Join us this Thursday, January 21st for our next Product Deepdive with Triton Digital’s Podcast Metrics product.

Introduction

“I didn’t know that was an option” is the number one sentence I hear when talking with folks about podcast adtech.

And that’s ok.

Most podcast adtech was built without following the rigid industry standards of other digital advertising channels. Now, that doesn’t mean there’s not a robust amount of buttons and levers that can be pulled to do truly unique things. What it does mean is that, in this space, it’s easier to make progress with just a surface understanding of how something like podcast adtech works.

That surface understanding helps us drive both technology and ad spend – month-over-month, but also accounts for confusion over how programmatic advertising works, or mistaking dynamic ad insertion for announcer-read ads only, and it leaves us pining over the wrong metrics.

But we’re here to dive deeper. To add more tools to your toolbelt.

Previously, I covered how campaign lift reports work (in two parts) so that you can use the knowledge to improve your current campaign or help you better plan for the next. So in this piece, I wanted to share with you another similar tool that definitely starts one step further into the deep end, but is invaluable to have in your toolbelt.

This week, I spent time with Jeff Vidler of Signal Hill Insights and Tom Webster of Edison Research to help better explain to you how survey-based brand lift studies work, as well as the right types of campaigns to use them with.

What Exactly Are Brand Studies?

Most conversation about advertising breaks down into one of two categories:

- Direct response, where the goal is maximum exposure to the ads to drive more listeners to take the desired action.

- Brand awareness, which is focused on getting the maximum number of listeners thinking about the brand rather than taking a specific action.

Many brands can benefit from and utilize both types of campaigns. Microsoft, for example, can use podcast advertising to drive listeners to make a purchase directly from their online store. That’s direct response. But Microsoft also benefits from campaigns that focus on educating the listener about the brand and what they offer, because their products are often purchased from numerous retailers.

For some brands, direct response isn’t an option. Ford doesn’t sell directly to car buyers themselves. So their goal is to increase your awareness of their brand—and the cars that carry the Ford name—so that when a consumer is ready to start the car-buying process, the Ford brand is more likely to be part of their consideration set.

Direct response campaigns are easy to measure: Were enough products directly sold to cover the cost of the campaign and make money for the company or not? And with a campaign lift report, direct response advertisers can get even more insight into direct response campaigns.

But campaign lift reports aren’t always applicable to brand awareness campaigns. That’s where survey-based brand lift studies come into play.

The three survey-based brand lift methodologies I’m going to cover today have similarities and differences between them. Central to all is the concept of a survey, where respondents are asked to provide their feedback. Beyond that, each methodology takes a different approach to how respondents are selected, total respondents reached, what the survey asks of the respondents, and how data from the surveys are presented.

So let’s dive in.

Controlled Exposure

Controlled exposure is typically used on campaigns targeting smaller-audience podcasts or when the advertising brand isn’t a household name. Controlled exposure studies are also great for branded podcasts, where the podcast itself is effectively an ad for the brand and the podcast all at the same time. This type of brand lift study can also be used with well-known podcasts and brands to test response to different creative executions, such as hosts vs announcer read, or to measure effectiveness of ads of various lengths.

If you’ve ever seen a banner ad asking you to fill out a survey, you’ve got a good idea of how controlled exposure typically starts.

Those banner ads are specifically targeted to a certain demographic. The survey behind the ad usually has some qualifying questions to make sure the ad targeting didn’t go haywire. Those respondents who pass that initial filtering are then split into two distinct panels. Respondents in the first panel are asked to listen to some or all of a podcast episode with an ad inserted, while respondents in the second panel listen to the same podcast episode without the ad. Immediately after listening to the episode, both groups are asked a series of questions—the exact same questions— about how they perceive the brand advertiser.

If the advertising campaign was successful, the controlled exposure study will show positive association with the brand. It actually goes further than this, as the feedback from the exposed group helps determine how effective the messaging of the ad was when paired with a specific podcast or genre of podcasts.

To do this with a degree of confidence, controlled exposure studies are not only focused on finding respondents that match the targeting for the campaign, but must also ensure the respondents listen to podcasts and specifically the genre of podcast the campaign will be running in.

The execution of the survey happens completely separate from the campaign, ideally with no overlap of users exposed to the live ad. That means the survey can be run at any time before, during, or after the campaign. And because of the controlled environment, the results are available for review quickly, allowing for changes to be made to the campaign before it starts or during its run based on the feedback.

The main thing to keep in mind is that this methodology takes place fully in an artificial listening environment. The respondents are not hearing the ad in a podcast they’ve chosen to listen to, at their normal listening time, on their mobile phone through their earbuds. The respondents are instead people who responded to a request to take a survey, participating primarily from their computer, with an interest in the genre of podcasts used.

Pre/Post

Pre/post studies help answer the question of what percentage of listeners to a specific show had the reaction the brand was looking for. For this methodology, the podcast host asks their entire audience to take a survey before the campaign runs. Then after the ad campaign is completed, they once again ask their entire audience to take another survey. Yes, it takes two studies spread out over time. One pre-campaign, one post-campaign.

