This Week in the Business of Podcasting

Ten days from now several of us Sounds Profitable-ians will be in Denver for Podcast Movement (stop by the Sounds Profitable Partner Lounge, I’ll likely be handing out badge stickers). Lots of prep to do, and the industry doesn’t stop just because you need to find your suitcase. Let’s get into the news!

Track behaviors, trends, and insights: Download Magellan AI’s podcast advertising benchmark report for Q2

Connect Patreon to Spotify and Stream Your Favorite Podcasts in One Place

During Spotify’s Stream On event this March, the platform announced an official partnership with Patreon to integrate paywalled content into Spotify. This Thursday Spotify announced the beta test is over and podcasters can now access the integration. A quote from the Spotify blog:

“Patreon is our latest partner in a growing list of publishers and platforms that offer subscriber-only content powered by Spotify Open Access. With just a few clicks, podcast creators on Patreon can add Spotify distribution to their podcast to grow their audiences while retaining full control over their subscriber bases, their content, and their revenue.”

In addition to the podcast distribution feature, Spotify says they’re testing a new feature that will help promote premium subscriptions on spotify. The plan is to implement a banner ad for the premium subscription offerings that will be placed at the top of the free feed’s page in the Sptofiy app. Once fully implemented, the feature will be made available for users of all the Spotify integrated platforms, including Patreon, Supporting Cast, and Supercast.

Gone are the days of figuring out how to add a Patreon RSS feed to Spotify. The easier it is for casual podcast listeners to access more of the content they like, the more likely they are to stick around long enough to be power listeners.

Q2 Earnings Calls in Podcasting

It’s quarterly earnings call season once again and some of the bigger names in podcasting have good numbers to share. Starting with Sara Guaglione’s roundup article for Digiday this Wednesday: iHeartMedia, Spotify, and Acast all reported quarterly revenue growth between 12% and 31% year-over year in their podcast businesses. A quote from the article:

“Their earnings results mirror recent reports that U.S. podcast ad revenue is expected to continue growing. According to research conducted by PwC for the Internet Advertising Bureau in May, total podcast ad revenue is projected to hit $2.28 billion in 2023, up 25% year over year.”

iHeartMedia’s podcast revenue was $97 million in Q2, a 12.9% year over year increase. Acast is up 22% from last year with net sales hitting $36 million. Spotify did not give specific revenue amounts but did say podcast advertising revenue growth is more than 30% year-over-year, a promising development given the company’s pivot into growing advertising.

Sirius XM’s earnings call was covered by Brad Hill of RainNews. Both podcasting and streaming music are considered ‘off platform’ content in SXM’s reporting structure, with off-platform reaching 13% year-over-year revenue growth in Q2. Pandora’s Q2 profit was $152 million, a quarter-over-quarter increase of 29%. President and Chief Content Officer Scott Greeenstein told shareholders podcasting at SXM is holding stable and the company is in a financial position to potentially make new acquisitions.

AI came up frequently in conversations of what companies look forward to in the near future. SXM is testing a suite of AI tools to optimize ad campaigns. Guaglione’s coverage cites Spotify CEO David Ek saying generative AI tech has three major applications: discovery, engagement, and retention. He also highlighted the potential of AI-generated show summaries.

Acast’s focus on automation include their self-serve platform and an AI-driven capability named Collections+ that uses Podchaser metadata to allow advertisers to target relevant listeners more effictively.

Why some publishers are reducing their podcast slate to try to grow their audio businesses

In a rare Download double-appearance: last week Sara Guaglione covered several major podcast publishers and how they’re reducing their podcast slates in an effort to grow their audio business overall.

NPR’s podcast team has adopted a strategy of consolidating feeds, preferring limited-run new projects aired within existing RSS feeds over the time and staff requirements of launching entirely new podcasts. NPR’s podcast ad revenue was predicted to decrease by nearly 30 million dollars back in Q1, but podcast audience numbers are coming back higher year-over-year. June’s unique monthly audience statistics from NPR show 18.5 million listeners, an increase of 500,000 from last year.

By consolidating feeds, NPR hopes to alleviate spreading that listener base thin over multiple podcasts that also require their own unique teams. Now teams are building multi-part documentary series to debut in the Embedded feed instead of their own bespoke podcasts.

