This week on the Product Deepdive: Fatima Zaidi gives a tour of CoHost’s prefix pixel and what it can do, including B2B analytics and advanced audience insights. Catch the full 28 minute walkthrough now at Sounds Profitable.

Yesterday, Sounds Profitable released Sound You Can See: Podcasting’s Video Dilemma, one of our most important releases of the year. We called it a “dilemma” because that’s exactly what many audio podcasters have been confronted with in the wake of the rising popularity of podcasts that are also available on video (and to be clear, we are mainly talking about YouTube here.) Indeed, the overwhelming majority of the top 20 podcasts on any available ranker are also available on YouTube, and it’s time we understood that it is no accident.

The narrative of this research is clear and compelling, and I highly recommend that you watch the entire webinar here. If you are a creator trying to improve your craft, or someone on the monetization side looking for revenue (and many of you are both), surely it’s worth less than an hour of your time to give some deep thought to this issue and watch the complete presentation. But to summarize the main findings, here are the ten stats and facts from this report that will help you the most in 2024…and beyond.

1. The video podcast consumer and the audio podcast consumer are the same people

We need to stop thinking of video consumers as different to our audio audience – in fact, they are the same humans, consuming either form depending on their context, mood, and environment. In our survey of 1155 adults 18+ who had watched a video podcast in the last 30 days, fully 86% had also listened to an audio podcast in that same period of time. When asked to estimate how much of their total podcast consumption time was spent with video, this same group indicated that less than half (47%) was spent with video.

2. Video podcast consumers are most likely to watch podcasts on YouTube – but listen to them on Spotify

63% of video consumers say that YouTube is what they use most often, while another 14% name one of several social media platforms that generally embed YouTube videos for sharing. However, for audio podcasts, Spotify captures the plurality of video consumers’ ears, with 42% indicating the platform compared to 20% for Apple Podcasts – and this despite the fact that far more video consumers use iPhones for podcast consumption than Android phones, computers, or smart speakers.

3. The Video consumer is from a different, newer generation of the podcast audience

Why are YouTube and Spotify so popular with video podcast consumers? For most, those are the two platforms that introduced this audience to podcasting to begin with. 83% of this cohort of podcast consumers have been listening to podcasts for five years or less; in other words, they came into the medium in a vastly different landscape than the Apple-dominated universe of 10-15 years ago. When asked which platform they first discovered podcasting on, 41% said YouTube, while 18% named Spotify. Apple Podcasts was third, at 15%.

4. Video podcast consumers aren’t confusing YouTube shows for podcasts – they know what they are watching

When asked how video consumers know a given video is a podcast, and not just another YouTube video, 54% say that it’s because the word “podcast” is in the title of the show. Another 51% noted that their determination is based on seeing either microphones or a studio (or both) in the video, which sets a podcast video apart from the typical video consumed on YouTube. About half reported that the host or creator of the show is known for podcasting, while 30% indicated that the show is also available on audio-only podcast platforms, which further reinforces point one, above – these are the same humans who listen to audio podcasts, and are fully aware of the differences.

5. The audience for video podcasts are very similar to the overall audience for the genre of podcasts they consume

A comparison of the top genres overall for the video podcast consumer tracks very closely to a listing of the top genres overall. The top five (which includes their preferences for audio AND video) comprises Comedy, Sports, News, Music, and True Crime, which (with one exception) tracks with leading genre rankers in the industry. The exception here is music, which continues to be a great opportunity for podcasting if sensible licensing and royalty agreements can be worked out. Here is where platforms like YouTube and Spotify currently have an advantage over some other platforms because they have the infrastructure in place to monitor for licensed music and compensate rights holders accordingly.

6. While the video audience listen to all genres, they have preferred formats for what they watch on video

More important than the genre of a podcast is the format. 79% of this audience say that they watch conversations or interview podcasts on video, significantly higher than the next format, host or creator monologues. And when ask what they prefer to watch on video, conversations between hosts (43%), interviews (39%) and host/creator monologues (19%) perform significantly better than most forms of scripted narrative, such as drama (8%), fiction (5%), or podcast trailers (4%). This is good news for creators – the easiest things to translate to video (people talking into microphones) are exactly what people prefer to see from video podcasts.

