Spotify Audience Network to remove price floors.

A new email from Spotify has announced that as of July 1st, publishers on Megaphone will no longer have the ability to set price floors for the Spotify Audience Network (SPAN). The current ad ecosystem on Megaphone operates as a waterfall, with each ad request hitting direct-sold, then SPAN, then VAST/programmatic. Each layer can only compete with itself. Removing a price floor in a programmatic space can drive more competition for inventory, increasing the win price over time. However, SPAN is not programmatic, and it’s not clear if the change will introduce bid ranges for Spotify campaigns that take advantage of this new lack of price floor. It’s possible SPAN will begin consuming more inventory before allowing calls out to programmatic solutions. A quote from Sounds Profitable founder Bryan Barletta: “This is an action that will have a sizable impact for publishers on Megaphone who have put considerable effort into their own programmatic relationships. SPAN sitting on top of programmatic, and not competing with it, prevents a publisher from maximizing their own ad inventory and relinquishing control to Spotify fully.” Publishers have also been given the ability to set inventory to direct sales-only for ads uploaded to Megaphone. [Source]

Marketers remain invested in programmatic, but agencies show less confidence than brands by Julia Tabisz

A Digiday survey of brand, retailer, and agency professionals in Q1 found programmatic advertising remains a mainstay of marketer’s advertising budgets, but agencies show less confidence in recent months. 38% of marketers said their programmatic spending budget increased year over year, making it the largest category for brand’s display ad investments. One part of the marketer/agency divide is how success is gauged. Marketers tend to look at sales, while agencies tend to prefer clickthrough rates. [Source]

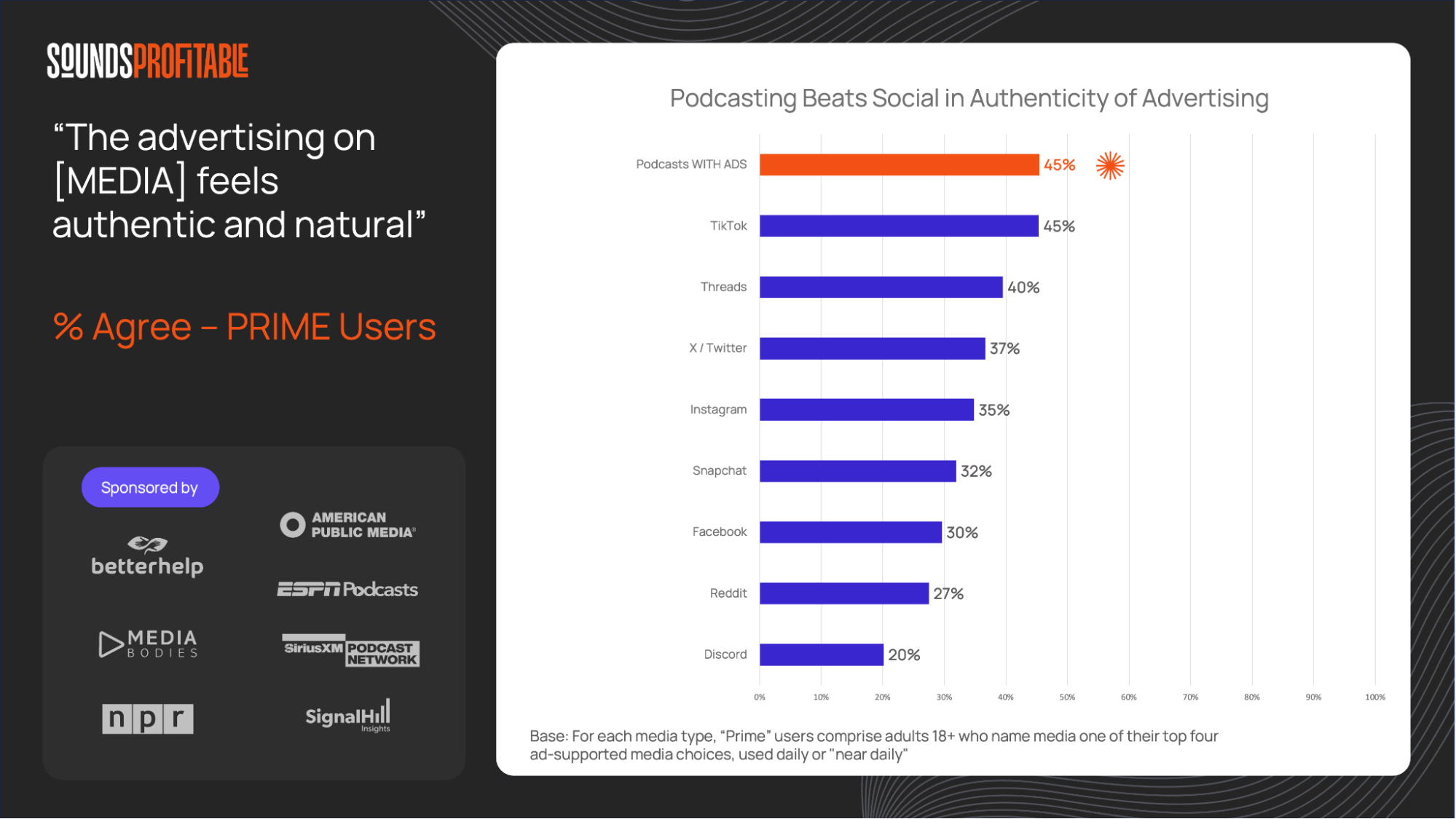

Audio in the AI age by Brian Morrissey

As new versions of generative AI tools become more powerful and more widely available, Morrissey argues podcasting has strong potential to become the refuge for audiences looking for human-made content. With a surge of generic generated content in text and visual mediums, audio maintains a level of authenticity and connection. And while a podcast on its own isn’t a for-sure standalone business venture, they have the power to build a durable, loyal audience. [Source]

Online Hub Podcast-to-Screen Connects Audiovisual Producers With New Media IP by Ben Croll

Podcast network Paradiso Media has unveiled an online hub named Podcast to Screen, a resource to facilitate rights acquisitions for podcasts to be adapted into audiovisual medium. The service launches with over 200 IPs on offer in its database. Podcast adaptations continue to be popular, with successes like Dirty John paving the way for new programs like the upcoming docuseries adaptation of Scamanda. [Source]

…as for the rest of the news:

-

Edison Research’s top 50 U.S. Podcasts for Q1 2024, measured by weekly podcast listeners aged 13+, is now live. Highlights include New Heights riding a Swiftie wave to #4 and old-school contender WTF with Marc Maron dropping out of the rankings.

-

Podscribe announces International Research to expand database of global podcasts

-

The proposed merger of Australian media companies SCA and ARN has been shelved after an investor pulled out of the original deal, though SCA says they’re still open to future proposals.

-

Triton Digital has published their April stats for top podcasts in Australia. Casefile and Hamish and Andy maintain the top two spots, while ABC News Top Stories joins the ranker with a debut in third place.