Public opinion and risk tolerance can shift overnight. Brands and agencies are often concerned about how to approach brand safety and suitability when it comes to podcasts. Many of their decisions are built on assumptions from different times and different mediums. Do they even apply to podcasting?

Safe and Sound, the first ever study of brand safety and suitability from the listener’s perspective, aims to answer that. Check out the latest Sounds Profitable research, available now for download.

Q4 2022 felt like a lot of punches in the mouth from the outlets that cover podcasting, striving for just a few more clicks to reach their revenue goal before year end. So much so that, until I sat down to write this recap, it was easy to forget all the success we’ve seen in podcasting in the last year alone. Podcasting is mainstream now, and in a world that demands massive growth and profits year over year, it’s incredibly easy to dismiss any form of success that falls short of unicorn status.

As Tom Webster so eloquently put it when sharing news with our partners, “No one is even bothering to write those articles about radio or TV, where ‘flat is the new up’”. In podcasting, we’re still going up.

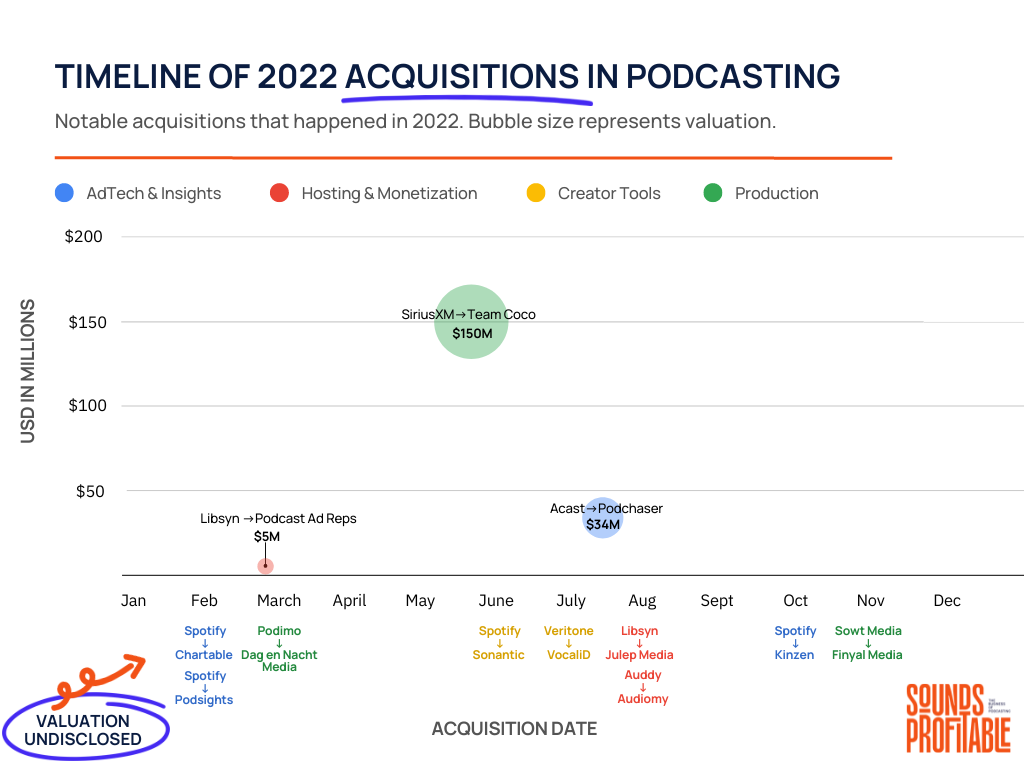

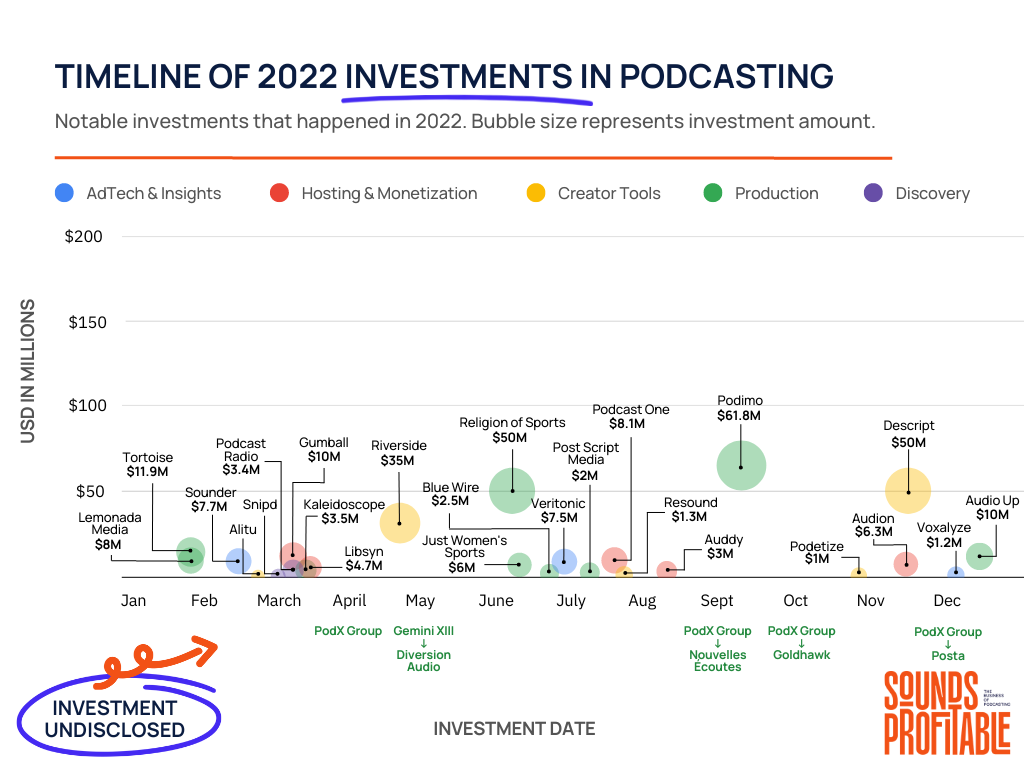

This article contains a recap of the 14 acquisitions and 26 investments we saw related to podcasting in 2022, totalling over a billion dollars. It’s to remind you that the pressures facing our industry are not unique to our industry, but the growth and success companies continue to find in podcasting is and will continue to be powerful and on equal footing or greater than media channels far larger than our own. Our goal at Sounds Profitable this year is to put more clear evidence of that in your hands, while highlighting how we think you can best use it, to squash more of these conversations and empower you to keep growing this industry.

Before you dive in, we highly recommend you download the 2023 Podscape from Sounds Profitable and Magellan AI. 2022 was a busy year for podcasting, so to ensure the Podscape is as accurate as possible we’re putting out a January preview edition.

Is your company missing? Notice something we omitted? Drop us a line! With your reader feedback we’ll be set to publish the finalized version next month.

And, to keep up to date with acquisitions and investments in real time, don’t forget to subscribe to Podnews.