7. Why do consumers choose video over audio? Focus, context, and setting

When asked where they consume video podcasts and audio podcasts, the former choice is overwhelmingly confined to the home, and to private viewing. Audio podcasts – even of the same shows that people might otherwise watch – are favored in settings outside the home, with the vehicle being the top location (19%). The mode for watching video podcasting is not a low attention mode – it is in fact a lean-forward choice for when these consumers want to follow a conversation better. The audio option is favored when this audience cohort can’t focus on a screen or is otherwise engaged in multitasking. The option to have both audio and video versions of a podcast, then, is not about appealing to different audiences, but giving the same audience multiple options to consume their favorite podcasts depending on the level of attention they are able to devote.

8. YouTube is the dominant choice for consuming video podcasts, for multiple reasons

As already indicated, many podcast consumers actually discovered the medium there, so it is natural for them to continue to use the platform in that way. It’s also where this audience consumes most of their video, period, so in many cases they are already there and in a viewing “mode”. It should also be noted that 64% of YouTube podcast viewers indicated that the video platform was actually a better experience for them than using an audio-only podcast platform.

Among the reasons for this are the ease of navigating/skipping through content, captioning, and the engagement that the platform offers both in terms of user comments and in a feeling of closer engagement with the hosts facilitated by being able to watch them and see their nonverbal communication.

