This week, Bryan walks you through the entirety of the Sounds Profitable family of shows. At least as they are today. Listen in to see what you’re missing!

Podcast advertising isn’t unique. The challenges and opportunities we face mimic what was faced in display, audio, and video over the last two decades. Where we differ is our unique opportunity to learn from that history and build a better path forward. Strong opinions backed up by action can create change. And those effecting change in any other industry would be reluctant to share their thoughts with anyone but their clients. But not in podcasting. Today, I’m incredibly excited to share with you this guest piece from Krystina Rubino of Right Side Up, who has spent the last six of her 15-years in digital advertising focusing on offline and podcasting. Which is more than long enough to see the patterns start to repeat. – Bryan

There’s a huge shift happening within the podcast media buying landscape. Historically, our medium has transacted on a fixed cost, based on estimated downloads. But now, more and more publishers are shifting to impression-based ad sales, with shows and cross-network inventory being sold on a CPM basis, based on actual delivery.

As our industry adopts a media transaction method more akin to digital display than the legacies of spot-based radio, it’s becoming clear that we lack the sophisticated ad tech and infrastructure utilized to efficiently transact at scale in digital media. Buyers and advertisers are currently stuck trying to get a handle on our media partners’ capabilities, whether targeting, trafficking, reporting, etc., and the differences in terminology alone, from network to network, are staggering. Networks and publishers are working across multiple platforms and inventory sources and trying to project delivery for an entirely new way to serve podcast ads. When I navigate similar challenges today that we faced in digital media 10 years ago, I feel like I’m Keanu Reeves suffering from deja vu in the Matrix, only I don’t get the cool coat or know kung fu.

Because, this is not the first time a medium has started out with manual buying and, over time, technologically evolved to enable more sophisticated buying formats. In digital, this meant the eventual reality of cross-network and programmatic buying. Not only are we not there, but we’re in the very early stages of this gradual transition.

Right now, there’s really no way to easily validate impression-based buys and make sure advertisers are receiving exactly the inventory contracted. It’s a piecemeal process, done manually by publishers and buyers alike, that combines third-party airchecking, server-side reporting, and a lot of discussion in real-time as we figure out the limits of the current technology stack.

Knowing we are in the middle of this evolution, there are important lessons to be learned, but first, there are a few immediate items that need to be addressed for us to start on the journey towards transacting confidently on an impression basis.

Pricing has to evolve

Right now, CPMs in podcast advertising continue to hover in the $20–30+ range. The high CPMs in this medium are due to a few factors:

- Baked-in ads—ads that are native to the content and deliver at the time of the episode download, estimated on 30-day downloads but never removed

- “Faked-in” ads—where we’re buying episodically, but ads are delivered dynamically and impressions are uncapped and therefore, able to overdeliver

- Host-read endorsements—there is a premium for this style of creative delivery

- Supply and demand—podcasts are arguably one of the hottest media types for tech companies looking to diversify their media mix and the amount of podcasts that actually have direct response performance potential is fairly limited

Instead of seeing CPMs go down as buys shift to an impression basis, we’re seeing that many of our network partners are trying to keep them virtually identical to baked-in or possibly look at only a 10–20% decrease. Once we see lackluster performance incongruent to those rates, buyers pull ad dollars and re-allocate to other networks/shows or even other mediums, like radio and streaming audio. This has already happened with a number of our buys with partners who shifted to dynamically injected ads, and did not adjust buy structure and pricing commensurately; now we’re working together to evolve testing structures that our advertisers can confidently transact in.

Nota bene: Dynamic insertion (DI) or dynamic ad insertion (DAI) was originally coined to describe a separate piece of content, often an ad, that’s stitched into the podcast episode file at the time of download, as opposed to a “baked-in” or “embedded” ad, which is part of the original audio file. This allows media sellers to serve different creative to different listeners, and to transact at the impression level. Ad networks have evolved DI to mean ads sold on an impression basis.

