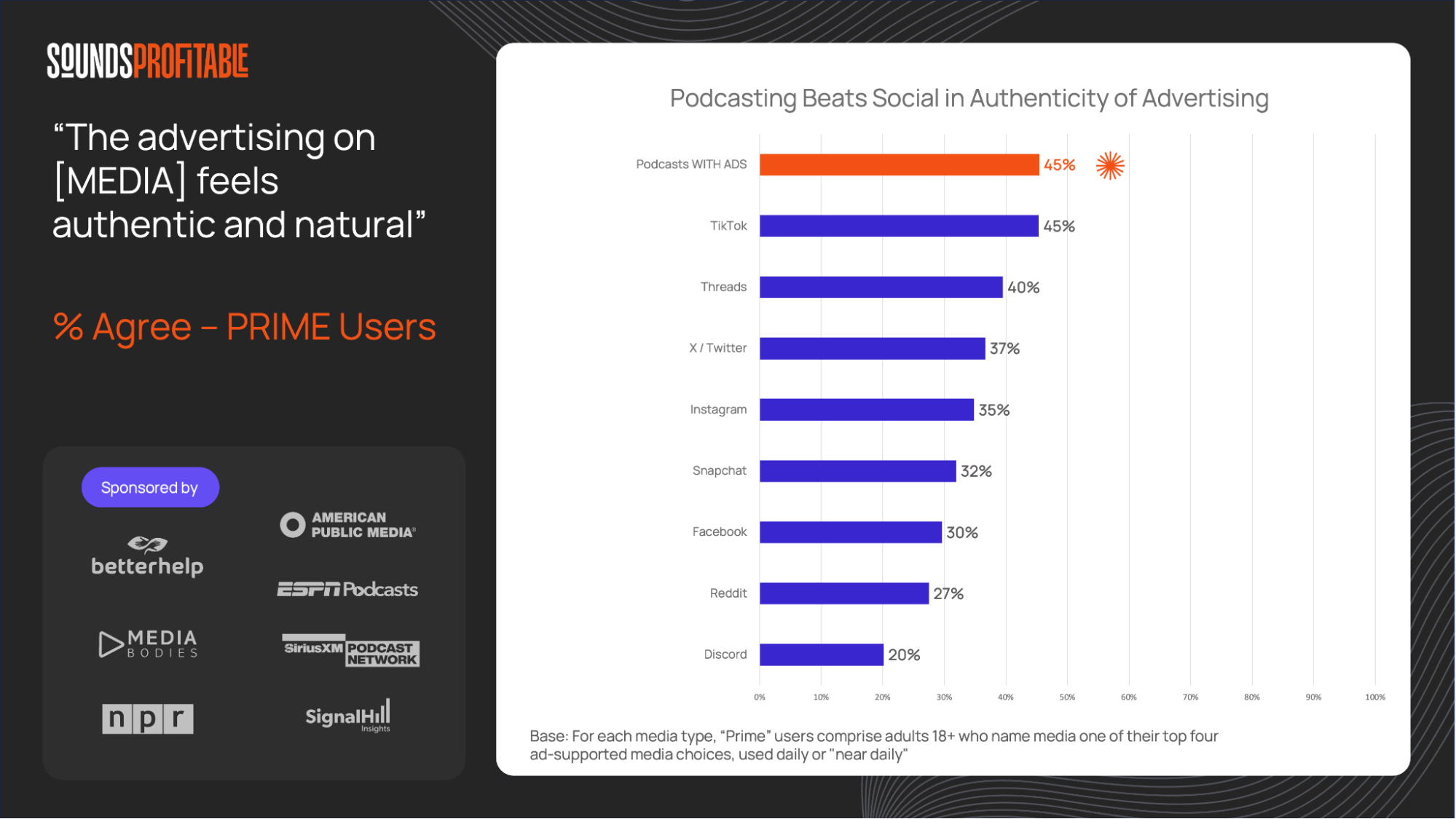

The latest IAB U.S. Podcast Advertising Revenue Study is now available. Key findings include a 5% revenue increase for the industry in 2023 and projections of 12% growth next year. A quote from Sounds Profitable partner Tom Webster: “There is no question that the last year was a bit rocky for the entire advertising space, and podcasting was not immune to that. However, the audience for podcasting continues to grow, and the core effectiveness metrics for podcast ads remain strong, which bodes well for a strong 2024.” Niche content is still vital, as over 25% of revenue came from “other” categories. As IAB CEO David Cohen notes, podcasts deliver at scale and can pinpoint small audiences in a way that allows advertisers to reach niche audiences affordably. [Source]

The Wilford Brimley Podcast by Tom Webster

As last year’s study The Medium Moves the Message found, podcasting reaches nearly as many 18-34 year-olds as radio and TV. On that same graph, though, is podcasting’s biggest growth opportunity: only 14% of respondents 55+ consumed podcasts in the past week. Webster argues that instead of continuing down the path of making podcasting a ‘young’ medium, it could become the discovery medium for the curious, regardless of age. 55+ audiences also buy mattresses and order food, and they tend to have more income with which to do so than the 18-34 demographic. [Source]

If You Are Asking How To Get More People To Listen To What You Make Now…You Are Probably Going To Fail by Eric Nuzum

Continuing the theme of serving audiences appropriately: the latest issue of The Audio Insurgent focuses on the concept of serving new audiences and where they should be centered. Questions tend to be framed from the perspective of making existing audio content reach more people. Nuzum argues the audience should be the core of the question, and the answer. The first step is to identify the audience to be served, understand them, and then determine what can be done to best serve them. [Source]

Programmers Hope That Lower Ad Volumes Will Earn More Viewer Time by Alyssa Boyle

Both programmers and investors at CTV Connect this week cite engagement as one of the top challenges to making CTV business profitable. Attempted solutions include paring back total commercial time during peak hours, with Warner Bros. Discovery shortening ad breaks during prime-time when most people are likely to be watching. Keeping in mind what kind of content is also vital. A high ad load on a 2 hour movie is far more disruptive to the viewing experience than the same percentage of ads applied to a TV show with 30 minute episodes that were edited to contain ad breaks in the first place. Something podcasting has experienced, with relatively low ad loads and near industry-wide practice of timing content to include built-in ad breaks. [Source]

What to Expect From This Year’s Upfront, According to Buyers by Bill Bradley

Last year’s TV upfront sessions experienced long negotiations and softer CPMs (cost per thousand impressions) than anticipated outside of sports content. Buyers interviewed by AdWeek anticipate more of the same, with sports remaining the most sought-after inventory. Which has lead to a rise of investment in women’s sports, with a record-breaking NCAA women’s tournament potentially bringing more client interest. Sports content is experiencing a similar boon in podcasting, as the aforementioned IAB Podcast Advertising Study found sports remains the second biggest genre for ad revenue for two years running. [Source]

…as for the rest of the news:

-

iHeartMedia has posted their Q1 report, including a $91 million podcast revenue (up 18% year-over-year).

-

Amy Poehler talks about her new improv comedy series Women Talkin’ Bout Murder. A sign of podcasting’s growth in that there’s both an audience for a satirical take on podcasts like My Favorite Murder, and said satire is noteworthy enough to be covered in The New York Times.