AdTech & Insights

In a move that caught many by surprise, Spotify kicked off the year by acquiring both Podsights and Chartable in February as part of $295 million in total spending that included Findaway (2021) and Sonantic, all while turning two of the three major podcast measurement and attribution companies into first party solutions. The result? Incumbents Artsai and Claritas doubled down on podcasting, while Gumball, Magellan AI, and Podscribe all launched new measurement and attribution solutions. Veritonic took further advantage of this opportunity, expanding from their successful brand lift solution into pixel-based attribution, while securing $7.5 million in funding just a few months after Spotify’s acquisitions.

The biggest category to watch, however, is brand safety & suitability. Sounder announced in February an additional $7.7 million in funding, counting iHeartMedia as a new investor, and foreshadowed a clear shift in focus leading to the closure of their hosting and advertising solutions just nine months later. Further, Spotify, who announced last summer their partnership with Integral Ad Science to validate their own first-party brand safety & suitability solution, acquired Kinzen in October to further their internal goals. Our latest research, Safe & Sound, should help shed further light on why we think this category will be the one to watch in 2023.

On the insights track, Voxalyze raised €1.2 million to expand their Podcast Visibility Optimization solution, their interpretation of Search Engine Optimization, to aid in discovery within major podcast apps. And, in a move that still has many scratching their heads, Acast acquired independent podcast database company Podchaser for $34 million in July. Much of the value Podchaser brought to the industry was in its neutrality and interconnectedness with many major hosts and podcast players, which is entirely lost as a first-party solution.

Hosting and Monetization

In February, Libsyn acquired Podcast Ad Reps, a publisher representation agency, for $5 million. Libsyn then raised $4.75 million in March before acquiring Julep Media, a German-focus analogue of AdvertiseCast (2021), expanding their advertising business further globally. Comparing the Libsyn from 2020 to the Libsyn of today, it’s incredibly clear that monetization is front and center for their new vision.