Pre/post studies ask the listeners of a specific podcast to take a survey. Sometimes the link to the survey is provided in the written episode details. Sometimes it’s only read aloud, either baked into the episode content, or more smartly with dynamic insertion. But regardless, not all listeners will take the survey. In reality, only a small fraction actually will take the survey. For this reason, this methodology is usually reserved shows of medium- or large-size with an engaged audience.

The advantage of this approach is that the listeners of the podcast are exposed to the ad in the wild and at the frequency configured for the campaign, allowing for measuring effectiveness of the entire strategy. That includes testing of ad recall over time, validating any targeting that takes place, and of course determining the value of the creative itself.

Pre/post studies answer whether the ad was effective on a specific podcast, as measured by listeners of that podcast that were willing to respond to a survey. It’s important to make that distinction. This isn’t a brand lift for the podcast’s entire audience. It only represents those who chose to respond, who may look quite different than the “average” listener of the podcast. And it certainly means the data can’t be applied to podcast listeners in general or even those that listen to podcasts of the same genre.

After the results from the post survey are in, the two surveys are weighted to the average to account for what biases they can. Tom Webster goes into greater detail on how to account for those biases when a podcast host surveys their audience in his article What Do Listeners Want… Part One, which is either a Mel Brookes homage or we’ll see a part two sometime soon.

Panel-Based

Panel-based surveys help determine how ad campaigns impact brand perceptions of the entire podcast listening audience.

The methodology is predicated on the idea that by maintaining a panel of millions of people who have identified themselves as podcast listeners and refreshing the panel frequently, the research partner is able to better account for the biases of the audiences and weigh them appropriately, resulting in a pool of panelists more reflective of the mainstream consumer.

So what’s the catch? The ad buy has to be large enough that the audience in the panel is likely to have naturally experienced one or more ads through their natural listening habits. That usually means a campaign run across a large podcast network and be for a well-known brand.

Researchers using this method have a wide pool to ask questions to. That allows them to show brand lift on several levels, comparing the people that listen to that podcast, that listen to podcasts but not that specific one, that don’t listen to podcasts at all, and even those that do and don’t interact with the brand or its category already.

Wrapping It Up

Now that you know the differences, it should be much easier to choose the right tool to measure campaign success. Some campaigns benefit from lift reports, others require brand studies. Both options provide a lot of value and any partner well versed in the differences will be able to run more effective campaigns.

Research companies such as Edison Research, Nielsen, and Signal Hill Insights are the most prominent partners in podcasting, and will work hand in hand with you to figure out which option works best for your campaign. Their focus is on asking the right questions to the right audience to get the best impact out of the methodology selected. They work closely with their preferred vendors to handle the cultivating of their panels and sending of the surveys.

For those of you who want to roll up your sleeves and handle the research part yourself, you can always work directly with companies like LoopMe, UpWave, and Luc.id, but make sure you’re equipped to really dig into the data you get back to present it appropriately.

The most enlightening thing I learned when researching brand lift studies was that each of the three research partners charge relatively similar rates for a study and offer at least one or more of the methodologies listed above.

Homework

Podcast adtech excites me on its own almost as much as teaching others about it does. This space is absolutely accessible to anyone who wants to learn, and it’s important to me not only to share my knowledge with you but to help you ask questions to further your own understanding. Below are some questions to think about after you’ve read the article, and to consider sending to any relevant partners you work with to get their answers.

- What is your company’s approach to survey based brand lift studies?

- Do you have a preferred relationship with any of the research companies listed?

- For DTC brands, have you explored the benefit of running survey based brand lift studies?

- Do you allocate any quarterly budget for research and larger directional projects?

- Do you work with external research companies for a full solution or with adtech partners and handle the results directly yourself?

Sounds Profitable will never charge our readers to learn from us, but several individuals have asked about supporting us directly. You can find out more about our individual sponsorship at our Patreon.

New Sponsors

Support from our amazing sponsors is truly the only way that Sounds Profitable could exist. They provide me the means to stay completely independent, allowing me to fully write about all aspects of this industry without being bound to any one company. With that said, I’d like to introduce you to our latest sponsors:

- BetterHelp is the world’s largest online therapy provider, bringing private, affordable care right to your phone or computer.

- Castos enables podcasters to create public podcasts to grow their audience, and private podcasts to deliver member-only, exclusive content

- Zvook instantly matches brands with podcasts across networks, optimizing for the brand’s budget and customer persona.

We appreciate the support of all our sponsors, so please take a look at the full list below. If I can make an introduction for you to any of the sponsors, please don’t hesitate to reach out!

If you’d like to learn more about sponsorship or advertising with us, just hit reply.