If we agree that host read/episode specific embedded inventory is the most valuable, and we keep that pricing relatively the same. What is the pricing for other inventory? Is it,

- Host-read, baked-in ads get the highest CPMs

- Host-read/episode specific DI/imps based, priced at 60–80% of a baked-in rate?

- Host-read/run of show(ROS)/imps based, priced at 50–60% of a baked-in rate?

- Host-read/run of network(RON)/imps based, priced at 30–50% of a baked-in rate, depending on verticals and/or audiences targeted?

- Non-host-read/RON/imps based, priced at 20% of a baked-in rate?

If we don’t adjust pricing in some way, we are setting advertisers up to fail—especially the direct response advertisers that largely, and most consistently, monetize this medium. The value of the impression is not the same, and thus the charge should be reduced proportionately. Advertisers cannot take the rates we pay for baked-in or dynamically inserted, show-level inventory with host read endorsement, and pay the same pricing for produced ads running uncapped across full catalog RON inventory. Because math.

We are also seeing extremely high CPMs for audience-based buying, often even higher than baked-in, which is unsustainable and also makes no sense. The goal of marketplaces is to monetize largely remnant inventory by applying additional data to target the audience, not the content.

The most common retort we hear on pricing is that advertisers are still reaching a listener, right? It’s still a host talking to the listener in most cases, so what’s the difference?

Lack of control over factors like frequency and competitive separation

One of the biggest concerns we have is the lack of consistent ability to frequency cap. There’s really no way for advertisers to cap frequency at a reasonable level so we don’t serve the same listener, however defined, 15x frequency and wind up with media waste or negative brand sentiment. I don’t know about you, but as a listener, I don’t really love hearing the same ad over and over again; I either skip or zone out. Especially when I binge episodes, and hear the same ad over, and over, and—well, you get the point. We are getting close to treating podcasting like streaming, spoken-word audio, and that is a very different listening experience.

Furthermore, a listener could theoretically be served an ad for two competitors in the same vertical if competitive exclusivity is at the listener experience level, or the impression flight ends and then the listener is still binging and the next company’s flight starts. Now the host seems like they are backing two of the same product types, and conversion rates for both brands diminish. One of these things is more skippable than the other. And we lose one of the major value propositions for brands entering podcasting, which is the ability to gain competitive exclusivity with commensurate buying.

There’s also intermittent adoption of frequency capping. The two main bulwarks against frequency capping have been:

- Host/ad server capability, which we recognize many partners are working through; not all ad servers can do it, and with the ones who can, partners have reported inconsistency in the technology actually working

- Business decisions made by partners not to frequency cap; this is short-sighted, focused on short-term ad delivery and completing contracts, vs. the right thing to do for advertisers and listeners

I recall all the same arguments happening in digital advertising history, e.g. do we frequency cap on 24 hours or seven days? What’s the right number? The answer is to be determined, together, as a marketplace, and now is the time to pursue it before we over-saturate the listening experience.

With the new trend towards ad stuffing (running more than four midrolls in an episode), and without knowing what’s possible re: separation for endorsement and branded ads, frequency capping becomes a necessity so we don’t alienate listeners with too much of the latter, which are more likely to be skipped.

This will all conspire to dilute the value of the impressions, further strengthening the argument for lower and lower CPMs. The experience has, from an advertiser perspective, fundamentally and negatively changed, therefore it cannot be priced the same.

Flighting is such a mystery, we could start a true crime podcast based on it

As an industry, we know how to flight baked-in ads, based on the decay curve of listenership as an episode ages. We’ve had years of price discovery for baked-in ads, we’ve been able to identify the right level of exposure for an audience based on different campaign objectives.

Our industry has yet to figure out a bulletproof way to flight impression-based buys for these same advertisers. Is it weekly? Is it monthly? According to the moon phases? On the leap year? WHO KNOWS.