Meanwhile publications like the New York Times-owned sports publication The Atlantic have cut smaller soccer club podcasts to focus resources on their existing flagship shows. A quote from audio managing editor Iain Macintosh:

“There was a huge slate of club shows and that’s been compacted down. But I think we’re doing what we’re doing better, with more thought, more authority and still having the opportunity to try new things.”

The Athletic has also tested a marketing initiative in the U.K., putting all of its marketing power behind one podcast for an entire week before moving on to a different show in the catalog. Macintosh says the experiment saw a big increase in audience with many double-digit increases, though specific stats were not shared.

As has been said before, the era of ‘dumb money’ in podcasting is likely at an end, with flashy acquisitions and massive catalogs taking a back seat to focused marketing and tight-knit collections of flagship shows. As Tom Webster mentioned in this week’s Sounds Profitable newsletter, podcasts like Serial cann’t achieve that sought-after “song of the summer” mainstream awareness if the producer isn’t focusing all of their marketing efforts on that specific podcast. To quote Webster:

“It’s just hard to get people to try one thing when we are constantly asking them to try all of the things.”

Industry Insights with Megellan AI

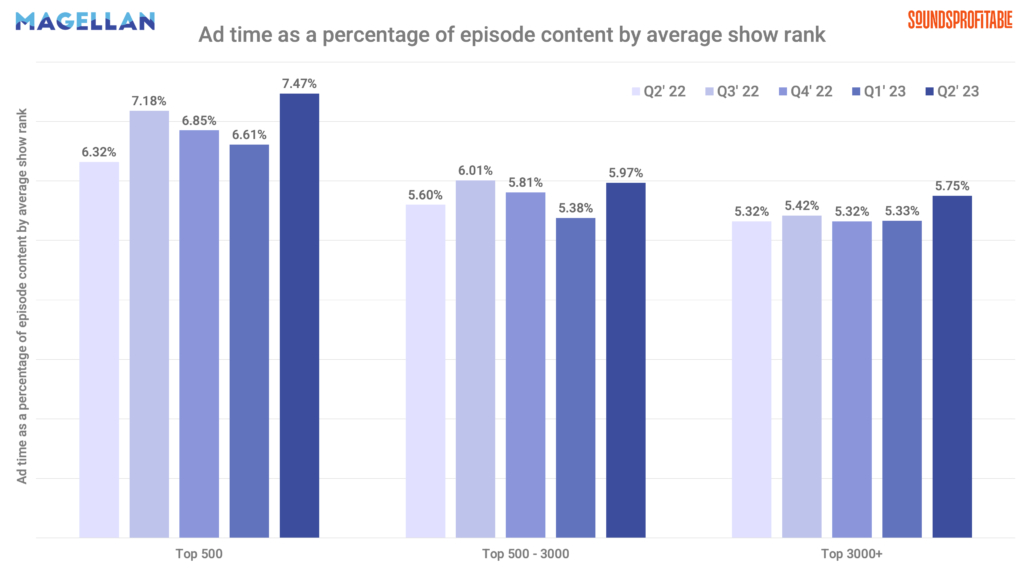

During Q1 and Q2 2023, overall average ad loads increased from 5.55% to 5.97%. Quarter-over-quarter ad loads increased across all show groupings, but most (+0.86) in the Top 500.

Looking to get a handle on podcast advertising metrics? Book a demo with the Magellan AI team.

Quick Hits

While they may not be top story material, the articles below from this week are definitely worth your time:

-

The Song of the Summer, and the Joe Rogan Problem by Tom Webster. While podcasting has had several song-of-the summer moments since Serial in 2014, the majority of recent podcast breakout moments have been dominated by one polarizing figure.

-

Libsyn’s AdvertiseCast Signs Exclusive Ad Partnerships with Two Leading Podcast Networks. The new partnerships give Multitude and Upfire Digital access to AdvertiseCast tools like Automatic Ads.

-

The Podcast Academy and DPC Entertainment Launch Podcast 360. The new podcast series launched this Tuesday. Each episode asks company founders and podcast experts three questions about podcasting, with a sixty second time limit per question.