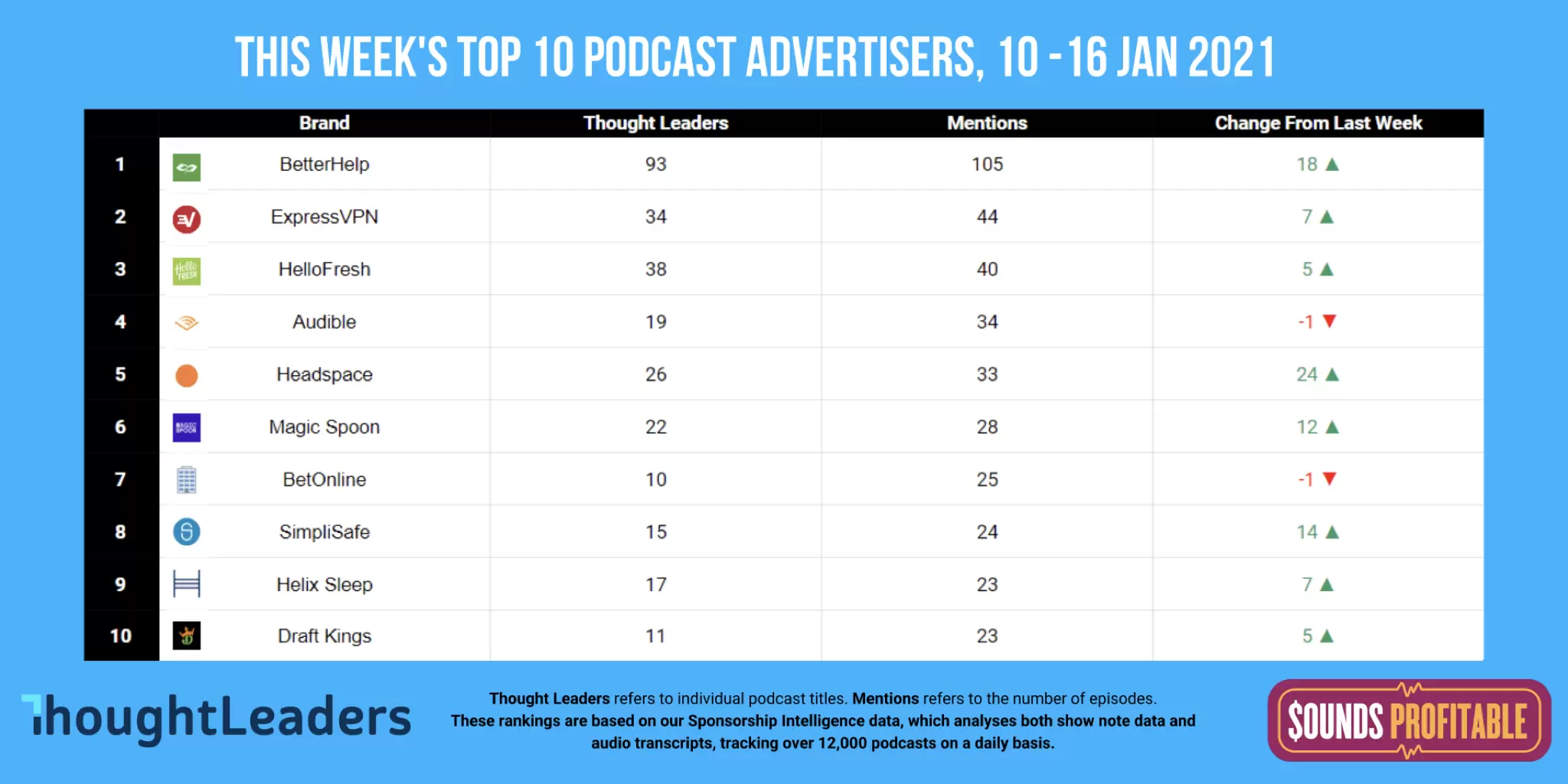

Market Insights – with ThoughtLeaders

The most striking thing I noticed from this weeks report is that outside of 1-4 and 7 staying relatively the same, the other 5 brands are all new to the top ten list. With the overall increase in mentions, it looks like Q1 spending is ramping up. Hit reply and let me know your thoughts!

Product Deepdives

We took your feedback to heart! This month’s Product Deepdive with Triton Digital will be available on demand Thursday January 21st. Sign up for the LinkedIn event to get an alert when it goes live or look for the link in Podnews on Thursday this week and in our newsletter next week.

If you missed our last product deepdive with Podscribe, you can find it here.

Things to Think About

I highly recommend all my subscribers also subscribe to Podnews. Last week, I found three pieces of information that caught my attention.

- Podnews’s editor, James Cridland, gives his personal feedback on where Pocket Casts went wrong. I’m curious to see if this is the start of consolidation on the podcast player side, whether by choice or by business performance. Will publishers continue to maintain their own players?

- Podchaser raised $4m. There’s a lot of potential with Podchaser, but it feels like they have a lot of directions they can go in. We should all keep an eye out on where they focus next.

- Backtracks announces $1.6m in funding and claim they’re “[…]the leading technology infrastructure platform for end-to-end podcast management, advertising and data analytics[..]”. Do you or have you used Backtracks? If so, reach out. Would love to learn more as I’ve yet to come across them before this announcement.