Kidding aside, there is no right answer, at least not yet. Some networks are anchoring flighting on share of voice (SOV), which is a metric advertisers cannot independently verify, and also a moving target as audiences increase. We’ve leaned more toward one- or two-week flights so we can control pacing. Many partners are asking us for month-long flights, but without the ability to frequency cap or evenly pace delivery according to a mutually agreed upon schedule, we’re less likely to acquiesce because of the lack of control.

Third-party ad serving, delivery reporting, and ad verification

Because podcasting is, at least currently, an open medium based on RSS technology, attempts at broader third-party ad serving and/or attribution have so far achieved mixed success.

One significant challenge as we shift cost basis from spot to impression basis, is that we need delivery reports provided directly from some sort of accredited ad server or hosting platform. These will be required in order to approve and pay invoices, at least until our industry more widely adopts third-party ad serving.

This does not mean that a human being logs into a platform that is not open to buyers, pulls a report, and manually types/copies impressions into an Excel spreadsheet. This is happening today and it concerns me greatly. I have personally experienced ad fraud tied to that scenario, and while a vast majority of our amazing partners don’t have ill intentions, human error still happens.

Our industry needs basic impression-based reporting, automatically sent to buyers on a schedule of their choosing, from the publisher’s compliant hosting platform and/or ad server. This is what we’ll use to approve and pay invoices—otherwise, how will we know what to pay? On top of that, show-level reporting, as well as frequency, geography, etc., are all dimensions that we should pursue collectively. I never thought I would pine for the days of placement-based reporting from Google Campaign Manager 360, but here we are!

Last, Bryan just explored ad verification, noting that, “In nearly all of digital advertising, third-party verification is a non-negotiable part of the equation.” If we are serving and transacting on podcasting more like digital audio, then we must mutually agree (buyers/advertisers and media sellers) on an undisputable source of delivery reporting so we can bill and pay invoices confidently, knowing that what we bought was delivered. Without access or visibility into the back end of how these impressions are being served, advertisers aren’t able to serve ads and track delivery, or control and optimize factors like creative rotations, for campaigns featuring DI host read ads and/or produced spots. Third-party tracking is only half the equation, because that refers to the pixel fire or whatever tracking modality is being used, e.g. a publisher could serve the wrong audio file, but fire the right tag, and an advertiser currently has no way of validating that the right ad was served.

Conclusion

Buyers are absolutely interested and invested in buying and experimenting with multiple ways of advertising, but the lack of transparency, 3P, and sophistication are several of the reasons why we still buy so much of our media episodically and baked- or faked-in. It is imperative that our network partners understand that advertisers will see an irreparable hit to performance, and therefore not be able to continue to invest in the channel, if pricing isn’t stratified based on what type of spot we buy and its true impact. We have raised these legitimate concerns with partners, to differing degrees of reception and success, and the ones who are “getting it,” are getting a higher share of our ad dollars. That will continue to be the case, especially as advertisers across the space that have kept podcasts as a mainstay channel in their mix see diminishing returns. And digital marketers exploring this channel for the first time will be wary of jumping into a channel that says it delivers like digital but has no way to verify it.

We’re asking all the right questions, but as an industry, we need to doggedly pursue the answers together. We’re more than happy to, in exchange for an aggressive upfront CPM discount, give our partners anonymized but still relevant data back post-campaign to help them understand what they should be pricing at, e.g. price discovery. And we view this as our obligation not only to our publishing partners, but for the brands we work with, so that we can ensure value is commensurate with how we’re buying and what we’re paying.

Buyers need publishers to partner with us in that pursuit, helping to remove, not add, any roadblocks in our way. More transparency in buying will only help all parties and help us get to the answers of what’s right for us in this medium, at this time, for the whole ecosystem.

New Sponsors

Sounds Profitable exists thanks to the continued support of our amazing sponsors. Each sponsor receives one hour of consulting per month as a way to say thanks.