Continuing globally, UK podcast rep firm Auddy raised £2.5 million in August, 12 months after acquiring production company Radio Wolfgang (2021) and just a few weeks before acquiring Audiomy to further their monetization and marketing services as well as expanding into German language territories. And in November, French podcast advertising marketplace Audion raised €6 million. It’s exciting to see podcast advertising-focused companies outside of the US raise funds, as many of the promises and press releases in 2021 of global expansion from existing podcast companies often fell short.

Back in the states, Gumball, the podcast advertising marketplace created by the team at Headgum Podcast Network raised $10 million in March, and PodcastOne, the wholly-owned subsidiary of LiveOne raised $8.1 million on their quest to spin-out as a separate company.

Creator Tools & Discovery

Tools that improve podcast creation continue to be a major category again this year. Audio and video recording platform Riverside raised $35 million in April, but it’s unclear how Squadcast’s awarded patent will impact their growth.

UK-based Alitu from The Podcast Host raised £500k to continue expanding their full service podcast making web-based solution which now offers hosting along with additional creation tools. And Resound raised $1.35 million for their automatic editing tool, which is a more hands-off approach to cleaning up recordings before editing. Back again this year is the audio and video AI-enhanced editing solution Descript, raising an additional $50 million in a round led by the OpenAI Startup Fund. OpenAI’s suite of tools further entering the podcasting space are likely to disrupt some existing relationships for Descript.

Keeping with the trend of AI, Spotify acquired dynamic AI voice platform Sonantic in what looks like a move to internally generate new text-to-speech content for listeners over providing it as a creation tool through Anchor. And Veritone acquired personalized synthetic voice company VocaliD as they continue to expand aiWARE with audio taking a clear front seat in their offering.

The listener-focused side was light, but interesting this year. AI-powered podcast app Snipd raised $700k and Nation Broadcasting acquired a 10% interest in UK-based radio station Podcast Radio. New ways to create, consume, and even interact with podcasting content is a challenging but worthy area, which even inspired Insider and Axel Springer to invest in Spooler, which challenges the static nature of podcasts.

Production

Swedish investment company PodX Group launched in April and wasted very little time, acquiring substantial stakes in three production companies: Nouvelles Écoutes in France, Goldhawk in the UK, and Posta in Argentina. Ashley Carman of Bloomberg took some time to speak with the team at PodX Group and their overall goals.

In the Netherlands, Podimo, a subscription service for audio books and exclusive podcasts, acquired podcast publisher Dag en Nacht in March before raising another €58.6 million in September, bringing their total raise to €160.2 million since launch in 2019. And in Jordan, Sowt Media acquired Dubai-based Finyal Media.

Back in the US, SiriusXM acquired podcast network Team Coco, which includes a five-year talent agreement with Conan O’Brien that spans far past just podcasting.

Here’s a list of additional production company investments from 2022, as it was by far the largest category:

- Religion of Sports raised $50 million

- Tortoise Media raised £10 million

- Audio Up Raised nearly $10 million

- Lemonada Media raised $8 million

- Just Women’s Sports raised $6 million

- Kaleidoscope raised $3.5 million

- Blue Wire raised $2.5 million

- Post Script Media raised $2 million

Wrapping It Up

By the time you’re reading this article you’re likely already into the swing of things for the year, but here’s my ask of you: save this article. And then, on your lunch breaks this week, look up articles about CTV, TV, Radio, Display, and OOH, and the projections in growth for those industries. Look at the overall advertising projections and the size of each vertical.

Bookmark them, and then compare them to the podcast projections you’re seeing.

The transitional line between niche and mainstream is brutal, but this is what we’ve all been working incredibly hard to achieve. 2023 will not be an easy year, but that does not mean that it won’t be successful for many of us and eye-opening for companies that were not built to weather tough economic conditions.

Specific companies deserve to get a few punches in the mouth, but podcasting is doing great and will continue to do better as we educate and explain as much as we possibly can to everyone working in this industry. Every sales person who can combat dismissals of podcast ad effectiveness and ROI is one more won campaign and converted brand or holding company. Every account manager who can explain the brand safety & suitability difference between choosing to listen to a podcast and flipping through the channels to find a TV show is a future leader of this industry.

While “go go go” got us the massive success we’ve seen over the last few years, 2023 is the year where we need to take a beat and make sure we get everyone up to speed, that we have clear onboarding and educational opportunities for employees of this industry.

And as always, we’re here to help however we can.