This Week in the Business of Podcasting

Remember to bundle up, folks. Yours truly decided to play with fire by not wearing a jacket out on a crisp December afternoon and here I am, surrounded by tissues and Tylenol. Still, through the fog of acetaminophen, I bring you this week’s developments in the business of podcasting.

Track behaviors, trends, and insights: Download Magellan AI’s podcast advertising benchmark report for Q2

Sound You Can See: Podcasting’s Video Dilemma

This Wednesday Sounds Profitable published a new study focusing on how video podcast audiences engage with podcasting. Sound You Can See is built from an online study of 1,155 podcast listeners aged 18+ who had consumed at least one video podcast in the last 30 days. The study finds there aren’t video consumers or audio consumers, the same audiences can choose between audio and video podcasting depending on the content and context. 86% of those who watched a video podcast have also listened to an audio-only version in that same month period.

Video podcast consumers also have a high chance of listening to the audio-only version, with 60% of respondents saying they listen to the audio podcast equivalent on platforms like Apple Podcasts and Spotify. Video audiences largely enjoy the same genres/topics as their audio-only counterparts, though shows about music rank higher than in audio podcasting (likely due to trickier licensing and legality issues in audio-only distribution compared to YouTube’s copyright system).

What’s most important for video podcast consumers is the format of the show, not the genre, with a bias towards unscripted chat-show styled content. It’s also important to note viewers tend to watch video podcasts for attentive, lean-in sessions, while they shift to audio when multitasking. 67% of respondents say they prefer to see the hosts and/or guests when asked why they prefer watching video podcasts over listening.

Edison Research, Cumulus Media publish Q3 Share of Ear Study

This week from Pierre Bouvard at Cumulus Media: the Q3 version of Edison Research’s Share of Ear report has arrived. This quarterly report, built from a survey of 4,000 U.S. citizens, finds AM/FM in-car listening is now more common than it was pre-pandemic.

Meanwhile, Spotify and Pandora’s share of ad-supported music streaming has decreased 31%.

Podcast share-of-ear is up 575% since then. Spoken word content is at an eight-year high, with ad-supported spoken word listening with the 25-54 demographic hitting 39% in Q3 of this year. The study finds all non-music content got share-of-ear bumps during the pandemic and have only continued growing since.

Spotify Inks Podcast Deal With Warner Bros. Discovery for CNN, HBO and More Shows by Caitlin Huston

New this Tuesday from Caitlin Huston at The Hollywood Reporter: Spotify has signed a deal with Warner Bros. Discovery to host and distribute podcasts from subsidiary companies using their Megaphone platform. The deal also makes Spotify one of WBD’s podcast monetization partners via the Spotify Audience Network.

As a result of this deal, podcasts produced by Max, CNN, Adult Swim, Turner Classic Movies Network, and others will soon be hosted by Spotify. This is the second big deal the two have made this year, paired with the announcement back in March where Spotify signed up to produce podcast adaptations of DC Comics properties for WBD.

In addition to the Spotify distribution deal, Warner Bros. Discovery still has a separate distribution deal with Acast for podcasts produced by the reality TV side of the company, including Food Network, TLC, HGTV, Animal Planet, Travel, and Discovery Channel.

Teens social media platform choices are shifting.

This Monday from Jasmine Sheena at MarketingBrew: The 2023 edition of an annual study by Pew Research looks into the social media and technology usage of U.S. teens. The report is built from surveys of 1,453 teenagers aged 13 to 17. The study found TikTok, Snapchat, and Instagram are the most-used apps among respondents.

Meanwhile, old-guard social media is struggling to keep the teen demographic. Facebook has dropped to around a third of teens saying they regularly use it, compared to a rate of 71% back in 2015. Tumblr has slipped in usage to the point Pew didn’t include it in the survey this year.

Tastes are evolving, and platforms that lean into short-form video content are coming out on top as the prime places to reach younger demographics. As a result, TikTok and Instagram look to be the primary places podcasts should focus their efforts when generating clips for social media campaigns.

Industry Insights with Magellan AI

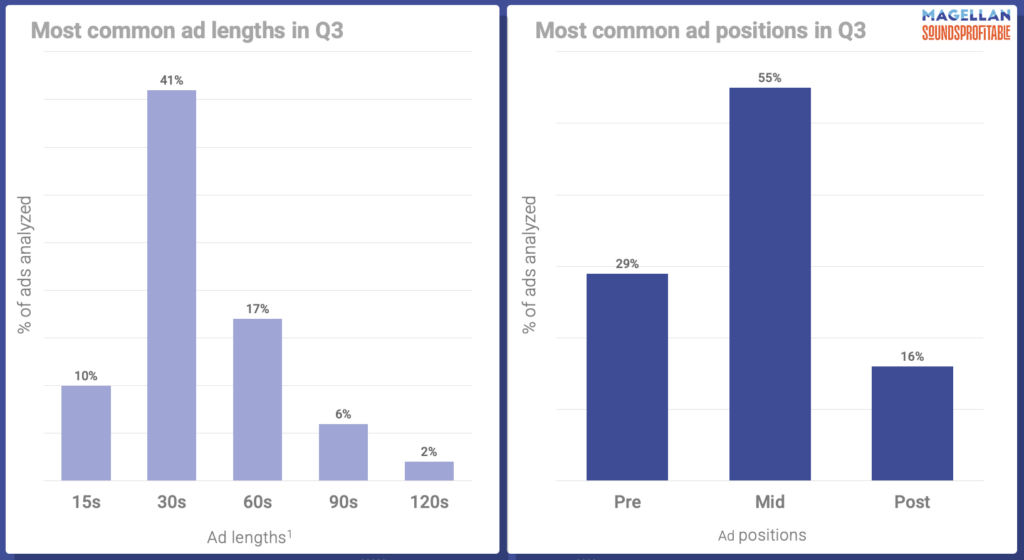

In Q3 2023, mid-rolls made up 55% of the ads Magellan AI detected, about the same as Q2. Most of the ads Magellan AI detected in Q3 were either 30s or 60s in length, cumulatively making up 58% of ads analyzed.

Looking to get a handle on podcast advertising metrics? [Book a demo with the Magellan AI team].

Looking to get a handle on podcast advertising metrics? Book a demo with the Magellan AI team.

Quick Hits

While they may not be top story material, the articles below from this week are definitely worth your time:

-

10 Critical Facts about Video and Podcasting for Success in 2024 by Tom Webster. To accompany the release of Sound You Can See, Tom’s latest article breaks down the dilemma facing video podcasting and how the future of podcasting isn’t a binary choice between audio or visual.

-

Realm Inks Deal with Adelicious for Exclusive U.S. Ad Sales Representation. The new deal will have Ream exclusively representing a slate of Adelicious podcasts in the US market, including Real Dictators and Short History Of…

-

TikTok sunsets podcast feature. As of today, TikTok is shutting down the beta of their Podcasting feature that aimed to allow full podcast episode imports into TikTok. Users of the beta will lose their full episodes, though traditionally-uploaded audiogram clips will remain.

-

Podcasters & Advertisers: Meet Your New Audience by Paul Riismandel. A close look at the “newcomer” demographic of podcasting and how the audience makeup is different from the “pioneer” fans who’ve been around for at least four years.

-

49% of global marketers predict increase in podcast ad spending by Adam Shepherd. A survey of marketers around the globe finds most of the countries surveyed have a positive outlook on podcast ad spend growth next year.