- Adwanted Group works with the media industry to simplify the advertising planning, buying, and selling process for the biggest agencies, media companies and brands through software, data and content solutions.

- Basis is the most comprehensive media automation and intelligence platform in the industry—and the only platform to consolidate planning, digital operations, reporting, and financial reconciliation across programmatic, publisher-direct, search, and social.

Want to learn more about sponsorship? Hit reply!

Rel’s Recs

Arielle Nissenblatt of EarBuds Podcast Collective this week has chosen Love Thy Neighbor from Pineapple Street Media, hosted by Megaphone.

This show brings the perfect mix of community, history, and lessons in cultural sensitivity. It’s hosted by Collier Myerson, who is both Black and Jewish, and she expertly shares the story of what became known as the 1991 Crown Heights riot. If you’re unfamiliar, in August of 1991, “a car accident set off four days of unrest. Two people died. Dozens were injured. Hundreds were arrested.” I’m Jewish and from the New York area, and had no idea about this incident and the series of events that led up to it. I recommend this show to anyone looking to better understand the themes of immigration, identity, religion, coexistence, and gentrification in Brooklyn.

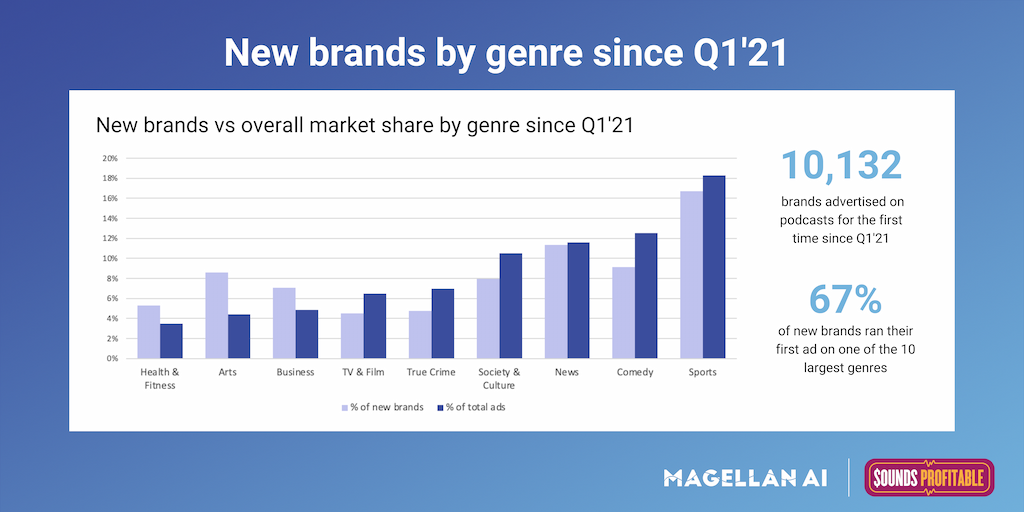

Market Insights with Magellan AI

Since Jan 2021, over 10k brands ran ads on podcasts for the first time. This week we wanted to see which genres brands prefer to test out the channel on and how that stacks up against overall market share.

We found that the bigger genres in the space accounted for less new brands compared to their overall market share, while smaller genres accounted for a larger proportion of new brands. Most notably the Arts genre accounted for 4% of total ads, but for 9% of new brands ads.

Interested in more insights about new brands? Download the Q4 Podcast Advertising Benchmark Report for the full analysis.

Anatomy of an Ad with ThoughtLeaders

What makes a good podcast ad? You know it when you hear it, sure. But is there more to it? We’ve teamed up with ThoughtLeaders to break down what works, what doesn’t, and what it takes to make great ads.

This week’s Anatomy of an Ad breaks down a host-read ad for Modern Fertility presented by Whitney Port, host of the podcast With Whit.

Find out what worked well and what could be improved upon as you work to make your own ad reads better.