This Week in the Business of Podcasting

This is your final reminder to start packing for Podcast Movement if you’re going. The next time you’ll hear from us will be a dispatch produced and uploaded from Denver. Until then, here’s the news from this week week before we all jet off to the Centennial State.

Track behaviors, trends, and insights: Download Magellan AI’s podcast advertising benchmark report for Q2

Acast Announces Podscribe as Global Preferred Attribution Partner.

Yesterday Acast announced a new partnership with Podscribe, adding their podcast attribution services for all Acast customers. Here’s a quote from Acast CEO Ross Adams:

“Podscribe’s track record in delivering accurate and insightful attribution solutions – which are certified at the highest level – is exceptional. We also know their approach to customer satisfaction is unmatched in this space. This collaboration reinforces Acast’s commitment to offering advertisers the very best impartial tools to succeed in the podcasting space.”

Acast positions the partnership as a step towards fostering an open and transparent future for podcasting. Starting in September, Acast will no longer accept new campaigns in Spotify’s Ad Analytics (formerly Podsights).

The importance of third-party verification has been stressed quite a few times on The Download and Sounds Profitable in general (we recommend revisiting Bryan Barletta’s article In Defense of Third-Party Podcast Solutions). It’s worth noting that with this announcement, Acast becomes the first major company to publicly make a statement on the matter and side with third-party attribution.

Edison Research Share of Ear Study Turns 9

Last Thursday Rain News’ Brad Hill covered the new Q2 release of Edison Research’s Share of Ear study, which also happens to be the study’s ninth birthday. When Share of Ear started back in 2014 the audio landscape was noticeably different.

AM/FM radio dominated American share of time spent listening to audio sources 52.1%, with owned music coming in second at 20.3%. With the rise of streaming music, YouTube, and podcasting, owned music has shrunk to just 7% and radio sits at 36% share of ear. Listening to music videos, which wasn’t even tracked nine years ago, now takes up 14% of listening time.

Unsurprisingly, Podcasting has gone through quite a growth spurt of its own. Back in 2014 podcasts made up 1.7% of the share of ear. Now the medium is up to 10%, as much share of ear as owned media and audiobooks combined.

Mattress Firm Branded Podcast Drives In-Store Sales

Last Thursday, Adweek’s Catherine Perloff covered new information about how Mattress Firm’s experiment in branded podcasting performed. The podcast Chasing Sleep, produced with iHeartmedia’s Ruby content studio, talked to experts and average people with unusual schedules (ER doctors and ultramarathoners, for example) about how to achieve good sleep.

The campaign was designed with agency Spark Foundry and was built to include ad placements across the iHeartMedia network. The campaign chose to forgo the usual promo code as an attribution method. A quote from iheart chief data officer Brian Kaminsky:

“Podcasts came onto the scene and very quickly got adopted by folks who were doing direct response marketing. It worked very nicely, but that business doesn’t scale well. There’s this myth out there that you can’t measure podcasts. It’s just patently not true.”

Instead, Mattress Firm worked with measurement firm Affinity Solutions to link podcast listenership to purchases. According to Affinity Solutions, their Consumer Purchase Lift tool usually sees incremental sales lift of 5 to 10% for an average campaign. Chasing Sleep drove four times return on ad spend and a 45% lift in incremental sales.

Amazon is quietly building an SSP.

Business Insider’s Lauren Johnson reported last Friday that new job postings from Amazon indicate the company is adding something new to their advertising arsenal. The new positions show Amazon is building a team called PubTech, who will be a part of Amazon Ads. The stated focus of the team is to build a new supply-side platform, or SSP. A quote from Johnson’s article:

“One job listing for a software engineer notes that the PubTech organization is “a new exciting program that is building supply side technology and pioneering novel experiences” for publishers to sell video, audio, and display ads.”

Johnson says the PubTech team’s stated purpose is to build products for Amazon properties like Twitch, FireTV, and streaming platform FreeVee. There’s also an overseer position for PubTech to create marketplace deals between advertisers and publishers.

While podcasting is not directly mentioned in the job listings, it is worth noting that there are currently only two enterprise-level podcast hosting platforms who don’t have an in-house SSP: Spotify’s Megaphone, and Amazon’s Art19. Once PubTech is up and running, that will change.

Industry Insights with Megellan AI

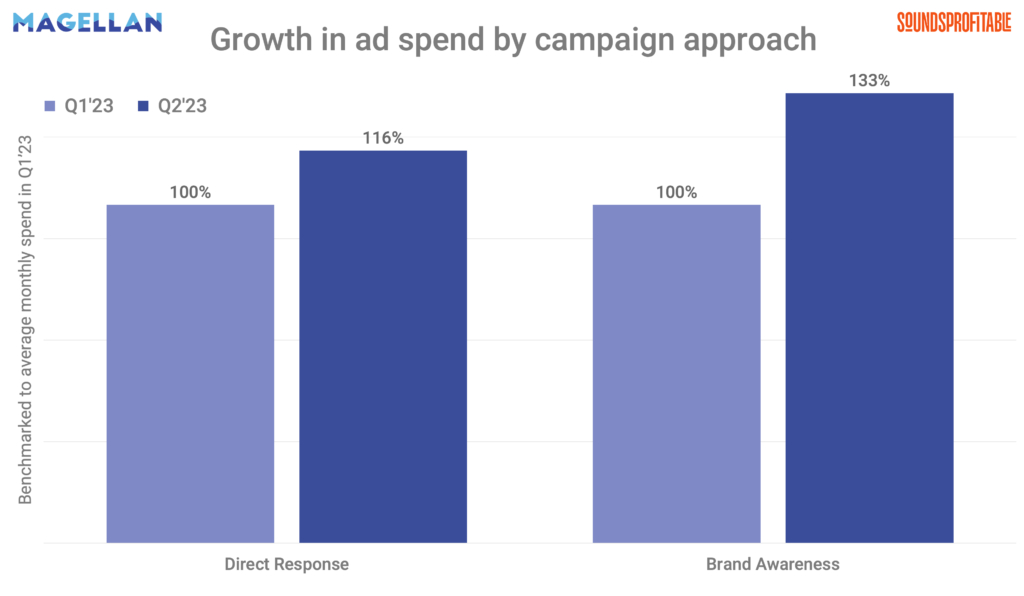

Between Q1 and Q2 2023, overall ad spending increased by 24%. Spending by Direct Response and Brand Awareness advertisers increased 16% and 33%, respectively, In Q2 Direct Response advertisers accounted for 50% of overall ad spending, Brand Awareness accounted for 47%, while Tune-in accounted for the rest.

Looking to get a handle on podcast advertising metrics? Book a demo with the Magellan AI team.

Quick Hits

While they may not be top story material, the articles below from this week are definitely worth your time:

-

Making a Podcast People Hate by Tom Webster – Using data from the upcoming Sounds Profitable study The Podcast Landscape in America, Tom demonstrates the power of making a podcast for a hyper-specific target audience.

- Descript Acquires SquadCast. Squadcast’s remote recording tech will be implemented in Descript to allow the service to offer podcast recording, editing, and publishing in one service. Previous Squadcast customers will be able to switch to Descript at no additional cost.

- Triton Digital Releases the July 2023 U.S. Podcast Ranker. Highlights include SXM Media at #1 in Top Seals Networks for July and NPR News Now retaining the top spot in podcast downloads.

- PodcastDb and Sonnant Partner to Create the First Ever Podcast Advertiser Directory. The directory will enable advertisers to find contextually-suitable podcast advertising opportunities.