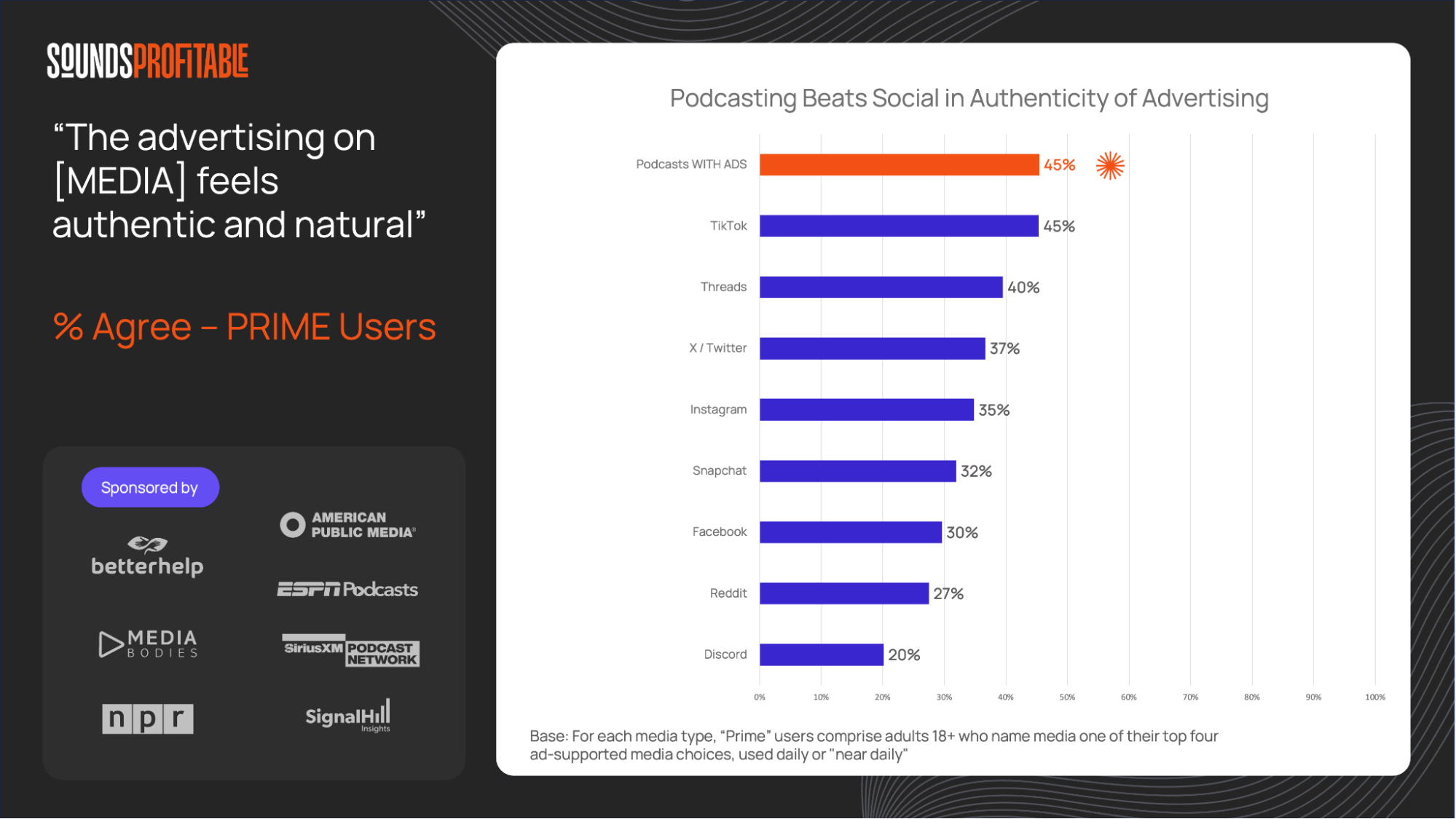

9. What don’t viewers love about YouTube? The platform’s native advertising

YouTube podcast consumers were highly negative about the platform’s native ads, typically encountered as pre-rolls and also as interruptions (often mid-sentence) in their favorite podcasts. The top five terms used to describe these ads were “annoying” (43%), “disruptive” (40%), “too frequent” (26%), “irrelevant” (26%) and “too long” (21%).

10. Those same YouTube viewers are overwhelmingly positive about the ads native to the podcast itself, often presented by the host or other persons associated with the show

This was especially true with YouTube Premium consumers (23% of the YouTube podcasting audience), who actually pay a monthly fee specifically to avoid ads (61%) and stop the platform from interrupting their content (53%). These same consumers were incredibly positive about the native ads in their favorite podcasts, with 87% saying they like or don’t mind them, compared to only 6% who dislike them. The top three attributes these viewers used to describe native podcast ads were “informative” (33%), “interesting” (26%), and “relevant” 25%.

All of these facts, taken together, present a compelling picture of a complex and robust audience for video podcasts – these aren’t video-only or even video-dominant podcast consumers – they choose audio or video, when they have the option, and having both available simply offers more touchpoint, relevance, and engagement with an audience that pays attention and wants to take our content with them wherever they go. If you can film your hosts’ conversations, you’ve got a video podcast. And if you are a video creator with a show primarily featuring conversations, monologues, or unscripted content, you’ve got an audio option easily available. Ultimately, the audience is in control – our best bet is to give them choice and control.

Watch the full presentation and download the entire deck here!

Sound You Can See is a survey of 1155 Americans 18+ who have watched at least one video podcast in the last 30 days. The project was designed and produced by Sounds Profitable, with research partner Signal Hill Insights, and sponsored by CoHost, PRX, SiriusXM Podcast Network, BetterHelp, Barometer, ESPN Podcasts, Paramount, Audiohook, Libsyn, and NPR.

New Partners

Sounds Profitable exists thanks to the continued support of our amazing partners. Monthly consulting, free tickets to our quarterly events, partner-only webinars, and access to our 1,800+ person slack channel are all benefits of partnering Sounds Profitable.

-

Jamx is an audio powerhouse with an end-to-end platform that infuses publishers, podcasters and advertisers in perfect synergy with a podcast discovery widget that recommends podcasts to audiences based on their interests.

-

Atomic's innovative approach blends great storytelling with history and science for premium platforms, brands, and networks, on projects like the Emmy-nominated Brain Games and hit family podcast Who Smarted?

Want to learn more about partnership? Hit reply or send us an email!